Access: Breaking up is hard to do

re·dun·dant (adjective) no longer needed or useful; superfluous

Hello reader,

Welcome to the 21st edition of Access. Today is our 6-month anniversary! Our very first post featured Coller Capital’s founder - if you didn’t catch it first time around, here’s a link (we’re biased, but it’s still one of our favourites).

Off the back of last week’s SVB-focused newsletter, we ended up having a ton of conversations with people in our network who had also experienced disruption at work. Much of this centred around redundancy, or the risk of it, which remains big news at the moment.

This week we’re sharing some of these stories, for no reason other than sometimes life throws you a curveball, and it’s important to know you’re not alone.

Massive thanks to all who shared their experiences with us - you know who you are ❤️

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition featured a deep dive into the turmoil at Silicon Valley Bank, including:

FEATURING:

In Brief: News & Views From Across Our Network

Can AI Predict Startup Success?

Job Cuts At Accenture

Let’s Play Pickleball!

In Depth: SVB Meltdown

IN BRIEF

Can an AI tool accurately predict the future? 🔮

Earlier this week, Pitchbook launched its VC Exit Predictor tool that uses machine learning to assess a startup's prospect of a successful exit.

Using a bunch of data points from Pitchbook’s own data set, the tool assigns a score to determine whether a particular VC-backed business is likely to be acquired, go public, or not exit (either through becoming self-sustaining, or failure).

“While no tool or person can predict the company exits with complete accuracy, the VC Exit Predictor’s ability to process large amounts of data and identify patterns can give investors an edge in making informed investment decisions”

- McKinley McGinn, product manager of market intelligence at PitchBook

It’s too early to know whether the tool is as good as Pitchbook says, but it’s been trained on 46,000 observations with known outcomes, and then tested on +11,000 out-of-sample observations, with 75% accuracy rate.

Tech Crunch’s Kyle Wiggers writes more on the topic, including some of the limitations of AI tools more generally - worth a read here.

***

Accenture Announces It’s Cutting 19,000 Jobs

‘Let There Be Change’ is the rather unfortunate tagline next to Accenture’s Google result.

The difficult news about staff job losses was only announced today so there’s limited information available, but the FT’s Sarah O’Connor speaks for all of us (below):

***

Maestro Wins Again At Team Building

In lighter news, our LinkedIn feed was once again blessed with photographs from Maestro’s latest team meeting.

There was engaging discussion! Innovative ideation! And most importantly, some friendly competition at PKL Boston (that’s pickleball, in case you’ve not tried the next American pastime).

Maestro, all we want to know is - where was our invite? 😁

Looking For Your Next Move?

Here’s a reminder of our pick of private markets job opportunities for this month:

European private capital firm looking to hire a senior Cyber Security professional to lead the development of their security strategy

Leading provider of audit, tax & advisory services seeking an experienced accountant to join their Central London practice

Private Equity fund specialising in N. European investments is currently interviewing for a tech / data manager to work in their middle office team

Private markets consultancy working with clients across Europe and US is seeking experienced management consultants to join their growing team

If you're thinking about your next role and would like to talk through your options, please feel free to reach out; we're happy to chat so we know what to keep an eye out for.

IN DEPTH

“Everything that was promised just went out of the window. New bosses, new rules” - Anonymous

Another week, another bank comes crashing down.

Last week, we reported on the turmoil at SVB and how this impacted not only its staff but also SVBs clients, as many founders spent a weekend without access to their company bank account, wondering whether they’d be able to make payroll.

There’s a growing sense of unease, as we all (inevitably) wonder what’s around the corner. But what to do about it?

We invited two of our colleagues, Jess Main & Supriya Dasgupta, to talk with some of the contacts in their network to find out how others have handled difficult moments at work. Here’s what they learned…

***

Whilst the UK redundancy rate remains relatively low, there’s been an increase over the past three months and a sharp uptick in the number of potential redundancies across banking & finance.

A quick search of posts on LinkedIn mentioning ‘redundant’ turned up a flood of stories.

Henry is a senior talent acquisition specialist who was made redundant from his role with an HR tech firm at the end of last year, just before Christmas.

“I spend my days in silence at home, maybe speak to a couple of friends over a coffee or the odd recruiter.... but fundamentally not having a job has cut me off from most of my social interactions and a sense of worth.”

He posts regularly about his experiences looking for a new role, from what he did after hearing the news (cleaned up his local park, because “it dawned on me that I'm free to do what ever I want on a Tuesday....”), to the reasons he turned down two offers (“A gut call… and am bricking it to be honest”).

