Access: The Grandfather of Private Equity

“We must all insist on ethical behaviour or we will kill the golden goose.” - Jerome Kohlberg

Hello reader,

Welcome to the 34th edition of Access - the most clicked link from last week’s newsletter was the link to our private capital network map, featuring leaders across our industry.

This week’s In Depth features the late, great, Jerome Kohlberg Jr. We’ve wanted to write this one for a while now, and it seemed fitting to share it in the week that he would have celebrated his 98th birthday.

To give you a flavour of the man behind the legend, in an obituary written by Business Insider at the time of Kohlberg’s passing, they described the KKR pioneer as ‘a conservative mind in one of Wall Street's gaudiest eras.’ The FT called him ‘the ‘First K’ who defied hardball at takeover triumvirate’.

We’ve dedicated this week’s In Depth to a profile on Kohlberg, we hope you enjoy the read.

Until next time -

Liz & Melissa

In case you missed it…

For last week’s edition we shared a jobseekers guide to handling tricky interview questions, plus the latest private equity news, including:

FEATURING:

In Brief: The very best global private markets resources, including:

73 Strings Completes Series A Funding Round

Gen II Fund Services Acquires Crestbridge

Federated Hermes Raises $486m for Fifth Fund

In Depth: The Grandfather of Private Equity

IN BRIEF

Below, you’ll find a selection of global news stories from people and companies in our private markets network.

73 Strings Completes Series A Funding Round

Hot on the heels of their Drawdown Award win in the Technology: Innovation category, 73 Strings has announced a Series A funding round led by Blackstone Innovations Investments and Fidelity International Strategic Ventures, with participation from Broadhaven Ventures.

”With this funding, we are well-positioned to continue providing best-in-class technology solutions to the private capital industry. Our diverse skill sets and global footprint enable us to deliver products that shape the future of the industry,”

- Abhishek Pandey, co-founder of 73 Strings.

Following accelerated growth in 2022, and with existing clients totalling $2 trillion in AUM, 73 Strings is aiming to fuel geographic expansion and continued product innovation.

Read more about the tech innovators transforming private capital - including 73 Strings - in our May edition below👇

***

Gen II Fund Services Acquires Crestbridge

Leading independent fund services provider Gen II has initiated a major European expansion, with the acquisition of Crestbridge’s private equity and real estate fund administration businesses.

“Like Gen II, Crestbridge is known for its client-first approach and commitment to investing in the best people and technology.”

Combining the two providers will create an organisation with more than 1,500 professionals, and further establishes Gen II as one of the world’s largest independent private capital fund administrators, expanding the firm’s jurisdictional reach to include the UK, Jersey, Ireland and other international markets.

[Read the press release in full]

***

Federated Hermes Raises $486m for Fifth Fund

Private equity fund Federated Hermes GPE announced this week that their fifth flagship fund, PEC V, has successfully closed at $486m, surpassing its target of $400m.

“Despite macroeconomic headwinds and a challenging fundraising environment, PEC V has closed well above our original target. It is a testament to Federated Hermes GPE’s global reach that PEC V has attracted investors from markets as widespread as Switzerland and Korea.”

- Peter Gale, CIO and Head of Private Equity at Federated Hermes GPE

The GP has a 22-year track record of making co-investments, having committed $4.5 billion across 278 global co-investments. Commitments to PEC V came from existing PEC series investors including Local Pensions Partnership Investments (LPPI) and Hostplus, as well as new investors from Europe and Korea.

***

ESG Networking In The City

Last week we hosted our first ESG networking event, bringing together a select group of sustainability & ESG professionals to discuss best practice, common challenges, innovation in this sector, & more.

A massive thank you to everyone who came along for a drink and a chat, it was lovely to see so many of you in person - we’re looking forward to holding more social events for our community in the near future.

IN DEPTH

“Jerry was a real visionary, having played an important role in developing the private equity model in the 1960's, and he was a true mentor to George Roberts and me" - Henry Kravis, cofounder at KKR

The late Jerome Kohlberg Jr. was born 98-years ago this week, on 10 July 1925 in New Rochelle, NY.

He was perhaps most famous for being the first ‘K’ in KKR, although he left the firm shortly before the leveraged buyout of RJR Nabisco that ‘Barbarians at the Gate’ was based on. Married to Nancy for 65-years, he died on 20 July 2015 at his home in Martha’s Vineyard.

Education & Early Career

Kohlberg studied an undergraduate degree at Swarthmore College in Pennsylvania. He joined in the July of 1943 during WWII, attending as a civilian for two terms, and then in the Navy for three.

