Access: The Tech Innovators Transforming Private Capital

“Innovation is the ability to see change as an opportunity, not a threat." - Steve Jobs

Hello reader,

Welcome to the 27th edition of Access - the most clicked link from last week’s newsletter was this piece from PE fund Ardian, about responsible investing going mainstream.

I was a guest on an eFinancial webinar last week, and was asked to sum up my thoughts on the current state of the market. Uncertainty & hesitation continue to reign supreme, although the Economist reckons we’re ushering in a new ‘humbler’ era of private equity, saying:

‘Economic uncertainty is still driving a wedge between the expectations of buyers and sellers, but more big deals were announced in March than any month since May last year.’

A more hopeful outlook than I’ve seen recently.

This week we’re focused on the technologists, leaders, & innovators who are driving change in private markets tech. All are nominees in this year’s Drawdown Awards, with the winner announced on June 7th. Best of luck to everyone on the list!

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition looked at the Imperfect Nature of Impact Investing, including:

FEATURING:

In Brief: PE Tech News & Resources

Technology Market Maps from PE Stack

Private Equity’s Undiminished Appetite for Tech Investment

How Will AI Transform Private Equity?

In Depth: The Tech Innovators Transforming Private Capital

IN BRIEF

Below, you’ll find a selection of private equity tech resources from people and companies in our private markets network.

PE Stack Market Maps

Founded by Tim Friedman in 2018, PE Stack is a treasure trove of information & insights relating to technology for private equity firms.

Their database of vendor profiles is free to access, and you can search by function, keyword, vendor name, front/middle/back office solutions, and a whole lot more.

We love their market maps that show all available solutions for a specific theme - it’s a great way to get familiar with the tech ecosystem on one page. Choose from front office, middle office, back office, or check out the latest one showing ESG software and data solutions.

Tim will be joining Altvia’s CSO Jeff Williams, and Paladin’s COO Ed Albrigo on May 23 for a live webinar discussing how to effectively navigate the software buying process for GPs.

***

Private Equity’s Undiminished Appetite for Tech Investment

EY released their Q1 2023 Private Equity Pulse Report this week, noting that despite a slowdown in deals, investment in technology remains a powerful theme particularly around cybersecurity, artificial intelligence and machine learning (AI/ML), climate-tech, and supply chain analytics.

