Access: Beyond the Capital

"The idea that we are not investing in the UK is for the birds" - George Graham

Hello reader,

Welcome to the 30th edition of Access - last week we took a break from the usual format to release the May 2023 Jobseeker Edition, featuring 94 private capital job opportunities across the globe.

This week, we’re exploring UK private equity with a focus on the firms that drive regional investment in businesses based outside London.

The North West is increasingly a popular choice with investors, as is Scotland, where deal value hit a five-year high in 2022.

“Last year was a tough one for the investment market globally, but it’s no fluke that Scotland bucked the downward trend. Scotland is still vulnerable to global headwinds, but our breadth and depth of mid-market businesses helped provide some welcome cover during a challenging year.”

- Graeme Williams, head of corporate finance M&A for Scotland at KPMG

Read on below to find out which firms are deploying capital outside London, the businesses they invest in, plus insights & reports on UK private equity.

Until next time -

Liz & Melissa

In case you missed it…

The Jobseeker Edition featured global opportunities at…

Private capital fund managers, including: Bain Capital, BlackRock, Blackstone, Carlyle, CVC Capital Partners, EQT, Neuberger Berman and more

Technology vendors offering front, middle and back office solutions, including: Chronograph, Dasseti, Dynamo Software, Greenstone, Quantium, OneTrust, and more

Advisors, consulting firms and fund services providers working in private markets, including: alterDomus, BCG, Cambridge Associates, Colmore, EY, SS&C and more

FEATURING:

In Brief: The very best UK-focused private markets resources, including:

What’s the Value of PE/VC to the UK Economy?

Investing in Future Wales

The Resilience of UK Private Equity

In Depth: Beyond the Capital

IN BRIEF

Below, you’ll find a selection of private equity resources from people and companies in our private markets network.

What’s the Value of PE/VC to the UK Economy?

This year, the BVCA estimates that private equity and venture capital backed businesses will employ 2.2m workers, collectively earning £75bn.

And it doesn’t stop there. Businesses that supply to PE/VC backed businesses employ an additional 1.3m workers, earning £49bn and generating a further £88bn of GDP.

As the Chief Exec of the BVCA says, it’s clear that PE & VC are of “immense value” to the UK economy.

