Hello reader,

For our 25th edition, we’re dispensing with the usual news, views, & people moves to make space for a bumper issue featuring the very best private equity resources. We’ve gathered our favourite podcasts, videos, and long reads, along with the top rated reports, infographics, and technical glossaries, all in one place. Whether you’re new to PE, or just looking for the latest market commentary, we’ve got you covered.

A note on what did, and did not, make it into this guide:

In the spirit of Access, everything we’ve included is either free, or available as a free trial. That’s not because we think writers shouldn’t be paid fairly for their work, but because in our experience, there’s a lot of information about private markets that isn’t easily available, and we’re trying to change that. If you read something you enjoy, consider showing your appreciation with a quick comment or review.

We are pretty good at hunting down resources (it’s our job to help people find information, and use information to find people!) but we’re always learning. If you think we missed something that should be included here, let us know. We’ll aim to update this on a regular-ish basis and reshare.

We might be biased, but we reckon Access is one of the best PE-focused newsletters out there - if you know someone you think would find this list of resources helpful, please send them a copy!

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition featured a deepdive into PE retail investor opportunities, plus news and views from around private markets, including:

FEATURING:

87 Of The Very Best Private Equity Resources, including:

PE 101 - the essentials (share it with new team members!)

Watch - we’ve trawled TikTok and YouTube so that you don’t have to

Read - long reads, explainers, & the best free PE news sources

Listen - podcasts galore 🎧

Learn - glossaries, courses, and much more

IN DEPTH

“The opportunity to improve companies, the ability to have an alignment of interest with management and us being the shareholders with long-term, patient capital - to me, these are the hallmarks of private equity.” - Claudia Zeisberger

We didn’t always work in private equity. In fact, Melissa & I met socially through mutual friends, long before we ended up building Hertalis (and subsequently Access) together.

In short, we’ve been where you are. We’ve needed to learn about the industry, figure out the key players, and decipher unfamiliar terminology (carry, anyone?). And it didn’t stop there - we also wanted to stay in the loop and start to unpick the more complex concepts.

A few observations from our years trying to gain insight into this industry:

There’s no shortage of information about PE deals (once they’re done) but information about how PE firms operate, on the inside, seems harder to come by

The Financial Times has some of the best quality financial writing available, but much of the PE coverage is quite negative

PE specialist media tends to be subscription-only. If you can get a free trial, it’s definitely worth doing, but the cost can be prohibitive unless your employer is willing to pay

The best way we’ve found to learn about the industry is to talk to someone who works within it. This is where we have an advantage, as along with our team, we spend a significant portion of our week in conversation with private equity professionals about their area of expertise. The amount of information we gather through these conversations is staggering.

This post is an output of these conversations and experience. Whether you’re a PE veteran, a niche super-specialist, or you just need to know a little bit about everything and sound credible, we’re confident that the resources we’ve assembled below will be helpful.

Did we miss something? Please send us your favourite resources! Hit the comment button, or reply to this email if you’re reading in your inbox.

Private Equity 101 🚀

If you’re new to the world of private markets, or just want a refresher, start here…

LEARN: Preqin’s Academy features six lessons with detailed explanations, great for those that want to learn the basics:

WATCH: This 8-minute video from rareliquid is a useful beginner's guide to private equity, which starts with a simple explanation of the PE fund structure, before moving on to cover top firms, a typical fund hierarchy, and day-to-day responsibilities.