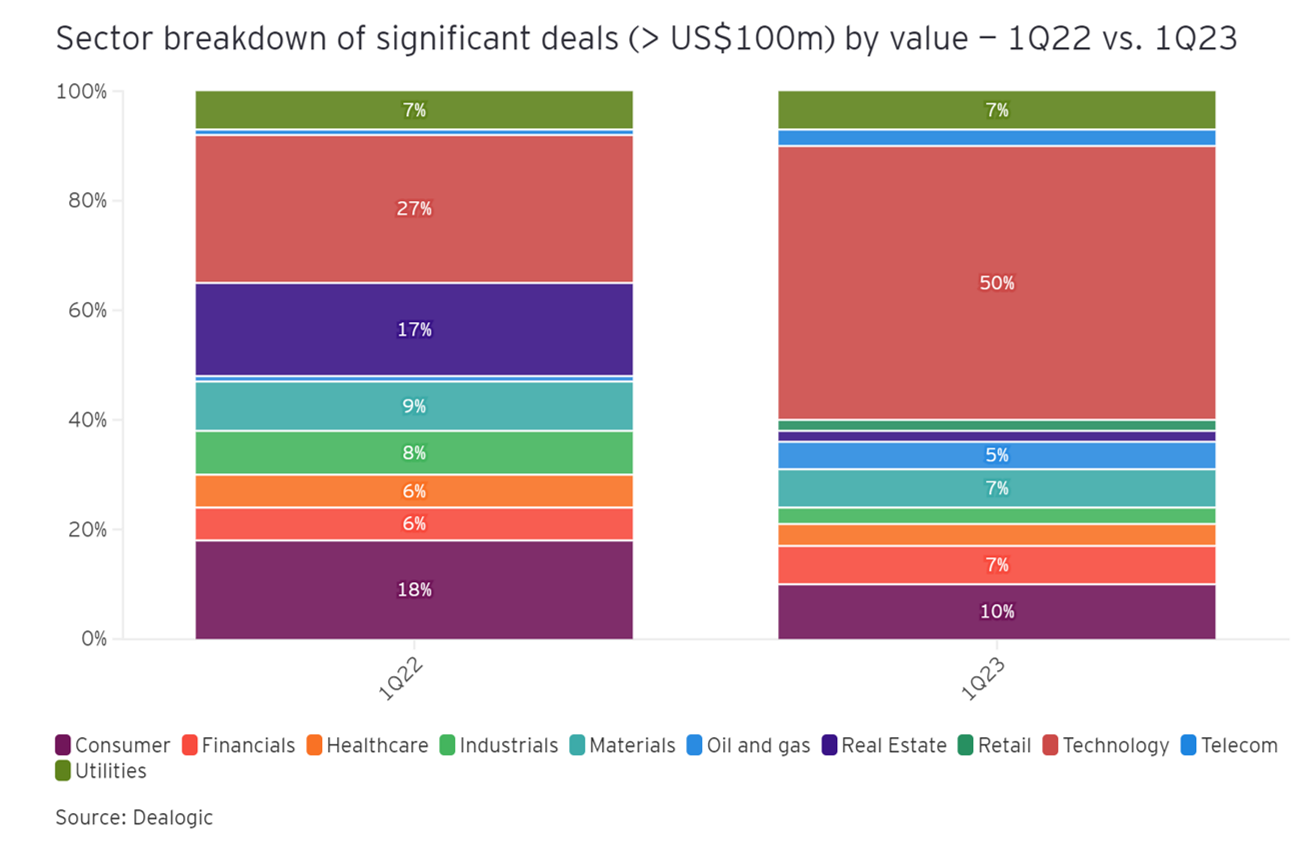

‘Tech-focused deals accounted for 50% of PE’s total activity by value, up from roughly a quarter in the first three months of 2022.’

[Read the Q1 2023 Pulse Report]

***

How Will AI Transform Private Equity?

This week, AI’s ‘Godfather’ Dr Geoffrey Hinton quit Google, warning of the ‘existential risk’ posed by rapid advances in artificial intelligence.

You may also have seen that shares in the education sector fell, after a revenue warning from edtech company Chegg, who acknowledged that sales had been eroded after students turned to AI chatbot ChatGPT for study support.

Over at Axios, Dan Primack considers How private equity could rapidly change as generative AI advances. It’s a relatively short read, yet poses some big questions.

“I have been in the VC business since 1970 — just at the major start of the chip revolution with Intel; then the biotech revolution with the discovery of gene splicing by Genentech in 1976; then the PC revolution in 1977 with Apple et al; then cellular in 1982; then the internet in 1980's; then cloud in the 90's. AI and Chat GPT is a bigger and more profound revolution than all of these in my opinion."

- Alan Patricof, founder of both Apax Partners and Greycroft

Looking For Your Next Hire?

We are building a community of the best finance and technology professionals in private markets. If your firm is looking for talent and you’d like to access our network, please reach out for a chat.

IN DEPTH

“Technology providers have a responsibility to shape the future of the industry, helping practitioners look beyond best practice, to next practice.” - Jessie Juan, Co-Founder at Quantium

As an industry, private equity has lagged behind other sectors when it comes to digitalisation. Relationships were historically the driving force behind deal-making, and a typical PE firm’s dataset is complex, but relatively small compared to other financial services businesses.

In short, tech solutions that worked for other industries, didn’t always work well for PE firms.

Fast forward to 2023, and everyone’s talking about digitalisation. Firms can choose between all-in-one, or best-of-breed, or a combination. And to connect it all up, there are data solutions that help to integrate the tech stack and enable customised reports.

The days of spreadsheets and PDFs are (hopefully) behind us.

The Drawdown recently announced their shortlists for the upcoming awards in June, so we thought we’d take a closer look at the Technology: Innovation nominees. Below, you’ll find a short profile on each one, including more information on the people behind the product.

Of the eight companies on this list, six were founded or formed in the last four years, which highlights the amount of change taking place within the PE tech ecosystem.

Notably, a lot of the leaders on this list have previous entrepreneurial experience building & running companies; there were only a handful of first-time founders and almost all had previous experience in this sector. Some also have hands-on experience as software users, which has informed how they build the solution - notably Quantium’s Jessie Juan, who was an LP at Partners Group.

It’s clear that to do this, and to do it well, requires a combination of passion for technology, commercial acumen, and a deep understanding of how to deliver an excellent user experience.

Enjoy the list below, and keep your eyes peeled for the winners announcement on 7 June!

💡

From Duff & Phelps to 73 Strings

ℹ️ Front Office, Middle Office

📅 Founded in 2019

They say: We provide efficiency and intelligence to how illiquid assets are analysed, valued, monitored and transacted thanks to our AI-augmented solutions, powered by 100s years of corporate finance and private assets expertise.

Three of the senior team worked together before founding 73 Strings. Yann Magnan is the current CEO (and is also listed as cofounder in some places, although he joined later than his colleagues). Co-founders Abhishek Pandey and Sambeet Parija worked with Magnan at Duff & Phelps, and are Deputy CEO and CPO respectively.