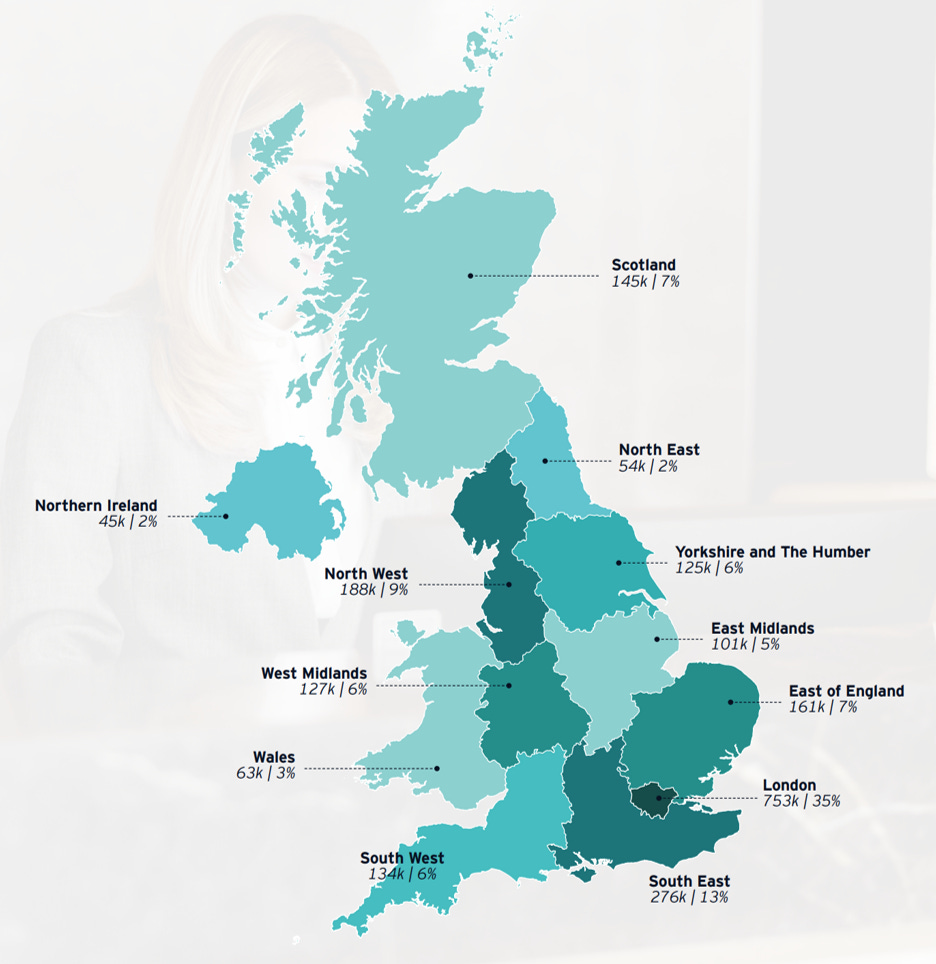

The graphic below shows the direct economic contribution of UK PE/VC backed businesses in 2023, by nation and region (Thousands of jobs | % of jobs).

To read the full report, produced by EY for the BVCA, head over to their website.

***

Investing in Future Wales

The second annual Investing in Future Wales business showcase took place earlier this year, hosted by the British Business Bank.

Since Wales was highlighted as one of the top 10 UK FinTech hubs in the 2021 Kalifa Review, the country is increasingly attracting scaling FinTechs and challenger banks, keen to capitalise on the local talent pool.

The panel discussion featured key players within the ecosystem, hosted by Sarah Williams Gardener from Fintech Wales. Watch the video to hear how:

Octopus Ventures are looking to Wales for the next big fintech investment

Starling Bank, the UK’s fastest growing Fintech, has chosen Wales as a key geography for their growth.

***

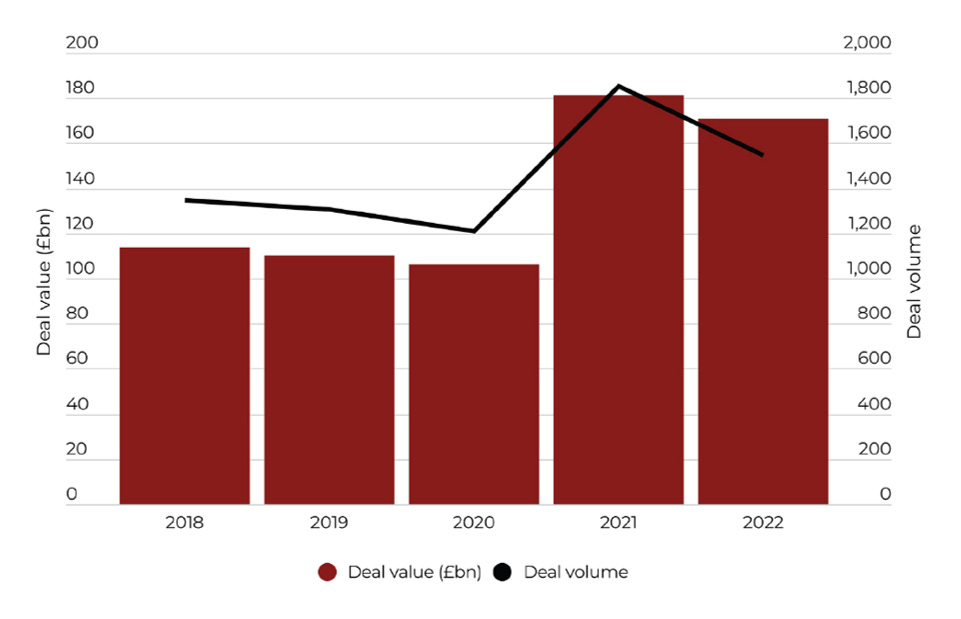

The Resilience of UK Private Equity

While fundraising has been challenging globally, the UK has also grappled with Brexit, political instability, and last year’s gilt crisis.

Both deal value and volume were down last year from 2021’s record high, and it’s been a rocky start to 2023 so far. So, what’s next for the UK?

Earlier this year, PE Wire surveyed 35 private equity professionals on their views around PE fundraising and investment in the UK. They found that:

Despite an overall decline, mid-market PE remains resilient

UK tech talent must be nurtured, especially outside London

The top three sectors for UK investment are tech, manufacturing, & healthcare.