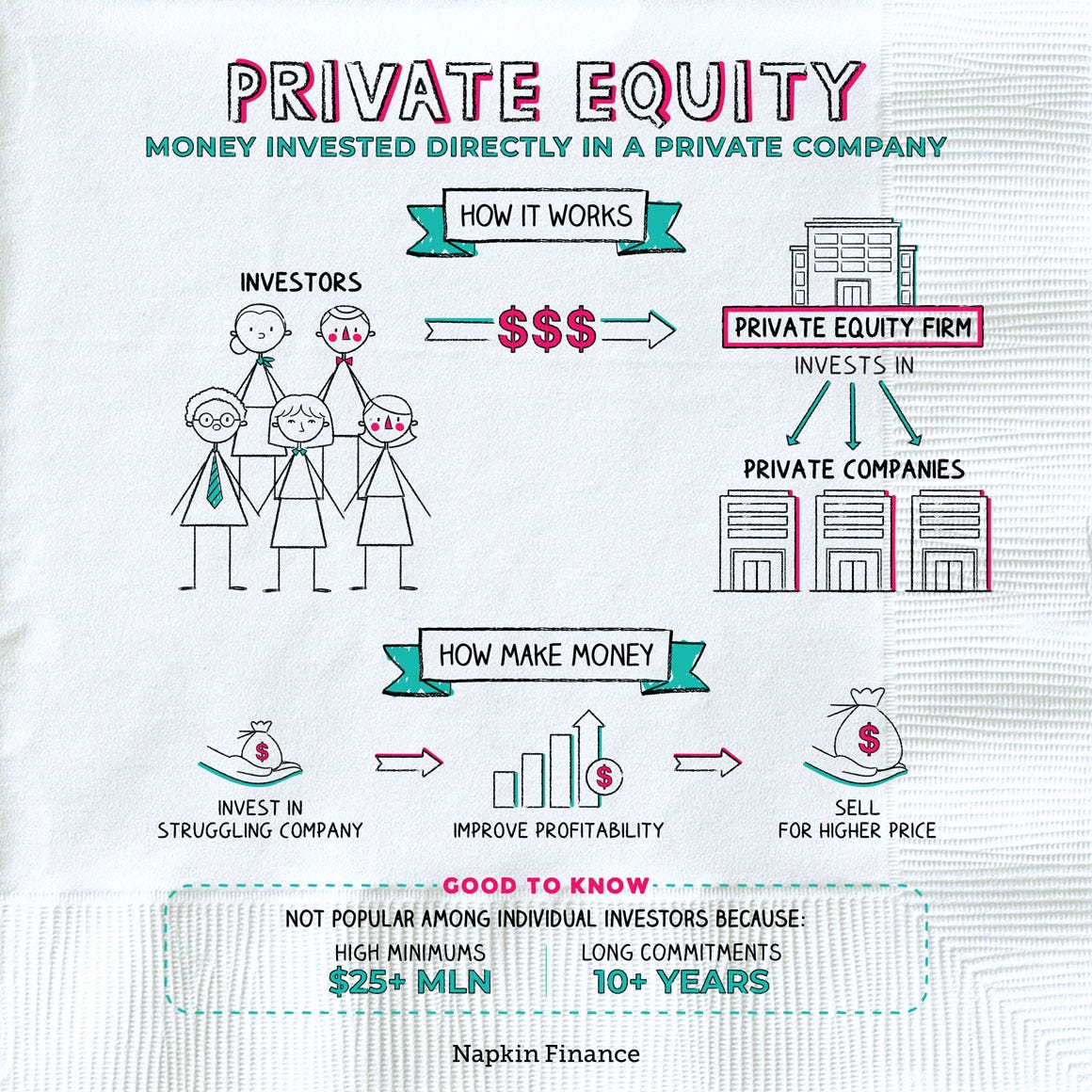

ON A NAPKIN: We’re not kidding. Check out Napkin Finance’s PE Explainer below, with some commentary here.

REFLECT: They say you have to look back to move forwards. Some diligent Googling unearthed this gem from 2007, hosted on Denver University’s website. The author, David Snow, was PEI’s Editor-in-Chief at the time although he’s since moved on to a Partner role at Privcap Media. It’s a 14-page PDF titled ‘An introduction to the fundamentals of an expanding, global industry’ and is now a veritable time capsule, with a mix of still-relevant terms and explainers, alongside historic commentary and predictions.

READ: As we covered in last week’s Access, there’s growing interest in PE opportunities from the retail investment sector. One of the leading platforms, Moonfare, has a no-nonsense guide to private equity that covers essentials, plus common strategies in under 4-mins each, including buyouts, growth, impact, venture, credit, & infrastructure.

💭Want to find out why companies like Moonfare are opening up PE to a wider audience? Check out our long read below:

Private Equity Podcasts

Like to listen? We’ve selected some of the top PE podcasts, check them out below:

🎧 The Voices of Private Equity podcast from ILPA features anecdotes and personal stories from leading industry professionals. Hear first-hand how the people who make high stakes decisions go about sorting through the challenges, opportunities, risks and rewards while market and political dynamics swirl around them.

🎧 The Preferred Return Podcast from Altvia focuses on the PE Techstack - this episode considers The Future of GP-LP Matchmaking in Private Markets or ‘Tinder for PE’, with Melissa Maleri and Conor Smyth from TritonLake.

🎧 Behind the Deal by Thoma Bravo goes behind-the-scenes of major acquisitions. Try Episode 2, which features the CEO from Sailpoint Technologies discussing how they forged a relationship that led to Thoma Bravo’s first ever IPO of a portfolio company, and eventually acquiring SailPoint twice over the course of a decade.

🎧 EYs NextWave Private Equity podcast series is packed with guests from some of the biggest PE firms on the planet, including Ardian’s Mark Benedetti on secondary deals, KKR’s MD for sustainable investing Elizabeth Seeger on ESG, and Hg’s Executive Chairman Nic Humphries on AI.