***

Sharon works for a global FMCG business and has spent the last five months being at risk of redundancy. Her post from this week is titled ‘FEELING BRIGHTER’, having secured a new role in a different team. She reflects on her experiences and shares some advice for others in a similar position.

“It’s not personal – however hard it is to believe this, it is crucial for how you deal with the process and what comes next.”

She also explains why she thinks that uncertainty at work can be an opportunity to reflect, to get some energy back, and to connect with people in your network.

***

We spoke to others who had similar experiences, where the internal process to complete reorganisations or finalise job cuts took many months to work through.

“I joined at a period of hyper-growth with the business looking to double in size and double it’s customer base. Unfortunately, the rapid growth far outpaced sales and we went through three rounds of redundancies. The first in late spring, which turned out not to be deep enough, then further reductions around 2 months after that. After two more missed sales targets, a third reduction was initiated. At this point, I’d lost faith in leadership and volunteered for redundancy.”

This theme of losing faith is a common one, often compounded by broken promises - we heard examples of managers trying to reassure staff, shortly before another round of job cuts is announced; another person stayed on to complete a project and discovered that the agreed completion bonus for their team wasn’t going to be paid.

At best, this makes it appear like those in charge don’t know what they’re doing; at worst, it seems like a deliberate attempt to conceal the truth.

***

Of all the different reasons that people experience change or uncertainty at work, redundancy stands out as a particularly emotive topic. (And one that impacts more people than you might think).

People leave companies all the time - turns out, when the breakup is instigated by your employer, things start to feel personal. There’s a big difference between taking a hard choice to leave because you’re unhappy, and a decision being made for you.

Here are a few things we heard this week:

“Big systemic problems, entire teams of people had been let down”

“Loyalty is so important… the news [of layoffs] hits you like a train”

“I just thought - How can you do this to me?“

“It can be hurtful and disappointing when you’re emotionally invested, but as it’s out of your control, you can really only focus on whatever comes next.”

***

As well as asking people about their experiences, we also did some research of our own. Some of the things we learned might surprise you.

For example - the first £30k of a redundancy payment is tax-free (not new news). But, did you know that, according to a piece in the FT from earlier this year, “the tax-free limit has been frozen for well over three decades, since it was set in 1988. If inflation had been allowed for, it would stand today at £73,000.”

😱

There’s no escaping it - money, some or none, can make a big difference in how someone experiences redundancy. In the UK, statutory redundancy only kicks in once you have two years service, and the payment is capped.

“Being without a job is very hard – being used to spending money when you don't have it or have a limited budget… identifying what you can go without.”

But even more than this, respect goes a really, really long way. Aside from being the right thing to do, imagine trying to engage meaningfully with a recruitment process whilst having strong, negative feelings about how your current employer has treated you.

If you’ve had a difficult week, please reach out. To us, or someone else in your network who can lend a listening ear - comments open if you’d like to share your own story or ask a question.

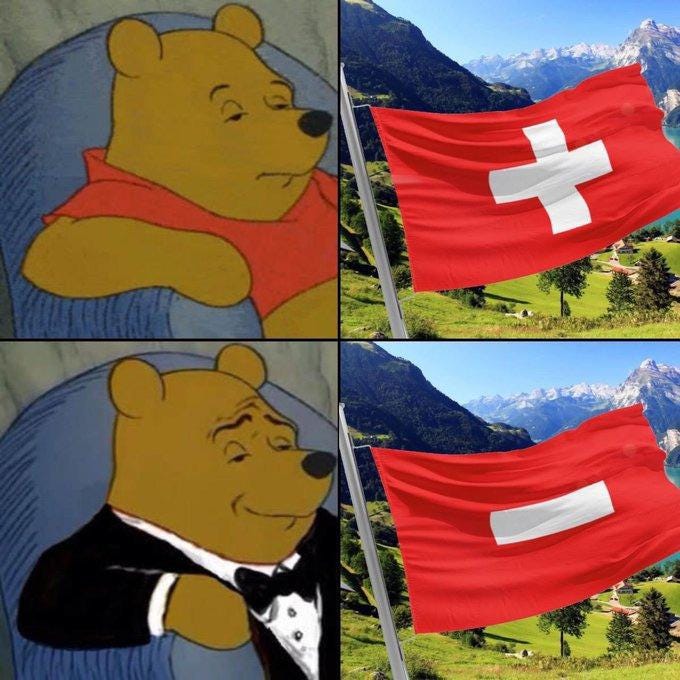

And finally… If you don’t laugh, you’ll cry

We’re not aiming to become the Meme Queens of private markets, but ‘Debit Suisse’ has been doing the rounds on social media and we couldn’t not share…

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)