[Read the full report on PE Wire]

***

Looking For Your Next Hire? 👀

We are building a community of the best finance and technology professionals in private markets, including:

ESG specialists

Private equity technology leaders

Fund finance experts

If your firm is looking for talent and you’d like to access our network, please reach out for a chat.

IN DEPTH

“The London market is almost overfished. There are a lot of funds there and you get to a place where you run out of quality investments to look at.” - Anish Kapoor, CEO at AccessPay

According to data specialist Beauhurst, there are currently 547 active VC and PE funds in the UK, with around 300 of these headquartered in London.

But what about the rest of the UK?

There is a thriving network of investment firms that are based outside of London, many of whom are focused on providing funding to businesses that might not otherwise catch the attention of London-based funds. Their mission is to bring investment to as many parts of the UK as possible, boosting the economy and making it possible for entrepreneurs and business leaders to secure the necessary funds to scale their companies sustainably.

Let’s take a look at the numbers.

BGF says that 83% of British SMEs are already located outside of London. It also lists ~13,000 SMEs in the UK today, which they define as a private company turning over £3m-£150m annually.

A 2019 report found that “after controlling for a wide range of firm and industry specific variables, the probability of a firm getting equity funding is up to 50% lower in nearly all regions outside London.”

Between 2011 and 2020, 61% of UK equity investments were in businesses based within one hour’s travel time of the investor; 82% within two hours.

Today, the BVCA estimates that 65% of companies receiving private investment are based outside of London, while 56% of jobs in privately backed UK businesses are outside London & the South East.

“…thanks to the support of private capital, many businesses have been able to adapt and grow in what remains an uncertain economic environment.”

- Michael Moore, Chief Executive at BVCA

For private markets funds seeking the best deals outside the capital, it’s increasingly important to set up a base in the region you’re targeting. Many investments are still made on the basis of relationships - data and analytics plays a much larger role these days in sourcing potential deals, but in an industry where investments are often held for 10-years or more, both sides want to know the other is fully committed. And in many cases, that means some level of physical proximity, as well as the fund manager demonstrating they understand the local business community and consumer eco-system.

Below, we feature profiles on some of the leading regionally-focused PE funds operating in the UK today.

***

Maven Capital Partners is Backing British Growth

They say: “We believe that the most effective way to build strong relationships with management teams is to operate at a local level.”

Maven In Numbers

11 Regional offices, incl. 3 in Scotland

£650m+ invested in UK businesses since 2009

£20m maximum investment in a single company

Maven was founded in 2009 after a management buyout of Aberdeen Asset Management’s private equity business. Maven is also the backer of Growth Capital Ventures that provides co-investment opportunities for private & institutional investors.

“At Maven we understand the importance of having a local presence. That’s why our team is located across a network of regional offices putting us at the heart of the main centres of UK business and transaction activity.”

Maven manages four regional funds, including the Northern Powerhouse Investment Fund’s Equity Finance Fund that provides funding of up to £2m for SMEs located across the North West of England, as well as Yorkshire & Humber and the Tees Valley.

🏢In The Portfolio

Private markets tech provider Delio received growth capital investment from Maven in 2019, with the aim of fuelling the Cardiff-headquartered FinTech’s global growth.

This initial investment paved the way for further funding. In 2022, Octopus Ventures led an $8.3m funding round - also supported by Maven - to bring Delio’s total equity funding to $15.5m.

[Read Maven’s take on the Thriving Tech Sector in the North West]

***

BGF Offers Growth Funding That’s Different by Design

They say: “BGF is the UK and Ireland’s most active and dynamic investor of equity capital in growing companies, backing entrepreneurs and innovators.”

BGF In Numbers

16 offices across the UK & Ireland

£3.5bn invested since 2011 across 500+ companies

Typical investment is between £1m & £20m

Founded in 2011, BGF (originally British Growth Fund) is backed by Barclays, HSBC, Lloyds Banking Group, NatWest and Standard Chartered, as well as the Ireland Strategic Investment Fund, AIB, Bank of Ireland and Ulster Bank. They specialise in long term, minority investments in UK SMEs, typically taking an equity share of 10-40%.

“BGF was set up to address the chronic and longstanding shortage of funding available to Britain and Ireland’s small and mid-sized firms, and to inspire a generation of entrepreneurs largely overlooked or insufficiently supported by the investment community.”