🎧 In their own words, the Parker Gale Private Equity Funcast is “occasionally insightful and often entertaining“ - that’s good enough for us… tune in for discussions about how they buy profitable tech companies, and the tools they use to build and grow them.

The Private Equity Landscape

Be in the know about who’s who, where they operate, and which funds have raised the most money…

The Top Ten (in just under 12-minutes): Learn more about the top 10 biggest private equity firms in the world (a whistlestop tour 🌪️)

A list within a list… the PEI 300 list ranks GPs by the amount of money they’ve raised. Check out the top rated firms, as well as PEI’s insights into year-on-year changes.

And if you enjoyed that, try our piece from earlier in the year featuring the Top Five PE Fundraisers, where we go behind the scenes to see what it’s like working there.

It’s not all about the funds - if you’re looking for the lowdown on private equity tech, try PE Stack which posts a weekly digest on tech news, people moves, and partnerships across the industry, as well as their popular vendor maps.

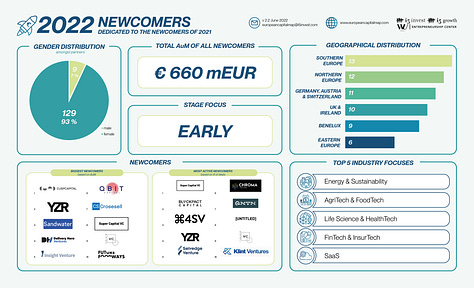

The European Capital Map 2022 is published by i5 invest and features fourteen logo maps and infographics, covering UK & Ireland, DACH region, Benelux, Northern Europe, Southern Europe, Eastern Europe, plus newly launched funds.

[Check out the full set on their website]

Hot Off The Press #1

These websites are subscription-based, however they offer a handful of articles for free, plus regular newsletters.

Industry Advocates 📢

Learn about the key organisations representing the private equity industry:

British Private Equity & Venture Capital Association (BVCA)

The BVCA’s Guide to Private Equity is aimed at companies that are seeking finance and might be curious to learn more about PE. Assuming you’re not, don’t be put off - it’s comprehensive, extremely well-written, and comes from the PE/VC industry body and public policy advocate in the UK. At 56 pages, it’s not a quick read, so we’d recommend using it as a reference guide - just dip in and out, depending on what you’re looking to find out.

Institutional Limited Partners Association (ILPA)

ILPA represents institutional investors - think insurance companies, family offices, pension funds or endowments - elsewhere in this guide, we’ve linked to their Voices of PE podcast, which is worth a listen.

Invest Europe

As you might expect from an industry advocate, Invest Europe’s website is very pro-PE, complete with an online film series exploring the role of PE in European society, and an e-book called the Little Book of Private Equity. At times, it strays into Hollywood-style story telling, which feels a bit off-kilter to anyone familiar with the industry’s quirks and imperfections, but if you’re ok with that, there’s a lot to like.

“Invest Europe is the world’s largest association of private capital providers. We represent Europe’s private equity, venture capital and infrastructure investment firms, as well as their investors, including some of Europe’s largest pension funds and insurers.”

Level 20

Dedicated to improving gender diversity in private equity, Level 20 is a not-for-profit organisation founded in 2015 by 12 senior PE professionals who recognised the need for change. Last year, we profiled their outgoing CEO Pam Jackson, who has recently been succeeded by Gurpreet Manku. There are some excellent resources on Level 20’s website, and you can gain access to more by applying for membership, which is free and open to anyone working in PE who is committed to improving gender diversity.

Principles for Responsible Investment (PRI)

What are the principles for responsible investment? We’re glad you asked. There are six principles, which you can learn about on PRI’s website, along with an academic research section that features the latest views on sustainable investments.

Short & Snappy

Here’s a selection of videos, threads, & explainers to watch or read in under 1-minute

Finance & Private Equity Made Simple: A Simple Model is a Tiktok channel you should be following. Most of the explainers are under a minute long, so easy to watch (and rewatch!)

How Does Private Capital Make A Difference? Try this short video from the BCVA

One of our favourite Twitter threads asks What Is PE And How Does It Make Money? - there’s also a brilliant infographic depicting the size of the industry, courtesy of Visual Capitalist.

