Hello reader,

This is the 19th edition of Access - last week’s most clicked link was our piece from Access | 017 featuring the top five private capital firms by capital raised.

I was travelling for a few days last week, visiting Art Dubai. The three-day international event features artworks from hundreds of artists across the world. Last year saw the introduction of its inaugural digital section - although the fair uses the term ‘phygital’ as a nod to the material element - and 2023 saw a sharp increase in the use of AI, mirroring what many of us are seeing played out in our LinkedIn feeds as the global obsession with ChatGPT rumbles on.

The experience got me thinking about what makes people buy art - is it a heart, or a head decision? For this week’s Access, we’ve set about unpicking the concept of art as an investment asset, and what makes it both unique and exclusive in the world of alternatives.

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition included profiles of some of the key players in private markets, including:

FEATURING:

In Brief: Insights from the world of private markets

PE Wire Awards 2023

People news, moves and promotions

The Inclusivity Index

In Depth: Art as an Alternative Asset

IN BRIEF

Private Equity Wire European Awards 2023

The PE Wire annual award ceremony took place this week, with 25 categories recognising fund managers and a whopping 46 categories dedicated to service providers.

We’d like to extend our congratulations to all the winners, but especially to Dasseti’s Tim Mapley who was one of the first to post on LinkedIn with a brilliant video message from the event, complete with ALL CAPS at the start. Tim, we loved it (and so did your CMO, kudos). Well done to the whole team on winning best ESG solution provider! 🥳

***

People Moves & Promotions Across Our Private Markets Network

As if the PE Wire Awards weren’t enough excitement for one week, we also have lots of job movers to congratulate, including…

Arcesium’s Patrick Spicer, who joins their EMEA team as Private Markets Solutions Architect… Jamie Davies, who has started a new role at Apperio as Commercial Director for PE, Banking, & Sovereign Wealth… Antonia Ogunsola who joins the investor relations team at 17Capital… Raghvendra Chandak is promoted to Director at Actis… Stephen Swentzel joins Hunter Point Capital as MD and Co-Head of GP Financing Solutions… Gessica Putri starts a new role in the talent team at Monk’s Hill Ventures… and Andrew Muir is promoted at HarbourVest Partners.

***

Equality Group Publishes Third Annual ‘Inclusivity Index’

The digital evaluation tool uses publicly available data to rank ~300 global private equity and venture capital firms across 43 equality, diversity & inclusion (EDI) metrics. To qualify, firms need a minimum of $1bn AUM; the top five are listed below.

ICG

Hg Capital

Eurazeo

Partners Group

The Carlyle Group

For more information about the Honordex, check out the Equality Group’s website.

IN DEPTH

“[One of the] two greatest stores of wealth internationally today is contemporary art... and I don’t mean that as a joke, I mean that as a serious asset class.” - Larry Fink, CEO of Blackrock

Is Art an Alternative Asset?

Let’s consider the facts; art is highly illiquid, with high costs involved in purchase, ownership, and sale. It also enjoys opaque valuations and a booming secondary market. Low correlation with public equities? Check. Mysterious, high risk, with the potential for outsized rewards? Check, check, and check.

On the face of it, private equity and art have an awful lot in common. Yet, art doesn’t appear alongside private equity, private debt, and real estate on Blackrock’s list of illiquid alternatives.

Not so much alternative then, as unconventional.

“Investing in art disregards the traditional benchmarks of financial analysis. Investing in art is a bet on the price appreciation of something whose values defies financial logic.”

- Artscoops

Sometimes grouped into so-called ‘collectibles’, art sits alongside wine, cars, stamps, and even baseball cards as an alternative investment that’s largely uncorrelated to the stock market. What sets it apart is the uniqueness of each piece of art, which creates a scarcity that isn’t typically replicated for other collectibles.

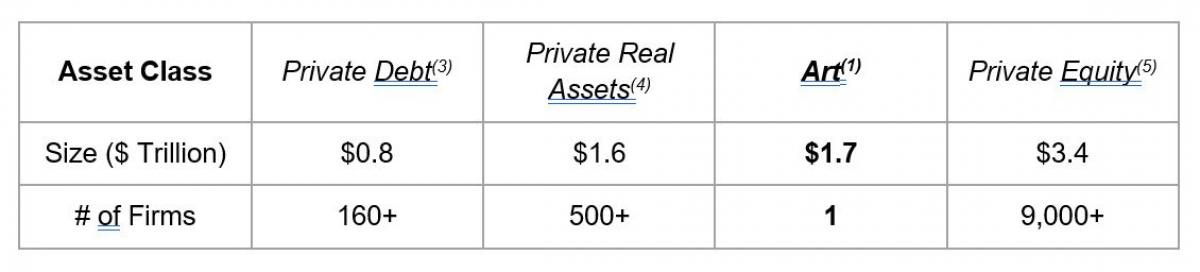

CAIA produced a table in 2021 comparing the size of the art market to other alternative assets. We’ve reproduced this below; CAIA uses numbers supplied by Preqin in 2019.