In 2018, BGF supported Canada to launch its own version, with Australia following suit in 2020.

🏢In The Portfolio

J&B Recycling is a waste management and recycling company based in the North East of England. A seven year partnership with BGF enabled the firm to exploit an opportunity in new government-legislated recycling targets, resulting in a business expansion of 200%. In addition to the financial support, BGF also provided J&B access to their Talent Network to hire a non-executive chairman.

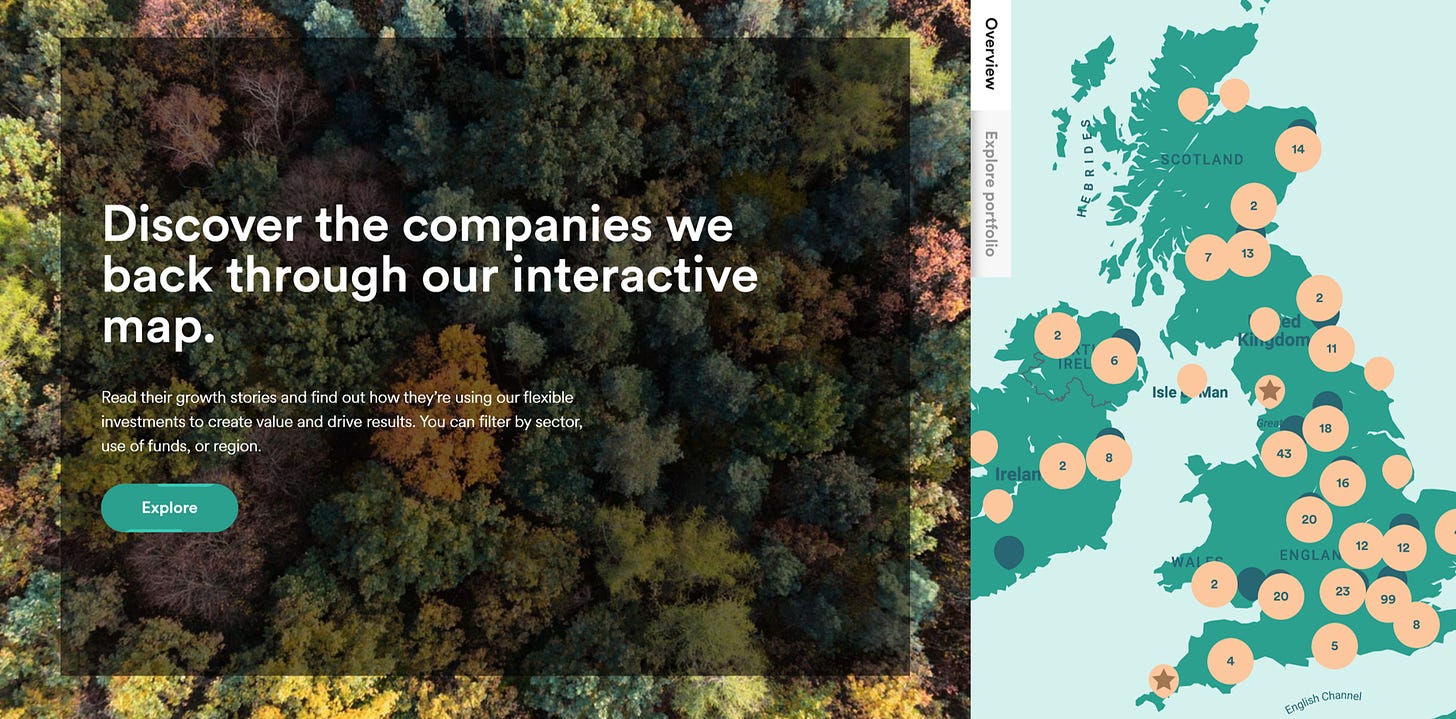

[Explore the rest of BGFs portfolio of UK investments via their interactive map]

***

Palatine - Not just private equity, positive equity

They say: “We strive for sustainable growth by building on solid foundations with a commitment to the environment and society.”

Palatine PE In Numbers

3 UK offices

Buyout fund invests between £10m and £50m

Impact fund invests between £5m and £20m

Palatine is headquartered in Manchester, with offices in London and Birmingham. They manage two funds; a buyout fund focused on sustainable growth, and an impact fund that seeks to invest in ‘commercially driven businesses with a mission to positively impact on society or the environment’.

