Hello reader,

Earlier this year, we announced we were dispensing with the usual news, views, & people moves to make space for a bumper issue featuring the very best private equity resources.

The feedback we received was so positive that we’ve committed to refreshing this on a regular-ish basis, so here’s the first of those promised updates.

Along with our favourite podcasts, videos, and long reads, we’ve also hunted down the latest PE market reports and commentary, plus a brand new section featuring people and profiles. You’ll also find infographics, interactive maps, and technical glossaries, and we’ve even linked to our latest jobs round up, in case you’re looking for a new challenge.

As usual, if we missed anything or you have a suggestion for the next edition, get in touch and let us know!

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition featured a deep dive into private capital and the sports industry…

Access: A Match Made in Heaven

FEATURING:

89 Of The Very Best Private Equity Resources, including:

PE 101 - the essentials (share it with new team members!)

Watch - we’ve trawled TikTok and YouTube so that you don’t have to

Read - long reads, explainers, & the best PE news sources

Listen - podcasts galore 🎧

Learn - glossaries, courses, and much more

IN DEPTH

“The opportunity to improve companies, the ability to have an alignment of interest with management and us being the shareholders with long-term, patient capital - to me, these are the hallmarks of private equity.” - Claudia Zeisberger

Welcome to the Private Equity Essentials edition. This was first published earlier in the year, so we’ve added your suggestions, created a brand new section for PE profiles, and refreshed the market reports to bring it bang up to date. Whether you’re a PE veteran, a niche super-specialist, or you just need to know a little bit about everything, we’re confident that the resources we’ve assembled below will be helpful.

Did we miss something? Please send us your favourite resources! Hit the comment button, or reply to this email if you’re reading in your inbox.

Private Equity 101 🚀

If you’re new to the world of private markets, or just want a refresher, start here…

LEARN: Preqin’s Academy features six lessons with detailed explanations, great for those that want to learn the basics:

WATCH: This 8-minute video from rareliquid is a useful beginner's guide to private equity, which starts with a simple explanation of the PE fund structure, before moving on to cover top firms, a typical fund hierarchy, and day-to-day responsibilities.