Got an upcoming interview in PE? Check out the most common PE interview questions

Private Equity x KK: In the video below, Iamdulma explains the relevance of Kim Kardashian’s private equity firm, Skky Partners and what this means for consumers 👇

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Hot Off The Press #2

Industry commentators are a great source of PE news and views. We’ve collated some recent releases below…

Annual BVCA review 2022-23 with key statistics and a comprehensive overview of the industry

The McKinsey Global Private Markets Report features key highlights of 2022 and is titled Private markets turn down the volume

The Private Equity Reporting Group (PERG) is an independent body that oversees enhancements in transparency and disclosure within the UK PE industry. Read their latest report

Accenture published their latest ESG in Private Equity report, have a read…

“ESG is being embraced for more than just humanitarian reasons. In many cases, sustainable investments are seeing returns superior to non-sustainable counterparts.”

Navigating a Shifting Tide: Read market outlooks and highlights in Bain’s annual global report

EY’s Private Equity Pulse features five key takeaways from 4Q 2022

On The Fringes

Here are some of the resources we love, that go broader than private markets.

M&A Science is a fantastic educational podcast that dives into the world of complex integrations with commentary from industry experts. Their website also hosts an M&A glossary, interviews, templates, ebooks and more!

Looking for a new (old) show to binge? Billions is a TV series starring Damian Lewis and Paul Giamatti - check out Investopedia’s Guide to Watching Billions for a glossary of terms used in the show to help you decipher what’s going on. (Fun fact: co-creator Andrew Ross Sorkin was an M&A reporter for The New York Times).

A great long read from the How They Make Money newsletter, on the Art of Spotting Economic Moats (essentially, attributes that give companies a sustainable competitive advantage).

Looking For A Long Read? 📖

Thirty years after Jensen’s prediction that the “publicly held corporation has outlived its usefulness in many sectors of the economy”, Peter Morris and Ludovic Phalippou wrote a paper for the Oxford Review of Economic Policy reflecting on the growth of private equity, stacked against a “dramatic fall in the number of quoted companies”.

Their 2019 report concluded that private equity was providing “an alternative to quoted stock markets” but acknowledged a complex picture where PE “is not the unalloyed negative that its extreme opponents portray, but neither is the picture as uniformly or conclusively positive for society as practitioners would like to suggest it is.”

“New organizations are emerging. Takeovers, leveraged buyouts, and other going-private transactions are manifestations of this change. [These PE-backed companies] can motivate people and manage resources more effectively than public corporations.”

[Read Jensen on the Eclipse of the Public Corporation, c.1989]

PE Glossaries

ILPA’s A-Z is one of the best and most comprehensive PE glossaries available, with short, easy-to-understand explanations of private markets terminology, ranging from the common to the more obscure.

Glossary-meets-explainer Capital Gains is a free weekly newsletter from The Diff’s Byrne Hobart that provides a weekly writeup of specific financial concepts. View the list here, or jump straight into the latest post, What is Alpha?

At the other end of the scale sits this ESG Glossary from law firm Vinson & Elkins, which defines some of the keywords used in sustainable investments.

Hot Off The Press #3

If you’re looking for easy-to-understand explainers of niche PE concepts, try some of the specialist PE firms and software vendors. Here are our top picks:

What Is NAV Financing And How Is It Used from 17Capital

Overview of PE Secondaries from Coller Capital

Untangling ESG Frameworks, Compliance, and Standards from Dynamo Software

The PEriodic Table of Technology from Altvia (with a great graphic showing how the techstack maps to functional areas)

Lucky Dip

Still looking for more? Pick from one of the fantastic resources below (and let us know what you found most helpful!)

Bocconi University runs a free course on Private Equity and Venture Capital via Coursera. It’s 100% online and while you can pay to work towards a certificate, if you just want to read and view the course content, it’s completely free (9-hours total learning content)

Remember rareliquid from our PE 101 section? Their ‘day in the life’ video features highlights, challenges faced, and helpful resources for anyone looking for an insider take on working in PE (36-mins watch)

What Do You Actually Do In Private Equity? Asked, and answered, in this great video from Peak Frameworks (6-min watch)

Be An Alternatives Guru In 5 Steps with BlackRock. We managed to hunt down a brilliant section on their US website that takes readers through five sections:

Types of Asset Classes (Part 1 - hedge funds, PE, credit)

Types of Asset Classes (Part 2 - real estate, infrastructure, closed-end)

And finally… The Private Equity Playlist 🎵

The exquisitely titled ‘Corp Capitalism Girlie on Wall Street’ Spotify playlist includes tracks from Lizzo, Madonna, Jay-Z, Chico Rose, and Rihanna.

upscale NY corp banking job in private equity, you drive a black beemer and are numb to the feeling of burnout and capitalism. Ur life is fast paced and u overexceed exp each Q . I have to love capitalism to support my lavish lifestyle. Its night and u drive back to ur NYC appartment and drink wine

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)