“Formed in 2005 by founding partners Gary Tipper, Ed Fazakerley and Tony Dickin, we sought to prove that being different and being based outside London didn’t mean that you couldn’t raise funding from likeminded people.”

Palatine’s focus on ESG is backed by a B-Corp Certification, which they achieved last year. You can read more about Palatine’s journey to B-Corp, along with other B-Corp profiles in Access 022 below 👇

🏢In The Portfolio

Easyfundraising is based in the West Midlands. You might recognise the name - it’s the UK’s leading charity reward shopping site, connecting more than 1.8 million registered consumers with their favourite retail brands to support the charities and causes they are most passionate about.

Palatine made an initial investment in 2020 from their Impact fund that helped Easyfundraising scale the size and impact of its business. Palatine also introduced a new chairman, and supported the recruitment of a CFO, CTO, and CEO.

***

TDC is A Truly Differentiated Asset Manager

They say: “We are a private debt fund that supports businesses in the heart of the UK economy”

TDC In Numbers

1 UK office

£1bn capital raised

Typical investment size £10m-£40m

Founded in 2015, TDC is based in Manchester and is ‘the only private credit asset manager based outside of London.’ Their Impact fund launched last year will focus on providing loans to SMEs in the North of England, with a first close of £40m from British Business Investments, the Greater Manchester Pension Fund, and private investors.

Against a backdrop of increased interest in private credit, PE giant KKR announced a capital partnership with TDC earlier this year. This provides TDC with significant capital to expand the sourcing of debt transactions, while KKR acquires a stake to help deliver TDC’s ambitious growth plans.

“While economic conditions are challenging and debt availability is tightening, we are still seeing a strong flow of private equity deals. We believe the new investment will place us in a great position to gain market share and show we are a committed funding partner”

TDC typically holds investments over three to five years, targeting further capital events - sale, IPO, fundraising or refinancing - to provide a route to exit.

🏢In The Portfolio

Vernacare is a manufacturing business based in the North West of England. In 2017, TDC provided a £10.2m Second Lien loan to the Vernacare Group to facilitate the acquisition of Synergy HCS, a US-based healthcare products group.

“Without your support, we would not have been able to conclude the HCS acquisition. This has been a game changer for the business and whilst we have not yet had the full exit, we are in a good position going forward.“

- Andy Lees at Palatine PE

Read the full case study on TDC’s website

***

NorthEdge Understands the Engines of Regional Economy

They say: “We are proud to be the UK’s largest independent regionally focussed investor, partnering with management teams in our regions to build better businesses.”

NorthEdge In Numbers

3 UK offices

4 funds with £900m funds under management

Typical investment size £2m-£50m.

Founded in 2012, NorthEdge is based in Manchester with offices in Leeds and Birmingham. Specialising in tech, healthcare, business services, and industrials, NorthEdge has invested in over 40 companies, with nearly 8,000 people employed in businesses across their portfolio.

“The firm is centred on our shared belief in the potential of economies outside the capital, and on meaningful values that we endeavour to meet as part of delivering strong returns to our investors.”

The senior team worked at 3i and LDC, the PE arm of Lloyds Banking Group, before forming NorthEdge together.

🏢In The Portfolio

Cutwel is one of the UK’s leading distributors to the British and Irish metalworking industry, serving over 12,000 customers.

NorthEdge made an initial investment to Cutwel in 2018, helping the business to almost double its employee base and build capacity & capability across its management team.

Last month, Cutwel was recognised by the BVCA for exceptional performance, having successfully transitioned from family ownership to an incentivised management team. While competitors are still following a more traditional person-based sales approach, Cutwel was praised for investing in digital platforms and tools to drive sales.

[Read more about NorthEdge’s investment in Cutwel]

***

And finally… For The Birds

Ahead of Room151’s LGPS Private Markets Forum 2023, a discussion has opened up about Local Government Pension Schemes (LGPS) pledging support to place-based impact investing.

George Graham, director at South Yorkshire Pensions Authority will be presenting at the forum on their approach, which aims to allocate £500m capital over 5-10 years to “local development lending, housing, local venture capital, private equity and private debt.”

Read the full debate on Jamie Broderick’s LinkedIn post here, including commentary from the Lord Mayor of London, Nicholas Lyons.

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)