Art as an Investment Opportunity

Scott Minerd, CIO at Guggenheim Partners (yes, that Guggenheim) was quoted last year as saying if given $10,000 to invest and a 5-year timeframe, he’d place it in real estate or fine art, rather than equities. For balance, the public markets are taking a beating, so perhaps it isn’t the glowing recommendation it seems.

The Washington Post argues that the consumption element of art is beyond hedge from an investor standpoint. In their words, “the pleasure of looking at it on their wall [is] protected against any macroeconomic conditions”. We think this is a bit of a dodge, so we did some more digging.

In the 1970’s, the British Rail Pension Fund (now RailPen) partnered with Sotheby’s to invest c.£40million into art. When these pieces were sold in the late ‘80’s and ‘90’s, the fund reported annual compound returns in the region of 11%, although this was against a backdrop of high inflation rates.

Going back even further, one of the earliest recorded art funds, La Peau de l’Ours, or ‘The Skin of the Bear’, was established in France in the early 1900’s. It takes its name from a cautionary fable attributed to Aesop and immortalised in Jean de la Fontaine’s ‘Fables’ - it instructs eager hunters not to sell the skin of the bear before the beast is dead. The message to investors in the fund was presumably ‘don’t spend your returns before they’ve been realised’, although the fund’s founder Andre Level needn’t have worried. The few accounts that we could find suggest that returns were in the region of 4x the initial stake.

What differentiates La Peau de l’Ours from the RailPen example is the investment approach. La Peau de l’Ours was betting on emerging artists, including Matisse, Gaugin, and Picasso, where RailPen, perhaps mindful of the workers who had entrusted their pension to the fund, bought pieces by established artists and makers.

One of the best known art funds is The Fine Art Group, run by Phillip Hoffman. Their track record lists an average annualised return of 18% on realised investments, with positive returns across 87% of realised investments. An article by CNBC from 2015 listed the fund’s minimum investment as $500k - $1m.

“The art market, by and large, is confusing, fragmented and inefficient, conferring considerable advantages to those who have the best information over those who are new collectors.”

For those who don’t have a spare million lying around, Masterworks is a platform akin to Moonfare, dedicated to the democratisation of private markets investing. (As a side note, both Masterworks and Moonfare’s websites appear to share similar fonts, layouts, and an ‘M’ logo, making for a confusing / amusing browsing experience during the research for this piece). Masterworks makes a compelling case for art as an effective hedge against inflation - but then, they would - pointing out the low correlation against stock indices, and ability to outperform other assets, including a track record of appreciation during high inflation periods.

Barriers to Entry & the “Democratisation” of Art

The Creative Industries Council estimated there were about 2.3 million people working in creative jobs in the UK in 2022. We checked a bunch of public data sources and found average salaries quoted between £30k and £50k - this piece spells it out bluntly, explaining that most UK creative jobs earn less than average annual salary.

In other words, a good chunk of the UK’s adult population work in creative roles, yet it seems unlikely that they’d be able to confidently risk the £36,000 average sale price for a single piece of art in 2022.

On top of this, diversification is a core principle for most seasoned art investors, as single artists or entire genres can fall out of favour, leaving you, as Deloitte so delicately put it, “at the mercy of erratic public taste and short-lived trends.”

Fractional ownership is one way around this, offering the chance to invest lower amounts to secure a piece of the action. Masterworks is one of the high profile platforms offering a tech-enabled solution, although is predominantly aimed at US investors. Maecenas is another that combines blockchain with fine art investing, effectively tokenising masterpieces. They focus on pieces of $1m and upwards, with a minimum investment of $1k USD.

“Contemporary art has outperformed the S&P for the past 26 years, but there has been no way to invest in it. Masterworks is the first company to offer art investment products to the retail investing public.”

- Scott Lynn, Masterworks CEO

Very much like retail investment platforms for equities, these types of digital marketplace take some of the guesswork out of investing and streamline the process of matching buyers with sellers. The obvious drawback is that pieces are stored in a vault somewhere, and you can’t hang 1/500 of an artwork on your wall. But it also sidesteps the thorny issue of needing to hang, maintain, and insure a piece of art in your home.

Art As Impact

When I set out to write this piece I didn’t have a clear idea of where I was headed, only that I wanted to explore how art fits into the wider alternatives eco-system.

There are some parallels that can be drawn between art and private equity - at least from an investment standpoint - noticeably, both are characterised by a level of inaccessibility. Unless you know someone, or have an inside track on where and how to invest, it’s nigh on impossible to gain access.

On the topic of what both alternative assets have in common, the final word (for now) goes to a good friend who works in the art world and was kind enough to host me in Dubai last week. I asked her about the wider implications of investing in art, and she told me this: if you are fortunate enough to be able to invest in art, consider your impact. Those who seek out emerging, underrepresented artists to shine a light on their work will leave a legacy that reaches far and wide.

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)