“Friends stood up for what they believed, didn't follow the crowd, and had a straightforward approach to others, always leaving room for understanding and forgiveness.”

– Kohlberg, describing the culture at Swarthmore

Kohlberg graduated from Swarthmore in 1946 although he continued to have close links with the college throughout his life. In a short essay written in the early 00’s titled ‘Lifelong Learning’, Kohlberg describes being “enthralled” by one of his lecturers, the poet and writer W.H. Auden, who taught English.

“Here we were, 10 or so freshmen, listening to one of the most distinguished poets and writers of the English-speaking world. Auden enhanced my love of literature, and, to this day, I pull books off our shelves and return to his writings and quotations.”

Drawing on financial support provided by the GI Bill, Kohlberg earned an MBA from Harvard and went on to study Law at Columbia. In his last year at law school, Kohlberg met his future wife, Nancy Seiffer. They went on to marry in the September of 1949, at Nancy’s family home.

Kohlberg began his career working in law firm in downtown New York but disliked what he felt was a lack of ethical practice. This was to be a recurrent theme throughout his career.

“I just felt it was too cutthroat. I felt the ethics, as I saw them, was pretty low, questionable, that it was a life [in] which you had to shut your eyes to too many things and that it didn't leave enough room for family.”

- Kohlberg, on the practice of law in New York

In 1952 Kohlberg decided to head west to Portland, Oregon, to clerk for US District Court Judge Gus Solomon who became a lifelong role model. In an interview conducted in 1999, he described admiring the judge’s “sense of integrity and honesty and… his ability to relate to most people, and his ability to cut through to the heart of things.”

Wall Street

By 1955 however, Kohlberg had returned to New York and was headed to Wall Street to join Bear Stearns, later progressing to manage the corporate finance department. He remained here for 25-years.

During his time at Bear Stearns, Kohlberg teamed up with two cousins, Henry Kravis & George Roberts, who were 19-years his junior, to collaborate on a series of so-called ‘bootstrap transactions’. Leveraging introductions from their own network, the three would raise money from wealthy individuals then borrow additional funds to purchase family-owned businesses that were looking to sell. This model became the template for what we now know as private equity.

“Bear Stearns was very much a sales and trading firm with a mentality of short term and we were much more long term oriented in our investments.”

– Henry Kravis

This relationship between Kohlberg, Kravis, & Roberts was formalised in 1976 when KKR was officially founded.

“Then we started to raise a fund. First we raised, I think it was $100 million and then, I forget, 500 [million], and then a billion, and then went on from there to today.”

Oregon was the first pension system that KKR signed up as an investor. At the time, the idea of leveraged buyouts was controversial for a public retirement fund, so having Oregon on board helped build credibility. Kohlberg acknowledges that “this was the key that unlocked the door to all the others who gradually followed suit.”

In 1978, US policy changes allowed corporate pension funds to invest in private equity & venture capital funds, which was a catalyst for what was to come next. KKR made a series of deals, including buying manufacturer Houdaille Industries in 1979 for $355m, leading up to the famed leveraged buyout of RJR Nabisco in 1988.

“And I think the buyout, which I'm credited with conceiving, has certainly blossomed and is a substantial part of the financial picture of our country.”

In the early 80’s, Kohlberg was diagnosed with a brain tumour. Following surgery and his recovery, he returned to KKR to find the culture had changed significantly.

Post-KKR

Kohlberg eventually resigned from KKR in 1987. He later cited ethical differences as the driver of the split, saying “We must all insist on ethical behaviour or we will kill the golden goose”. He went on to found Kohlberg & Co. with his son James.

In later life, Kohlberg dedicated much of his time and accumulated wealth to helping others, including support for returning veterans, and efforts to overhaul campaign finance laws. He also bought a local newspaper, the Martha’s Vineyard Gazette, commenting at the time that “My goal is to give back to the Vineyard and to the Gazette.”

He had spent summers at the Vineyard since the 1940’s, and was a familiar figure at Chilmark Sunday Softball. As Adam Wilson, a local town administrator, wrote on the Gazette’s website about the older fielder in the floppy hat: “Jerry was always viewed as being the wisest among us and his pleading to end an argument with ‘Can we just play ball’ would rule the day.”

We’ll leave you with this excerpt from United States District Court Oral History Project (which is well worth a read):

Michael O’Rourke: Another thing I meant to ask you about the Portland days before you left was: you, of course, were a young man then, and I'm just wondering, what did you learn from Gus Solomon about life?