“73 is a prime number, the 21st, and one of the most complex from a mathematical point of view. In computer science, strings denote sequences of characters or words. Therefore 73 Strings alludes to the modern alliance between words and figures.”

[Read the full interview with Magnan]

73 Strings is headquartered in Paris, with 49 employees listed on their LinkedIn page. There are currently job opportunities in London and India - head to their website to find out more.

💡

Alkymi is Built Using GPT

ℹ️ Middle Office, Back Office

📅 Founded in 2017

They say: Supercharge your workflows with GPT-powered data and take 10x more data actions with 98% less manual work.

Alkymi was founded in 2017 by Harald Collet, Adam Kleczewski, & Steven She. Kleczewski is their Chief Data Scientist and worked at AI-powered scheduling platform x.ai prior to founding Alkymi.

They have an impressive list of financial backers, including specialist tech investor Work-Bench, venture funder Canaan, and software company Simcorp, Last year, they announced a $21M Series A investment led by Intel Capital.

“Enterprise business users are drowning in unstructured data, emails, PDFs… we built Alkymi for them. If you can use Excel, you can use Alkymi. It’s really about knowing the data you’re after, and then using machine learning to target the data, so that when you receive an email or a PDF with important data it’s automatically extracted.”

[Read the full KPMG interview with Harald Collet]

In April this year, Alkymi announced that their Data Acceleration Platform is now powered by GPT, which is a first for software solutions that handle unstructured data. Users can also ask the Question Tool about document data, and Alkymi will find the answer, while another feature will summarise any document (and in over 95 languages).

Are they hiring? Yes and the roles are remote, with full salary listed! Gold star ⭐

💡

Leveraging Big4 Experience to Build DealsPlus

ℹ️ Front Office, Back Office

📅 Founded in 2020

They say: DealsPlus was founded by a group of individuals who want to change the way that private fund managers close, track and exit their deals.

DealsPlus was founded in 2020 by Venkat Subramaniam (previously EY & PwC) & Padmalakshmi Shankar. Their CPO Ben Stockton joined last year, also from EY, with a track record at Deloitte & Grant Thornton.

With a wealth of experience working in Big 4 accounting firms, the team has seen first hand the difficulties of their user base.

“As advisors, we have worked on over 300 private market transactions across buy and sell side - doing due diligence and structuring. Not one of them was plain sailing. From difficulties in managing deal closings, portfolio cap tables, and ensuring compliance obligations are up to date, to preparing a portfolio for exit - we have seen pain points across the board.“

DealsPlus has also received angel investment from Jeffrey Gelfand, former CFO at Centerbridge, who serves as a senior advisor to DealsPlus, as well as 73 Strings which appears elsewhere on this list.

[Read more about DealsPlus & Venkat Subramaniam on The Drawdown]

💡

Maestro: Where Private Equity Works

ℹ️ Front Office, Middle Office

📅 Founded in 2020

They say: Created exclusively for the PE industry, Maestro maximizes returns for all stakeholders by elevating financial and operational performance, enhancing collaboration and alignment, and accelerating value creation.

Maestro was launched in 2020 by the same founding team - Nick Leopard & Jon Apter - who started Accordion Partners in 2009, a private equity focused consulting firm that now boasts a client list that includes some of the largest GPs on the planet. A Fortune profile from 2012 describes Nick as Wall Street’s new ‘It’ guy:

“As much as private equity firms push, the management teams at their portfolio companies often can’t build extremely complex forecasts, so then there are surprises that no one saw coming.”

Maestro is backed by S&P and currently lists ~30 employees on LinkedIn, most of whom are based in the US. They’ve been hiring recently for a Senior Product Designer in NY, and my LinkedIn feed is regularly awash with fabulous photos from their team outings, so they’re clearly doing something right.

Apter talks of a decade spent working with 200+ sponsors and their portfolio companies to improve operational best practices. These experiences have been channelled into Maestro, which aims to accelerate value creation and improve user experience.

We dug out a great video podcast below with Nick Leopard talking about his experiences at Accordion - at around the 30-minute mark, there’s some interesting stuff about the inspiration behind Maestro 👇

💡

Planr is an Intelligence Platform for Investors & CEO’s

ℹ️ Front Office, Middle Office

📅 Founded in 2019

They say: Being data-rich is no longer enough – it’s time to become data-driven to stay ahead of the competition. Our AI-powered intelligence platform consolidates data from across your portfolio companies, providing you with real-time insights that help you make informed, data-driven decisions. Don’t let your data become a missed opportunity – unlock its potential.

CEO Owen Pagan is an experienced founder, CEO, & Board member. He started his career in web development, before a stint at Mazars as a technology project manager.

