Access: To B Or Not To B(Corp)

"Doing bad, or simply not caring, has become more expensive." - Vincent Stanley

Hello reader,

Welcome to the 22nd edition of Access. Recent editions have explored the SVB Meltdown and shared a more intimate dive into our network’s personal experience of uncertainty at work.

This week, we turn our attention to the B Corp movement. Increasing numbers of businesses are using B Corp’s Impact Assessment to benchmark their social and environmental performance. But is it open to manipulation by companies that aren’t aligned to B Labs core values? We also take a closer look at how private equity firms are using the B Corp Impact Assessment to identify possible investment targets.

Have a read, and let us know your thoughts.

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition featured conversations from our network about disruption at work, including:

FEATURING:

In Brief: News & Views From Across Our Network

Private Equity Is Open For Business

PE Leaders Discuss the Importance of Tech

B Corp 101

In Depth: B Corp for Private Markets

IN BRIEF

Private Equity Is Open For Business

Despite London just having lost its sole lead as world’s top financial centre, it seems there’s no stopping private equity from opening new offices in London and growing their UK-based teams.

Blackrock will be expanding their London HQ… both NY-headquartered One Rock Capital, and Boston-based Great Hill Partners have opened new offices to bolster European growth… Garrett Hayes McDermott Will & Emery to work on M&A, private equity and corporate advisory… Irina Hemmers moves from Inflexion to head up the new office for Thoma Bravo in London.

And even more activity expected in coming months… 👀

***

PE Leaders Discuss the Importance of Tech

Day two of the Real Deals & The Drawdown Tech Innovation conference is underway. Yesterday’s sessions, discussions and keynotes included:

Extracting maximum value from digital transformation strategies

The role of technology in deal sourcing, execution and exit

Presentations on the best-in-class tech solutions

What makes a great data strategy?

Head to the Real Deals LinkedIn page to find out more about the agenda for day two.

***

B Corp 101

Apparently we’ve all got dwindling attention spans, so here’s a one-minute TikTok video explainer about B Corp.

Special shoutout to B Corp Laura for her informative snapshots too.

IN DEPTH

“By ‘sustainability,’ I mean a form of resilience in the face of an ever-changing business landscape.” - Matthew Weatherley-White

March is the official month of B Corp so it seemed like as good a time as any to take a closer look at the B Corp certification. Managed by non profit organisation B Labs, the B Corp Impact Assessment is used by companies all over the world to benchmark their social and environmental performance.

The framework covers five areas of impact - governance, workers, community, customers, and environment. Certified B Corp companies have met high standards of social & environmental performance, alongside public transparency and legal accountability. Each B Corp is assessed meticulously against business standards in accordance to B Lab’s framework and required to re-certify every three years.

Founded in 2006, business partners Jay Coen Gilbert and Bart Houlahan reconnected with former classmate Andrew Kassoy to launch B Lab. Before joining Coen Gilbert and Houlahan, Kassoy worked at a private equity firm focused on social change.

Private Equity❤️B Corp

GPs are engaging with B Corp in a number of ways:

Certifying as a B Corp themselves

Using B Impact Assessment to evaluate and improve business health (both internally and of their portfolio)

Utilising the B Corp standards to assess the viability of investment targets

Directly investing into B Corp certified companies

For some private equity firms, the B Corp accreditation is a demonstration of sustainability credentials and a commitment to social and environmental impact. Typically, impact investing has had more of an entrepreneurial focus, particularly for venture capitalists. Matthew Weatherley-White, Co-Founder and Managing Director of B Corp certified Caprock, suggests that systemic change is needed - with the increasing importance of ESG and impacting investing, private capital will need to adopt sustainability as a fundamental part of their operating models.

“Smaller, privately-held B Corps have stayed under the radar of impact investors, a movement dominated by large entities like sovereign funds, pension funds, and endowments that invest primarily in publicly traded companies.”

- Vincent Stanley, Director of Philosophy at Patagonia

The B Corp certification is an indicative metric that a firm meets certain governance, community and environment standards, whilst doing good for their employees and customers. It provides a helpful measure of the durability of a portfolio company or prospective investment, which appeals to fund managers looking for value creation. Strong ESG credentials are attractive and can result in more potential exit routes for PE investors.