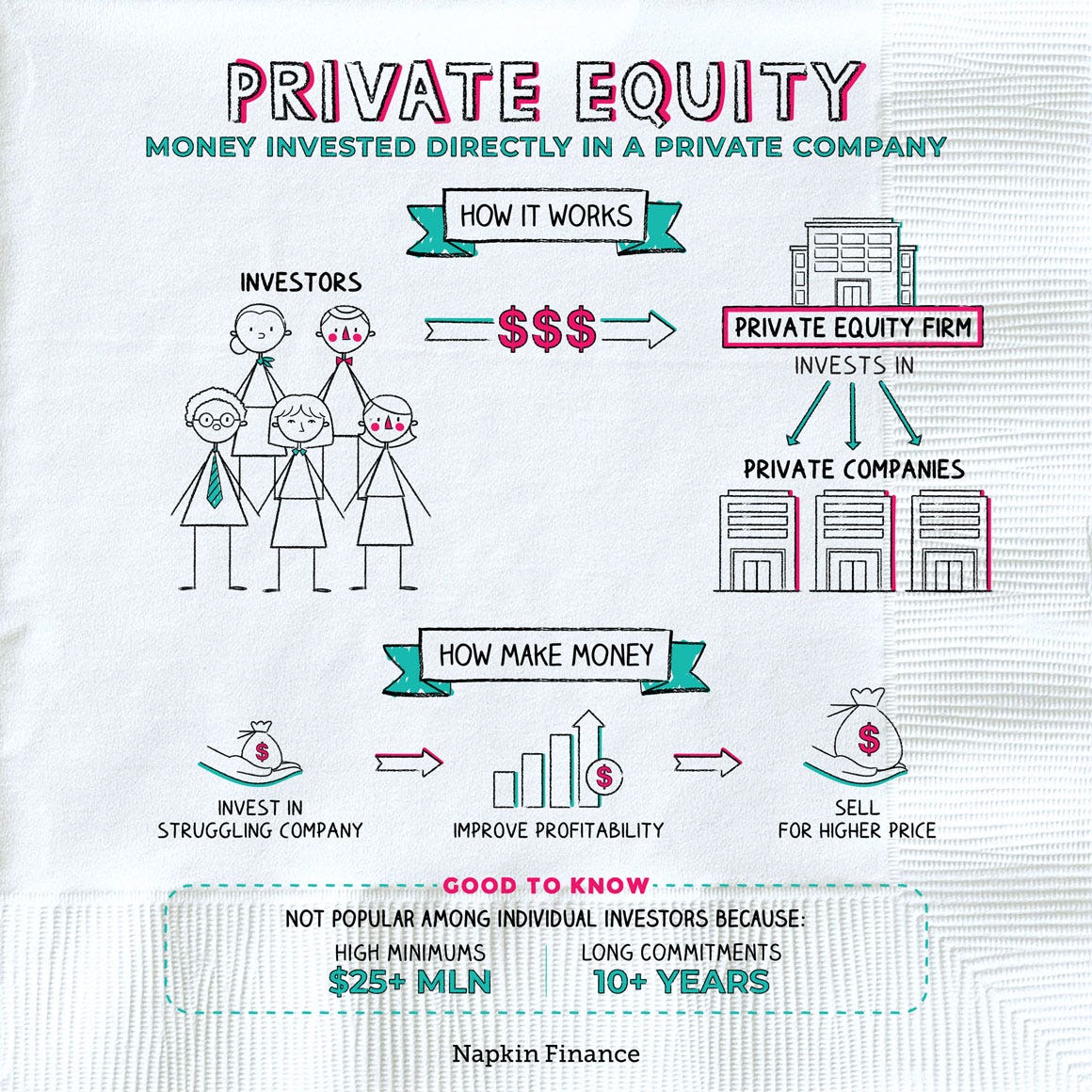

ON A NAPKIN: We’re not kidding. Check out Napkin Finance’s PE Explainer below, with some commentary here.

REFLECT: They say you have to look back to move forwards. Some diligent Googling unearthed this gem from 2007, hosted on Denver University’s website. The author, David Snow, was PEI’s Editor-in-Chief at the time although he’s since moved on to a Partner role at Privcap Media. It’s a 14-page PDF titled ‘An introduction to the fundamentals of an expanding, global industry’ and is now a veritable time capsule, with a mix of still-relevant terms and explainers, alongside historic commentary and predictions.

READ: As we reported in Access | 024, there’s growing interest in PE opportunities from the retail investment sector. One of the leading platforms, Moonfare, has a no-nonsense guide to private equity that covers essentials, plus common strategies in under 4-mins each, including buyouts, growth, impact, venture, credit, & infrastructure. You can also read their post on mid-year trends for 2023 here.

💭Want to find out why companies like Moonfare are opening up PE to a wider audience? Check out our long read below:

Private Equity Podcasts

Like to listen? We’ve selected some of the top PE podcasts, check them out below:

🎧 The Voices of Private Equity podcast from ILPA features anecdotes and personal stories from leading industry professionals. Hear first-hand how the people who make high stakes decisions go about sorting through the challenges, opportunities, risks and rewards while market and political dynamics swirl around them.

🎧 The Alt Goes Mainstream podcast invites you to join the smartest people in the room to learn how top investors and allocators are incorporating alternative investments into the portfolios of tomorrow, with Michael Sidgmore from Broadhaven Ventures.

🎧 The Preferred Return Podcast from Altvia focuses on the PE Techstack - this episode considers The Future of GP-LP Matchmaking in Private Markets or ‘Tinder for PE’, with Melissa Maleri and Conor Smyth from TritonLake.

🎧 Behind the Deal by Thoma Bravo goes behind-the-scenes of major acquisitions. Try Episode 2, which features the CEO from Sailpoint Technologies discussing how they forged a relationship that led to Thoma Bravo’s first ever IPO of a portfolio company, and eventually acquiring SailPoint twice over the course of a decade.

🎧 EYs NextWave Private Equity podcast series is packed with guests from some of the biggest PE firms on the planet, including Ardian’s Mark Benedetti on secondary deals, KKR’s MD for sustainable investing Elizabeth Seeger on ESG, and Hg’s Executive Chairman Nic Humphries on AI.

🎧 In their own words, the Parker Gale Private Equity Funcast is “occasionally insightful and often entertaining“ - that’s good enough for us… tune in for discussions about how they buy profitable tech companies, and the tools they use to build and grow them.

The Private Equity Landscape

Be in the know about who’s who, where they operate, and which funds have raised the most money…

The Top Ten (in just under 12-minutes): Learn more about the top 10 biggest private equity firms in the world (a whistlestop tour 🌪️)

A list within a list… the PEI 300 list ranks GPs by the amount of money they’ve raised. Check out the top rated firms, as well as PEI’s insights into year-on-year changes.

