Access: Impact & influence

“If I have done something worthy, everybody is already copying me,” - Renuka Ramnath

Hello reader,

Welcome to the 18th edition of Access - the most clicked link from last week’s edition was Harry Stebbings’ podcast featuring Thoma Bravo’s co-founder, Orlando Bravo.

Last week, the industry received sad news of Thomas H. Lee passing. In memory of his contributions to private equity, it seemed fitting to take a look at his impact. This edition will include short biographies on Thomas H. Lee and other key players within private markets, offering a view of their influential contributions to date and a look forward to the future of private equity.

Who are the other leaders in PE that you’d like to learn more about? Drop us a note.

Until next time -

Melissa

In case you missed it…

Last week’s edition included profiles of the top five PE firms from the 2022 PEI 300. We took a look at:

FEATURING:

In Brief: Insights from the world of private markets

Rethinking value creation in private equity

People moves, news and promotions

Company values: Livingbridge publishes its updated core values

In Depth: Short bios on PE pioneers - Thomas H. Lee, Renuka Ramnath, Weijian Shan & Wol Kolade.

IN BRIEF

What does value creation look like for PE in 2023?

The future of value creation is evolving - Financier Worldwide discusses value creation in PE with senior leaders from Ankura Consulting Group, a global advisory firm.

“Four value levers – talent, pricing, data-driven decision making and corporate governance to get consistent results – are at the top of most PE agendas for 2023.”

- Dave Owen, Senior Managing Director at Ankura Consulting Group, LLC

Through comprehensive understanding of market position and key trends, due diligence activities are set to drive value creation. Methods and approaches that are popular include:

Developing an ESG strategy

Improving talent acquisition and employee development

Digital enhancements & data for insights

De-risking initiatives - increased cyber security, streamlined supply chains and financial controls

[Rethinking value creation - talent, tech, insights & governance]

***

People Moves, News & Promotions Across Our Private Markets Network

Congratulations to Benjamin Davis who has started a new role as CEO of Octopus Investments… also to Emma Nicholson who has been promoted to investment associate at AEW… Beach Equity welcomes Simon McIlwaine as partner… Kevin Davies starts a new credit control role with PEI… Kai Niu joins Addepar as a senior product analyst.

IQ-EQ’s Alison Duffy was named a top marketing professional in the Business & Finance Media Group CMO100 Index 2023 - congratulations!

***

Spotted on LinkedIn…

Last week we featured a rundown of company values from the top five PE firms by capital raised. It seems that other firms are thinking about this too - Livingbridge released an updated set of values earlier this week.

IN DEPTH

“I hope that other people copy this initiative.” - Wol Kolade

Thomas H. Lee

Thomas H. Lee was a pioneering leader in private equity who helped to shape the leveraged buyout industry. He founded Thomas H. Lee Partners (THL), a boutique investment firm based in Boston, in 1974. Since then, he’s raised $15 billion of capital in hundreds of transactions including the acquisition of Snapple in 1992 which was sold to Quaker Oats two years later for 32 times what he bought it for.

In 2006, Lee decided to part ways with THL. He moved to New York and set up Lee Equity Partners, focused on midsized buyouts.

"I've been lucky to make some money. I'm more than happy to give some of it back."

His impact transcends just private equity - Lee was an influential philanthropist with a keen interest in collecting art. He was a benefactor to his alma mater, Harvard College amongst other institutions, and was a trustee at cultural organisations including Lincoln Centre for the Performing Arts, The Museum of Modern Art and the Whitney Museum of American Art.

Renuka Ramnath

Known as the ‘mother of private equity’ in India, Renuka Ramnath did start off with a goal to become a pioneering financier. Prior to being introduced to finance, Ramnath studied textile engineering at Veermata Jijabai Technological Institute, at a time where she was just one of two females in the classroom. She went on to complete her MBA at Mumbai University. Ramnath started her career in manufacturing and engineering but moved to ICICI’s merchant banking department in 1986. She developed her knowledge of building a business and was soon appointed head of corporate finance and equities at ICICI Securities.

During her time at ICICI, Ramnath became the managing director and CEO of ICICI Ventures, the Group’s private equity arm - this was in 2001 when PE as an asset class was in its infancy. She pioneered the growth of the fund from a $100 million proprietary fund to a $2 billion PE fund with third-party capital.

“I wanted to worship entrepreneurship because it creates jobs and it gives meaning to so many million lives. The virtues of entrepreneurship completely drew me into the investment business.”

Ramnath went on to establish Multiples Asset Management in 2009 with ex-ICICI Venture colleague Sudhir Variyar, focusing on midsized companies, investing between $15 million and $50 million. One of her core tenets for Multiples was to invest in the possibility of each entrepreneur. Undoubtedly, her success is reflected in Multiples becoming one of the most prominent late-stage PE firms with investments in marquee start ups.

Appointed in March 2020 as chairperson of the Indian Private Equity and Venture Capital Association (IVCA), Ramnath’s impact continues as she aims to attract high quality international long-term risk capital and open up domestic capital by demonstrating India as an attractive investment decision.

Weijian Shan

Co-founder, executive director and executive chairman of PAG, Weijian Shan, is a prominent figure in private equity, particularly in Asia-Pacific markets.

PAG’s businesses span real estate investment, option return (including private debt and public market strategies), and private equity. Shan’s focus is on private equity buyouts. He operates successfully across a shifting geopolitical landscape, enabling PAG’s investors to access Chinese start-ups and key industries such as financial services and industrial gases.

“[Y]ou have to invest in businesses which have meaningful entry barriers, competitive advantages that other people will not be able to imitate or to compete with. [T]hat's what we look at for every deal.”