Jerome Kohlberg, Jr.: I think to enjoy it to the fullest, and to be your own person, and to stand up for what you believed in, no matter what the price might be, and particularly to look out for those who were a little bit weaker, less fortunate, couldn't speak up for themselves; do a little good.

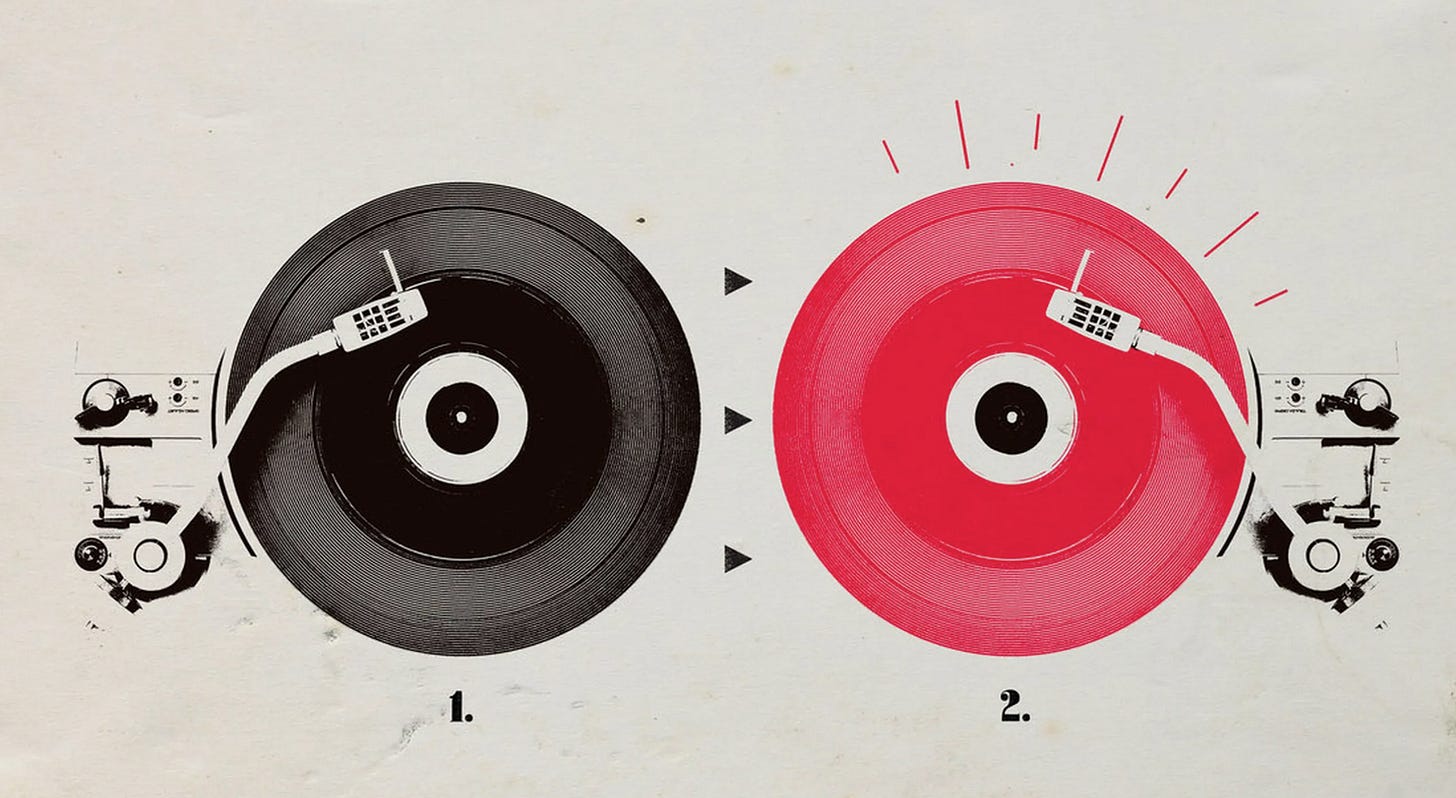

And finally… Does Private Equity Have a Taylor Swift Problem?

“Private equity funds will pay big bucks to buy up song catalogues, but what protects these investments from being devalued by future re-recordings?”, asks Dan Primack of Axios.

While Swift is perhaps the most famous example of a artist re-recording their songs, she’s far from the only one. Read the Masters of Their Own Realities on The Ringer, and check out Primack’s take here on Axios.

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)