“One of the things PE does well is drive change at pace. The B Corp process of getting and staying accredited assists that agenda.”

Is Certification Too Accessible?

But with more global corporations certifying as a B Corp, its reliability as an accreditation has been called into question. Whilst the rigorous impact assessment requires a minimum score, it’s not always clear whether business performance against those standards are driving positive change.

“It’s incredibly accessible. Any company can become a B Corp. It is its biggest strength, but also its biggest weakness. It doesn’t require the big changes in business that we urgently need.”

- Erinch Sahan, former chief executive of the World Fair Trade Organization

Some of the B Corp certified companies that have faced criticism include: Nespresso (child labour, wage theft, abuse of factory workers), Danone (reneging on contracts with small farmers), Innocent Drinks (single-use plastics), and Brew Dog (toxic work culture), whose certification was actually revoked.

Nonetheless, for private equity backed firms or PE houses themselves, the certification and impact assessment represent an accessible benchmark to determine social and environmental performance.

“[I]f the purpose of business is around generating profit, what we're finding is that you generate more profit in today's day and age if you're conscious of your environmental and social footprint.”

Megan Starr, Global Head of Impact at The Carlyle Group

And it’s more than just a SWOT analysis. Businesses conducting the B Corp Impact Assessment thoroughly audit their business processes. Often, the changes made to achieve B Corp status will contribute to improved business operations & increase compatibility with PE investment - improvements such as codification of policies, more stringent governance processes, or reporting practices. These non-financial metrics impact how the business is run, creating value for current investors as well as future owners who would be acquiring better businesses.

We’ve chosen a handful of interesting examples of B Corp certified firms with links to private markets to take a closer look at…

Palatine Has ESG In Its DNA

Founded in 2005, Palatine is a private equity firm focused on sustainable investing. With an overall score of 111.3 out of a possible 200, Palatine became B Corp certified in November 2022 - the fourth highest-scoring PE firm in Europe. Scoring particularly well in the ‘Governance’ category, Palatine is in the running for B Corp’s 2023 ‘Best for the World’ list.

“We see private equity as a force for good and a way to support ambitious and driven teams to grow their businesses, whilst at the same time doing the right thing by our planet and society”

Their investment approach is based on three key pillars - relationships, value enhancement, and sustainability. As a leader in sustainable investment across the mid-market, Palatine has two funds Buyout Fund (£10-30m investments) and an Impact Fund (£5-20m investments), partnering with management teams across financial services, health and education, technology and business services.

***

Reduce Your Pet’s Paw Print With Scrumbles 🐾

Natural pet food company Scrumbles, was founded in 2018 by partners Aneisha Soobroyen and Jack Walker, inspired by their pets Smudge and Boo. Scrumbles is the 2nd ever pet food company globally to certify as an ethical B Corp, a leader in pet food with probiotics for gut health.

In their first six months of operating, Scrumbles appeared on Dragon’s Den where they were offered (but declined) a £60k investment from Deborah Meaden. Earlier this month, BGF completed a £6 million investment in Scrumbles - funding which will enable its continued omni-channel growth and expansion of the company’s senior team.

Read their B Corp 2022-23 impact report here.

“One of the things I loved when I first joined Scrumbles was the opportunity to donate £5k to a charity of my choice as part of our 1% for the planet annual donation. It instantly made me feel part of the team and showed me that sustainability was truly part of our Scrumbles’ DNA, and not just a marketing gimmick.”

***

Bambino Mio Is Making Reusable Nappies Mainstream

Single-use nappies are the third biggest contributor to landfill in the UK, among the top 25 products found in the ocean and a collective 90 billion of them are disposed every year.

Reusable nappy firm, Bambino Mio was founded in 1997. In 2021, they received £13 million of backing (also from BGF), plus co-investment from UK Enterprise Fund (UKEF) and became B Corp certified in January 2023. The funding from BGF continues to support Bambino Mio in its expansion across the UK and abroad as a leading product developer of sustainable nappies.

“I believe that all businesses should feel a responsibility to consider people and our planet rather than making decisions just based on profit, we believe that this fundamental component can have a lasting significance, for generations to come.”

Their efforts to make reusable nappies mainstream are supported by eco-conscious consumers looking for alternatives to single-use plastics to reduce the world’s plastic pollution and non-biodegradable waste. With a score of 93.4, Bambino Mio is leading the way in the nappy industry, scoring particularly well against the standards in areas such as its campaigning work and support of local community projects.