In 1969, Shan was pulled out of school at 15 and worked hard labour as a farmer in the Gobi desert. He was allowed to return to Beijing six years later and became one of the first Chinese students to study in the US. Shan’s book 'Out of the Gobi: My Story of China and America’ details his experience as a Chinese person living in America, transitioning from farmer to businessman.

Shan holds a Ph.D and Masters of Arts in Economics from University of California, Berkeley and also an MBA from University of San Francisco. He is an alum of JP Morgan, where he was a managing director, and TPG Capital where he was a partner. Whilst at TPG, he pioneered the first purchase of a Chinese bank by a foreign investor - the acquisition of Shenzhen Development Bank.

Wol Kolade

CEO of Livingbridge private equity firm, Wol Kolade has spent almost 30 years in the private equity industry. In addition to his leadership role at Livingbridge, Kolade was the chair of the BVCA in 2007-8 and currently sits on multiple advisory boards.

Kolade is a driving force behind diversity in private equity - he sits on the advisory board at Level 20, and co-founded the successful 10,000 Black Interns Initiative which announced the 10,000 Able Interns Initiative towards the end of 2022.

“The job of a leader is making sure that everyone has the best chance to do their job really well. It's not about ego or having all the answers.”

Read more about Wol Kolade in Access | 006 ⬇️

***

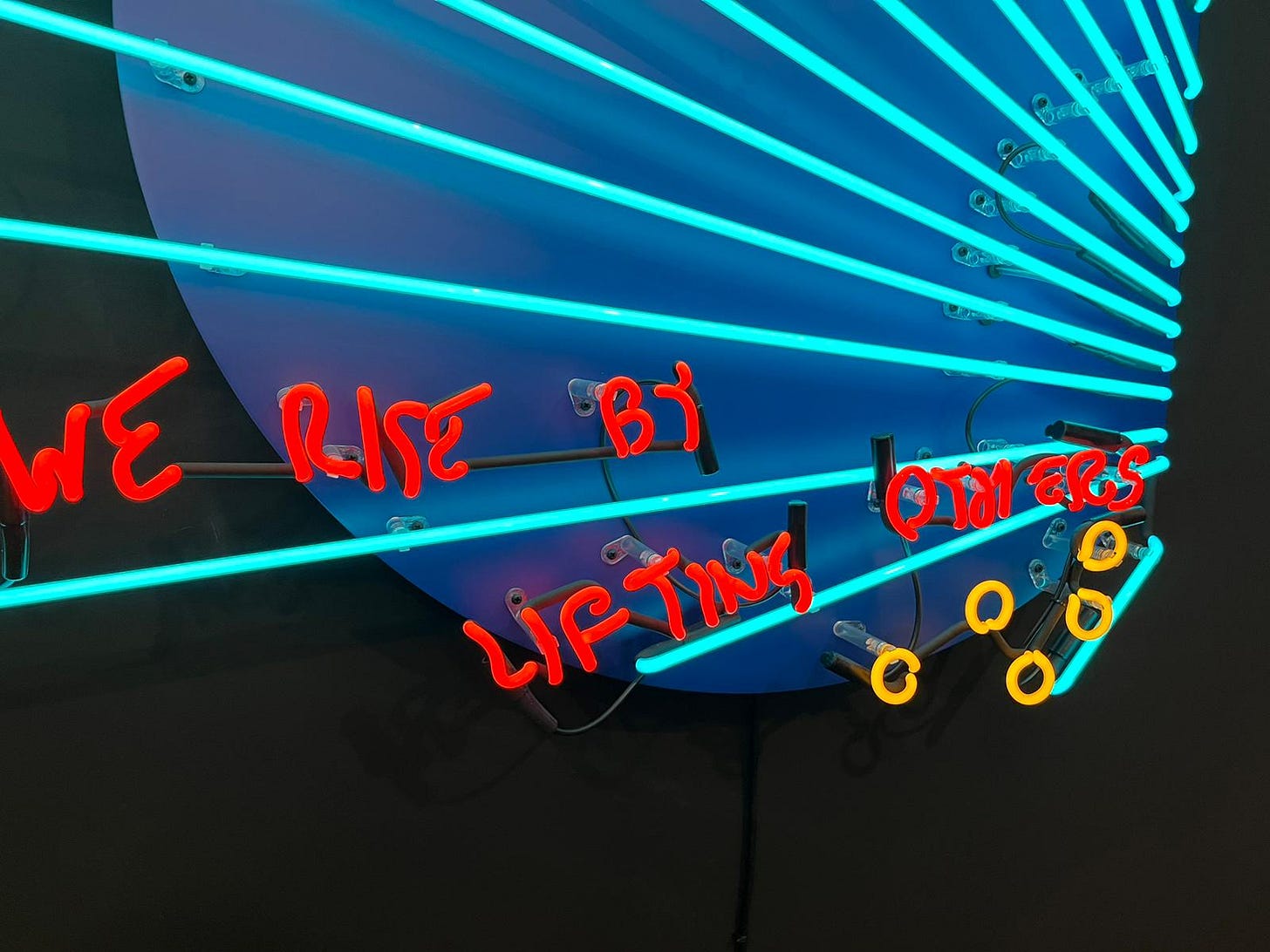

And finally… impact comes in all shapes and sizes

Team Hertalis is separated across continents this week, but still on the same wavelength… Here’s a snap from Liz’s travels. We picked only a small selection of individuals who have shaped the industry for this edition, there are many more who continue to have an impact.

- We Rise By Lifting Others (2022), by Marinella Senatore

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)