And if you enjoyed that, try our piece from earlier in the year featuring the Top Five PE Fundraisers, where we go behind the scenes to see what it’s like working there.

It’s not all about the funds - if you’re looking for the lowdown on private equity tech, try PE Stack which posts a weekly digest on tech news, people moves, and partnerships across the industry, as well as their popular vendor maps.

As we reported in edition 28, the Venture Capital and Private Equity Country Attractiveness Index ranks 125 countries across the world for the quality of their investment environment, and the ease of transaction-making. Check out the interactive heat map here.

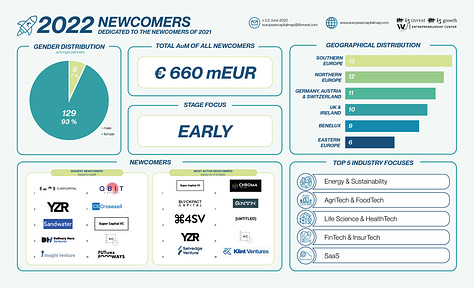

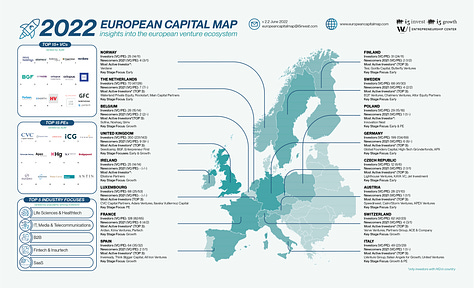

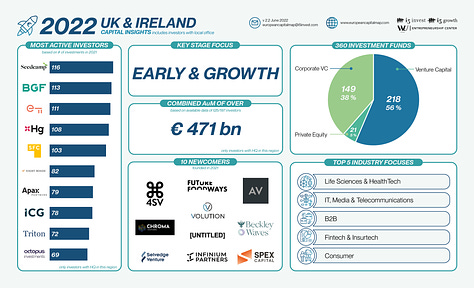

The European Capital Map 2022 is published by i5 invest and features fourteen logo maps and infographics, covering UK & Ireland, DACH region, Benelux, Northern Europe, Southern Europe, Eastern Europe, plus newly launched funds.

[Check out the full set on their website]

Private Capital People 👯

Learn about the people who work in private capital, from CEOs to founders, and fund managers to investors.

📖 Every week, journalist & author Polina Pompliano shares stories about the world’s most interesting people. Her profiles often cover entrepreneurs and investors, including the latest edition of The Profile which features Elon Musk and hedge fund founder Chase Coleman III (plus designer Patricia Moore and the D&D players on death row).

🎧 Deal Talk: Interviews with Private Equity Leaders is just that - a podcast featuring some of the biggest names in private equity. In the last 6 months, it’s featured Marcus Brennecke from EQT, Lauren Gross from Founders Fund, and Kurt Björklund from Permira, as well as an interview with KKR’s Henry Kravis.

👀 Speaking of KKR, last month we shared a piece on the Grandfather of Private Equity, Jerome Kohlberg Jr. It was researched, in part, using recordings and transcripts from the United States District Court Oral History Project, which is a fascinating resource and definitely worth checking out - links in the article below 👇

📰 Arlan Hamilton Went From Homeless to Running $20 Million in VC Funds. Time Magazine’s Leadership Brief features an interview with the founder of Backstage Capital, which focuses on providing investment to underrepresented founders, including women, people of colour, and LGBTQ entrepreneurs. Read the interview in full here.

Hot Off The Press #1

These websites are subscription-based, however they offer a handful of articles for free, plus regular newsletters.

Industry Advocates 📢

Learn about the key organisations representing the private equity industry:

British Private Equity & Venture Capital Association (BVCA)

The BVCA’s Guide to Private Equity is aimed at companies that are seeking finance and might be curious to learn more about PE. Assuming you’re not, don’t be put off - it’s comprehensive, extremely well-written, and comes from the PE/VC industry body and public policy advocate in the UK. At 56 pages, it’s not a quick read, so we’d recommend using it as a reference guide - just dip in and out, depending on what you’re looking to find out.

Institutional Limited Partners Association (ILPA)

ILPA represents institutional investors - think insurance companies, family offices, pension funds or endowments - elsewhere in this guide, we’ve linked to their Voices of PE podcast, which is worth a listen.

Invest Europe

As you might expect from an industry advocate, Invest Europe’s website is very pro-PE, complete with an online film series exploring the role of PE in European society, and an e-book called the Little Book of Private Equity. At times, it strays into Hollywood-style story telling, which feels a bit off-kilter to anyone familiar with the industry’s quirks and imperfections, but if you’re ok with that, there’s a lot to like.