“We built Planr because we have been there – in C-Suite and investor roles where you are informed at the last minute that a target will be missed. You have to report a loss without accurate insight into what happened or how you can prevent it from happening again.”

There’s not much information available about the team or their founding story on the (otherwise excellent) website, although LinkedIn indicates their current CTO and co-founder is David Welch, previously at CoreHR.

We were able to dig up an interesting report that Pagan contributed to, called Keeping Calm: The Resilience of UK Private Equity.

“Private equity is quickly moving from an asset class with a lot of hand rolling & data crunching to one where hypotheses are being supplemented and automated by AI.”

[Read the full report on PE Wire]

💡

From LP Investor to Quantium Founder

ℹ️ Front Office, Middle Office, Back Office

📅 Founded in 2016

They say: Modern fund and portfolio management solutions with investor servicing at its core.

Quantium was founded in 2016 by Jessie Juan, Sun Suriyapatanapong, & Anita Meng. They have offices in Singapore, Hong Kong, Beijing, & Bangkok, and earlier in the year they were hiring for an Account Executive in London to expand the team into the UK.

“Being an LP provided me with excellent international exposure to the private markets… [with] a bird’s eye view of how the industry works; market trends, GPs’ operational challenges and best practices in Europe, the Americas, and in Asia.”

- Jessie Juan

Juan was previously an LP at Partners Group, managing ~$1bn capital deployment. Juan’s experiences as an investor informed her decision to build Quantium - there’s a fantastic interview with her on Quantium’s website, well worth a read.

“Typical legacy systems for fund and portfolio management haven’t evolved with the industry, which is a major limitation to most GPs. To design truly next-generation software, innovators can’t just look at today’s problems – they should be envisioning potential pain points three, five, ten years from now.”

💡

TrustQuay: The Tech Titan

ℹ️ Back Office

📅 Formed in 2020

They say: TrustQuay was formed from the merger of Microgen Financial Systems and Touchstone Wealth Management, to become the global leader in technology for the trust, corporate services and alternative fund administration markets.

One of the largest firms on our list, TrustQuay was formed after Silverfleet Capital acquired Microgen in 2019, and then completed a merger with Touchstone in early 2020. TrustQuay has also received investment from Hg, a leading software and services investor.

Their LinkedIn page lists 140 employees, mainly based in the UK & Jersey, with a handful in Singapore & Australia. Group CEO Keith Hale is an experienced specialist in this industry, and has already overseen the growth and subsequent sale of two other companies; Netik, which he founded in 1997 and was subsequently sold to the Bank of New York in 2004, and Multifonds, where Hale served as CEO and oversaw the sale to Temenos.

TrustQuay’s Future Focus Report defines a pathway to digitalisation for trust, corporate, & fund services, with four steps; Consolidate, Regulate, Automate, & Differentiate.

It would be wrong to think that you can’t think about 'automate' until you’ve been through ‘consolidate’. But our research shows that mapping out digitalisation as a journey makes it a far less onerous, far less nebulous concept for businesses, meaning that action plans can be more realistic and benefits realised far quicker.

[Download TrustQuay’s Future Focus Report]

💡

The Dynamic Duo behind UNTAP

🌐 https://www.untap.pe/en/

ℹ️ Middle Office

📅 Founded in 2019

They say: UNTAP Portfolio Management cloud software helps private equity funds consolidate financial results, value creation planning and ESG metrics to bring you a complete view and understanding of your portfolio.

Previously known as EXM Insight, UNTAP was founded in 2019 by Juan Manrique and Manfredi Bargioni. In 2021, the team partnered with Nucleus DNA, a US fintech incubator, to support their expansion into the US market, before rebranding later that year as UNTAP.

Manrique & Bargioni have a partnership that spans over a decade, having worked together for ten years at eTask.it & Hydra Management before founding UNTAP.

“I am an engineer, technologist and entrepreneur by heart. My passion has always been to solve complex business challenges through the effective use of technology, creating value for all stakeholders involved.”

- Juan Manrique

Alongside the portfolio monitoring and investor reporting solutions, UNTAP has partnered with ESG specialists Carbon Responsible and Greenstone to integrate ESG data into the platform. This year, they’ve been nominated in three categories for The Drawdown awards - ESG, Portfolio Monitoring, & Innovation.

💡

And finally… WTF is GPT4?

Chat GPT might be everywhere just now, but what you may not know is that GPT stands for Generative Pre-trained Transformer (GPT). Put simply, it’s a model that allows computers to generate human-like conversational text. The first model was introduced in 2018 by OpenAI, with GPT-4 released in March 2023.

Scientific American has a great explainer here, or if you prefer to watch, try the video below 🤖

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)