***

The First Italian Coffee B Corp ☕

Well-known coffee brand, illycaffè has been around since its inception in 1933, with the vision of being “the world reference for coffee culture.” With 1,350 employees worldwide, illycaffè values ethics, sustainability, transparency and personal development. illycaffè achieved Benefit Corporation (“Società Benefit”) status in 2019 and reinforced its commitment to sustainability when it became the first Italian coffee company to achieve B Corp accreditation in March 2021.

“We were drawn to the quality of illy’s underlying business, their approach to value creation, and their impeccable ethical standards, which are reflected in both their corporate governance and commitment to sustainability.”

- Robert Agostinelli, Co-Founder and Managing Director at Rhône

Founded in Trieste, Italy as a family-run business, illycaffè sold a minority stake (c.20%) to Rhône Capital in November 2020. The strategic partnership was formed to support and propel expansion of its international footprint, particularly in North America.

***

Altvia Thrives as a B Corp

Private equity software firm, Altvia is a leading provider of CRM and investor & deal management systems. Founded in 2006, their software supports over 40,000 LP investors and is transforming the way GPs deliver value to their stakeholders.

Altvia became an accredited B Corp company in 2011, with an emphasis on having a connected company culture - they’ve achieved Best For The World: Workers award, in 2014, 2015, 2018, 2019, 2021 and 2022.

“Participants in the private capital markets are rapidly adopting new technologies to drive improvements and efficiencies, as they navigate increasing demands from regulatory bodies, ESG impacts and expanding partnerships with Limited Partners,”

- Nick Lukens, Managing Director at Marlin Equity Partners

As a SaaS company, Altvia delivers private capital CRM solutions whilst building confidence in their clients that their practices meet the highest standards for corporate responsibility. In addition to their industry-leading products for PE firms, Altvia also received investment from Marlin Equity Partners in July 2022.

***

Researching the connection points between PE and B Corp has been fascinating. PE firms love a good performance metric and the impact assessment is a useful way to benchmark social and environmental factors for businesses operating in just about any sector.

It also serves as a public declaration of where the company is now, and what it aims to achieve. It seems logical that companies who publicly pledge their support of ESG goals are much more likely to achieve them, and hold themselves accountable for doing so.

B Corp has only been around for a relatively short period of time, so it’ll be interesting to track its value creation in the long term - we look forward to the next chapter.

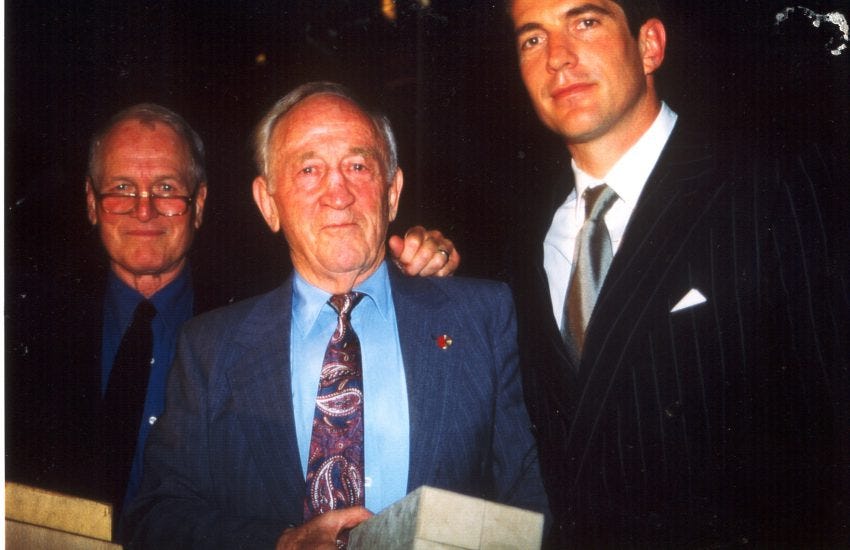

And finally… The Unlikely Celebrity Connection

As part of our research for this piece, we did a bit of digging into the history of B Corp. Turns out, actor-turned-philanthropist Paul Newman played an unlikely role in the making of the world’s first B Corp in 2007…

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)