“Invest Europe is the world’s largest association of private capital providers. We represent Europe’s private equity, venture capital and infrastructure investment firms, as well as their investors, including some of Europe’s largest pension funds and insurers.”

Level 20

Dedicated to improving gender diversity in private equity, Level 20 is a not-for-profit organisation founded in 2015 by 12 senior PE professionals who recognised the need for change. Last year, we profiled their outgoing CEO Pam Jackson, who has recently been succeeded by Gurpreet Manku. There are some excellent resources on Level 20’s website, and you can gain access to more by applying for membership, which is free and open to anyone working in PE who is committed to improving gender diversity.

Principles for Responsible Investment (PRI)

What are the principles for responsible investment? We’re glad you asked. There are six principles, which you can learn about on PRI’s website, along with an academic research section that features the latest views on sustainable investments.

Global Private Capital Association (GPCA)

Founded in 2004, the GPCA is the global industry association for private capital in emerging markets. It represents private capital investors across the world, with a focus on investment into Asia, Latin America, Central & Eastern Europe, and the Middle East.

Short & Snappy

Here’s a selection of videos, threads, & explainers to watch or read in under 1-minute

Finance & Private Equity Made Simple: A Simple Model is a Tiktok channel you should be following. Most of the explainers are under a minute long, so they’re easy to watch (and rewatch!)

How Does Private Capital Make A Difference? Try this short video from the BCVA

One of our favourite X (formerly Twitter) threads asks What Is PE And How Does It Make Money? - there’s also a brilliant infographic depicting the size of the industry, courtesy of Visual Capitalist.

Got an upcoming interview in PE? Check out the most common PE interview questions

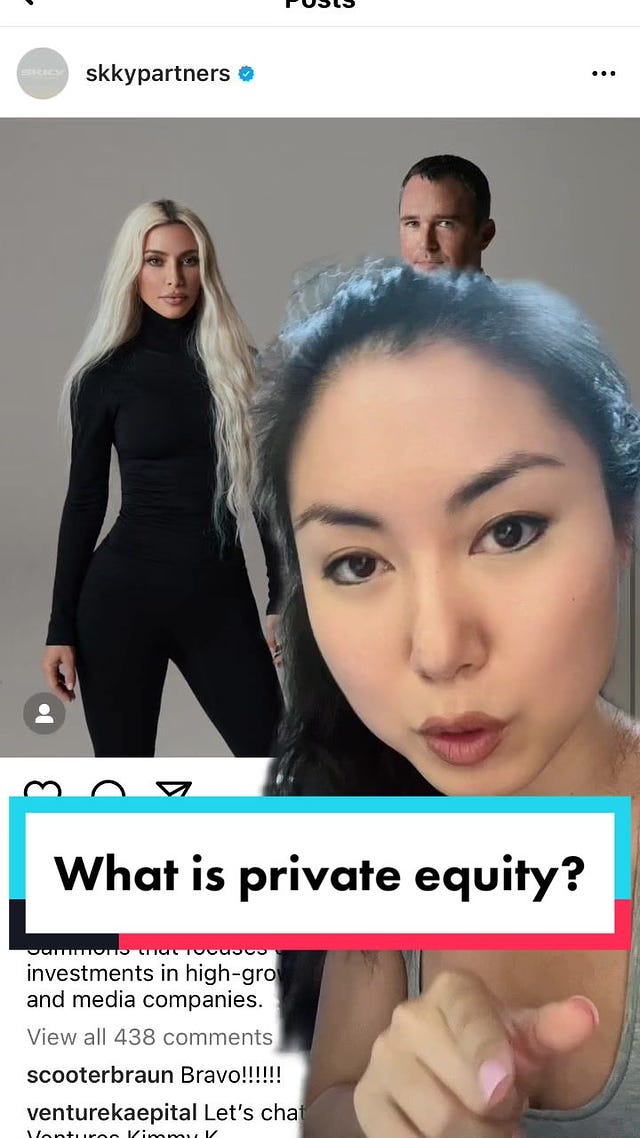

Private Equity x KK: In the video below, Iamdulma explains the relevance of Kim Kardashian’s private equity firm, Skky Partners and what this means for consumers 👇

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Hot Off The Press #2

Industry commentators are a great source of PE news and views. We’ve collated some recent releases below…

The Annual BVCA review 2022-23 has key statistics and a comprehensive overview of the industry, while their latest report titled Private capital: rising to the challenges of turbulent times is available on their website.

