Hello reader,

Welcome to the 14th edition of Access, and our first email edition of 2023! We are delighted to be back🥳

This week, we read that VC-backed Colossal Biosciences is planning to de-extinct the dodo, teaching us that nothing (even extinction) is forever. That sets the scene for what follows, which is our attempt to gather the best trend predictions for private markets. Our only guarantee is that it almost certainly won’t play out as you, or we, expect…

One thing you can rely on, is receiving Access into your inbox weekly, with the very best news and views across private markets. If you know someone you think would enjoy reading, please do send them a copy!

Until next time -

Liz & Melissa

In case you missed it…

Our end of year newsletter for 2022 included the best interviews from the world of private markets, including profiles on Wol Kolade, Kim Lew, and Robin Saluoks.

Enjoyed RyRy’s LinkedIn posts this week? Try our In-Depth section on Ryan Reynolds, the hands-on investor with a Hollywood side-hustle.

FEATURING:

In Brief: Insights from the world of private markets

Looking back, to move forwards: Revisiting Jensen’s predictions for PE

People news, moves and promotions

Private equity, through the lens of Glassdoor reviews

In Depth: Private Markets Outlook 2023: Trends, predictions, and time machines

IN BRIEF

Is Private Equity A Superior Form of Ownership?

Thirty years after Jensen’s prediction that the “publicly held corporation has outlived its usefulness in many sectors of the economy”, Peter Morris and Ludovic Phalippou wrote a paper for the Oxford Review of Economic Policy reflecting on the growth of private equity, stacked against a “dramatic fall in the number of quoted companies”.

Their 2019 report concluded that private equity was providing “an alternative to quoted stock markets” but acknowledged a complex picture where PE “is not the unalloyed negative that its extreme opponents portray, but neither is the picture as uniformly or conclusively positive for society as practitioners would like to suggest it is.”

Decide for yourself.

“New organizations are emerging. Takeovers, leveraged buyouts, and other going-private transactions are manifestations of this change. A central source of waste in the public corporation is the conflict between owners and managers over free cash flow. This conflict helps explain the prominent role of debt in the new organizations. The new organizations’ resolution of the conflict explains how they can motivate people and manage resources more effectively than public corporations.”

[Looking back to move forward: Read Jensen on the Eclipse of the Public Corporation, c.1989]

***

January saw a flurry of promotions across the PE universe. Here are just a few of recent movers and shakers from across our network…

Congratulations to Henry Hulme, promoted to Principal - Head of Portfolio Data and Valuations at Pantheon Ventures… also to Catherine Allan who was promoted to Senior Associate in Astorg’s Investor Relations team… Preqin appointed a new CCO, Nosheen Amir-Ebrahimi… Antonio Muniz joined LemonEdge as Implementation Manager… Holland Mountain welcomed Maritza Zantiotis to the consulting team… and VISTRA hired Michael Eghan as Senior Manager, Commercial - Corporates and VC/PE Scale Up.

***

Our New Year’s resolution for 2023 is to read more Glassdoor reviews. Here’s a mixtape of reviews from one PE tech firm that’s taken a bit of a hit of late. Like many online review sites, Glassdoor isn’t necessarily to be taken at face value… although it does provide an interesting window into the world of workplace relations.

“Little Fin, mostly Tech”

“Pros: growing very rapidly which is nice”

“Cons: Their war cry in team meetings is ‘Revenue, Revenue, Revenue’”

“Advice to Management: I am out of advise [sic]. Screaming into the void.”

IN DEPTH

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance.” - Chuck Prince

Last month, IPEM Cannes 2023 took place under the theme ‘Reality Check?’. As Kasper Wichmann writes, you can’t help but think of the Prince quote. Wichmann’s post after attending IPEM contains key takeaways from the event, which you can read over on PE Compass.

If this is private equity’s new reality, then what does the road ahead look like? We’ve taken a very quick canter through some of the current (and historic) commentary on navigating turbulence in the private markets - read on, and then let us know what your predictions are for 2023.

🔮

The Future of Private Equity: 2009 vintage

On April 1, 2009 - should we read into the date? - McKinsey asked, “Is there life after leverage for private equity?”. The article covers some familiar ground, from managing investor expectations through to finding new ways to invest.

“By and large, the sector is well prepared for these challenges. Active ownership is its biggest competitive advantage over companies in the quoted market: the best private-equity firms are more effective because of their stronger strategic leadership and performance oversight, as well as their ability to manage key stakeholders.”

[Read on McKinsey’s website here]

🔮

11 Tech Trends for 2023

Featuring IaaS, or Immortality-as-a-Service - you heard it here first, folks…

“The pursuit of extreme lifespans, a topic humans have been fascinated with for millennia, is now gaining renewed attention from VCs and tech companies.”

[Feast your eyeballs on the full infographic from Visual Capitalist]

🔮

ESG: Hot, or Not?

3p’s Leon Kaye presents a balanced list of trends for the coming year, covering the E (environmental), S (social) and G (governance). There’s some particularly interesting commentary on why circularity is headed the same way as ‘net zero’ - fantastic in theory, virtually impossible in practice.

Coverage of the Anti-ESG movement is everywhere, but this piece from Julius Krein stood out as a “right-of-center perspective, on why right-of-center responses to ESG are so lacking” - via Byrne Hobart at The Diff. If you didn’t sign up for their newsletter yet, you can do so below (it’s great).