The McKinsey Global Private Markets Report features key highlights of 2022 and is titled Private markets turn down the volume. More recently, McKinsey published a report outlining The state of diversity in global private markets that is well worth a read.

The Private Equity Reporting Group (PERG) is an independent body that oversees enhancements in transparency and disclosure within the UK PE industry. Read their latest annual report

Accenture published their latest ESG in Private Equity report, have a read…

“ESG is being embraced for more than just humanitarian reasons. In many cases, sustainable investments are seeing returns superior to non-sustainable counterparts.”

Stuck in Place: Read how ‘stalled dealmaking and exits have jammed the capital flywheel, putting a premium on liquidity’ in Bain’s mid-year report

EY’s Private Equity Pulse features key takeaways from Q2 2023

On The Fringes

Here are some of the resources we love, that go broader than private markets.

M&A Science is a fantastic educational podcast that dives into the world of complex integrations with commentary from industry experts. Their website also hosts an M&A glossary, interviews, templates, ebooks and more!

Looking for a new (old) show to binge? Billions is a TV series starring Damian Lewis and Paul Giamatti - the final season just launched on Sky. Check out Investopedia’s Guide to Watching Billions for a glossary of terms used in the show to help you decipher what’s going on. (Fun fact: co-creator Andrew Ross Sorkin was an M&A reporter for The New York Times).

A great long read from the How They Make Money newsletter, on the Art of Spotting Economic Moats (essentially, attributes that give companies a sustainable competitive advantage).

Looking For A Long Read? 📖

Thirty years after Jensen’s prediction that the “publicly held corporation has outlived its usefulness in many sectors of the economy”, Peter Morris and Ludovic Phalippou wrote a paper for the Oxford Review of Economic Policy reflecting on the growth of private equity, stacked against a “dramatic fall in the number of quoted companies”.

Their 2019 report concluded that private equity was providing “an alternative to quoted stock markets” but acknowledged a complex picture where PE “is not the unalloyed negative that its extreme opponents portray, but neither is the picture as uniformly or conclusively positive for society as practitioners would like to suggest it is.”

“New organizations are emerging. Takeovers, leveraged buyouts, and other going-private transactions are manifestations of this change. [These PE-backed companies] can motivate people and manage resources more effectively than public corporations.”

[Read Jensen on the Eclipse of the Public Corporation, c.1989]

PE Glossaries

ILPA’s A-Z is one of the best and most comprehensive PE glossaries available, with short, easy-to-understand explanations of private markets terminology, ranging from the common to the more obscure.

Glossary-meets-explainer Capital Gains is a free weekly newsletter from The Diff’s Byrne Hobart that provides a weekly writeup of specific financial concepts. View the list here.

At the other end of the scale sits this ESG Glossary from law firm Vinson & Elkins, which defines some of the keywords used in sustainable investments.

Hot Off The Press #3

If you’re looking for easy-to-understand explainers of niche PE concepts, try some of the specialist PE firms and software vendors. Here are our top picks:

What Is NAV Financing And How Is It Used from 17Capital

Overview of PE Secondaries from Coller Capital. There’s also a useful Q&A on their website here from a recent piece in Private Debt Investor

Untangling ESG Frameworks, Compliance, and Standards from Dynamo Software

The PEriodic Table of Technology from Altvia (with a great graphic showing how the techstack maps to functional areas)

Lucky Dip

Still looking for more? Pick from one of the fantastic resources below (and let us know what you found most helpful!)

Bocconi University runs a free course on Private Equity and Venture Capital via Coursera. It’s 100% online and while you can pay to work towards a certificate, if you just want to read and view the course content, it’s completely free (9-hours total learning content)

Remember rareliquid from our PE 101 section? Their ‘day in the life’ video features highlights, challenges faced, and helpful resources for anyone looking for an insider take on working in PE (36-mins watch)

What Do You Actually Do In Private Equity? Asked, and answered, in this great video from Peak Frameworks (6-min watch)

Be An Alternatives Guru In 5 Steps with BlackRock. We managed to hunt down a brilliant section on their US website that takes readers through five sections:

Types of Asset Classes (Part 1 - hedge funds, PE, credit)

Types of Asset Classes (Part 2 - real estate, infrastructure, closed-end)

And finally… The Jobseeker Edition, Aug 2023

Whether you’re actively seeking a new opportunity, hiring a new team member, or just curious to see what’s out there, our Jobseeker Edition is the best way to find out about private capital jobs.

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)