[Read Why the Right Can’t Beat ESG on Compact]

🔮

Dry Powder is (Still) Close to an All-Time High

Various sources quote dry powder as hovering around $2 trillion (USD) globally. (If you’re new here and wondering what dry powder is, Pitchbook’s explainer might be worth a read).

If you’re curious about what this accumulation of uncommitted cash might signify for 2023, try this piece from Dan Davies in the FT - aside from the excellent pirate references, including a lively description of ‘the tyranny of the IRR’ - it walks the reader through the paradox of high dry powder levels.

“So the industry is in a circular bind. Private equity firms can’t do buyouts until valuations fall further, and expectations of private equity buyouts are helping support valuations.“

We won’t spoil the ending, but it’s worth reading in full - on the Financial Times here.

🔮

The Rise and Rise of Private Credit

In their end of year Q4 review, EY wrote that private credit’s inroads will be 2022’s legacy, predicting an increase in other forms of ‘creative financing’ too.

Charlotte Muellers, co-head of North America credit investments at PSP Investments was quoted by efinancial as saying the current market conditions represent a “once in a lifetime opportunity” for private credit jobs.

Andrew Davies and John Empson, partners and co-heads of private credit at CVC spoke to Private Debt Investor about the future of the asset class, highlighting the opportunities for growth across Europe.

“There are many incremental ways that private debt can grow… larger firms can apply what they have learned over the years and can create private credit funds that align with investment flows and could operate more broadly across the alternatives space. Some of these opportunities, such as real asset related credit funds and asset financing, as well as new geographies, could all represent a huge opportunity.”

🔮

Hiring and Retention: An Uphill Battle?

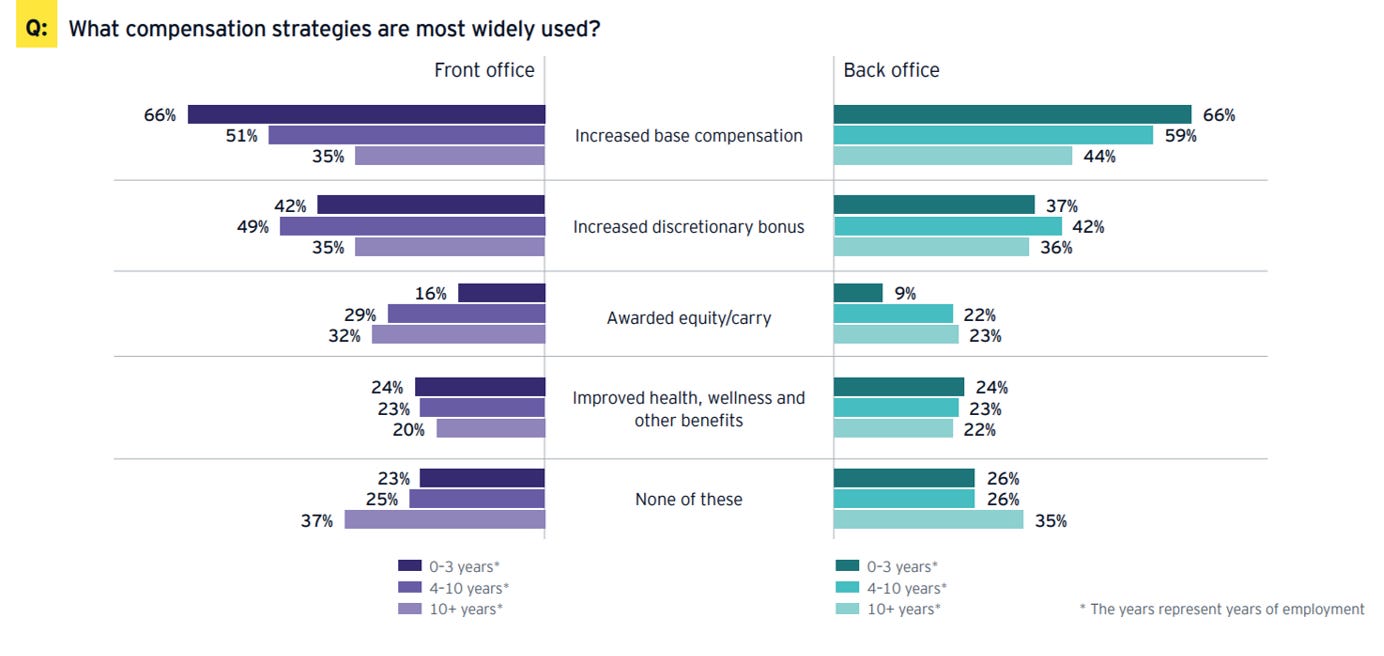

The 2023 Global Private Equity Survey from EY takes a temperature check from PE CFOs and COOs. Talent management featured in the top three priorities for CFOs, “because retaining and attracting talent will be key in a volatile marketplace”.

The report acknowledged that base pay, bonuses and carry plans remain important parts of private equity remuneration, but noted that beyond compensation, flexible working practices and improved wellness benefits have overtaken promotions as a key lever for retention, particularly at larger firms. The chart below shows health & wellness benefits alongside the financial incentives, with a breakdown of front vs. back office.

[Download a copy of the EY 2023 PE Survey here]

***

And finally… Who doesn’t love a little dry powder?

Team Maestro hit the slopes (and our LinkedIn feed) this week - as far as team activities go, this is a strong start to the year. Can anyone beat this? Send us your best photos! 📷 Sadly, Maestro isn’t listing any open roles at the moment, but we will keep our eyes and ears open for you…

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)