Access: Green Is The New Black

“I like my money right where I can see it: hanging in my closet.” - Carrie Bradshaw

Hello reader,

Welcome to the 31st edition of Access - the most clicked link from last week’s newsletter was to our Jobseeker Edition, with 94 private capital jobs at some of the leading fund managers, technology specialists, and expert consultancies.

London Fashion Week kicks off today - there are two LFWs each year, if you were wondering - this one is a City Wide Celebration with ‘a curated programme of unique experiences and activations… spearheaded by inclusivity and consciousness’.

Whether you’re a devout follower of fashion, or a casual consumer, you’ll likely have noticed that the clothing industry loves change. Styles shift from season to season, reflecting not only what consumers need, but what the fashion gods have determined will be in vogue.

This constant theme of evolution & reinvention sets the scene for this week’s In Depth piece, which takes a closer look at trends shaping the global fashion industry.

Until next time -

Liz & Melissa

In case you missed it…

For last week’s edition we reported on UK private equity, including:

FEATURING:

In Brief: The very best global private markets resources, including:

PEI 300: Blackstone Retakes Fundraising Throne

Don’t Get Carried Away…

The Drawdown Award Winners 2023

In Depth: Green Is The New Black

IN BRIEF

Below, you’ll find a selection of global news stories from people and companies in our private markets network.

PEI 300: Blackstone Retakes Fundraising Throne

The annual list of top private equity fundraisers has just been published, with Blackstone knocking KKR off the top spot.

EQT, the sole European firm in the top five, remains at #3, with Thoma Bravo climbing up to fourth place. CVC Capital Partners - last year’s #4 with 55,414 - drops out of the top 10 for the first time since PEI starting publishing rankings in 2007.

Numbers given are $m, representing total funds raised over the last five years.

Blackstone - 125,612 (2022 = 82,457, #2)

KKR - 103,713 (2022 = 126,508, #1)

EQT - 101,660 (2022 = 57,287, #3)

Thoma Bravo - 74,093 (2022 = 50,257, #5)

The Carlyle Group - 69,681 (2022 = 48,441, #6)

The 300 firms on the list raised $3.13tr between them over the past five years, which is an increase of $530bn on last year’s number, although last year’s prediction that the ranking could shift further East hasn’t materialised, after investors cool on China.

Want to know what it’s like working for one of the top PE fundraisers? Check out our post featuring private markets employer snapshots from earlier this year 👇

***

Don’t Get Carried Away…

Private equity funds are investing, not trading, says Damien Crossley, Partner at Macfarlanes. Crossley’s piece was first published back in March, but has resurfaced in the wake of reports that Labour party doner Dale Vince is planning to seek a judicial review of the UK’s approach to taxing carried interest.

Carried interest is taxed as capital gains in the UK, rather than income tax. The PE industry has long argued that as investor money is at risk, any returns should be taxed as profits from investment, not from trade.

Crossley was quoted in the FT last week, explaining that while tax campaigners have cited a £600m hole in UK taxes due to the carried interest ‘loophole’, the same PE execs paid £952m in tax, and more than a quarter are non-domiciled taxpayers.

If even a small number of the UK’s PE employees were to leave the UK due to tax changes, it would leave the country worse off.

“Maybe [Labour] can say they have closed a loophole without shooting the golden goose.”

[The full debate is worth a read, on the FT here, and Macfarlanes here]

***

The Drawdown Award Winners 2023

The annual Drawdown Awards ceremony took place on Wednesday evening, celebrating excellence and innovation within private fund operations.

Congratulations to all the winners, but especially to our colleagues & friends at Holland Mountain, who walked away with two awards for their consulting team and ATLAS data solutions.

Photos of the winners are beginning to emerge on LinkedIn - here’s a handful of our favourites.

***

📢Calling All ESG Professionals

Our very own Jess Main is holding an inaugural gathering of ESG pros later this year at a secret venue somewhere in London (clue: there will be beers).

Strictly no workshops or webinars, just a chance to connect with others who understand the challenges you’re trying to solve.

To reserve a free spot, hit the button below, or connect with Jess on LinkedIn.

IN DEPTH

“We don't wake up for less than $10,000 a day.” - Linda Evangelista, talking to Vogue in 1990

Private equity has a long history of backing fashion brands. From Canada Goose (Bain) and Dr Martens (Permira), through to UK unicorn Gymshark (General Atlantic), plenty of big name brands have benefited from private investment.

In 2016, one firm, Catterton, went even further, partnering with famed luxury brand LVMH to create L Catterton, resulting in ‘largest, diversified consumer-dedicated private equity firm in the world.’

It’s not always a harmonious relationship - Jimmy Choo founder, Tamara Mellon, was unimpressed saying, “I think the private equity model is open to people who are more vultures and parasites because it’s a chaotic business . . . it draws a different type of personality.”

The industry has also experienced significant change in the past few years. Consumer habits shifted in the wake of the pandemic (suits out, athleisure in) and the sector is poised for a slowdown as shoppers conserve their cash. Vintage fashion has experienced a resurgence, as consumers seek more affordable ways to indulge, while the cost-of-living crisis has also prompted more people to turn their clothes into cash. Luxury goods are also expected to weather the storm, as wealthier consumers are less impacted by the rising cost of living.

Building a Circular Economy

Question: What do you get if you mix luxury fashion with sustainable purchasing?

Answer: A secondaries market for fashion, which has now grown to an estimated $120bn market worldwide.

And it’s not just the sustainable angle that’s attracting consumers. Celebrities wearing designer vintage on the red carpet has helped bring some glamour to resale and rental - Zendaya (below, in monochrome Valentino, first worn by Linda Evangelista on the 1992 runway) has been crowned Queen of Vintage, with Grazia proclaiming “in a world of 'wear it once' culture, it's time to be more Zendaya.”

One of the largest and best known resale platforms for designer fashion is private equity-backed Vestiaire Collective, founded by Fanny Moizant & Sophie Hersan in 2009. Valued at $1.7bn in 2021, it’s grown to become a B-Corp certified global platform for vintage fashion - Gucci is one of the latest brands to announce a partnership with Vestiaire Collective, with a preloved service that pays sellers in store credit.

At the other end of the spectrum, online marketplace Vinted has a growing community of 75 million users across the globe. Talking with Sifted last month, CEO Thomas Plantenga commented that Vinted was “technically IPO-ready” but his focus was on longer-term goals.

“The end game is that we build a tool that is constantly relevant for our society, and it does something very useful… a strong European tech company that will be there for decades, that will pay tax nicely and that will be a useful force in society. That would be something I’m proud of”

Last year, Vinted acquired Rebelle, a marketplace for luxury goods, although when it comes to reselling high end designer items, Plantenga admits that counterfeiting is an obvious concern. Product authentication protocols help here, and they will now be able to leverage Rebelle’s expertise to improve trust and protect brand reputation.

Conscious Consumption

The UN Alliance for Sustainable Fashion estimates the size of the global fashion & textiles industry at $2.4tn, employing ~300 million people across the value chain. It’s also responsible for between 2-8% of the world’s greenhouse gas emissions, while textiles comprise ~9% of annual microplastics losses in our oceans.

Given its size and impact, the fashion industry has a vital role to play in ending unsustainable practices, yet when it comes to sustainability, there are obvious difficulties for consumer brands. How do you authentically address the issue of consumption, when you’re producing products designed to increase it?

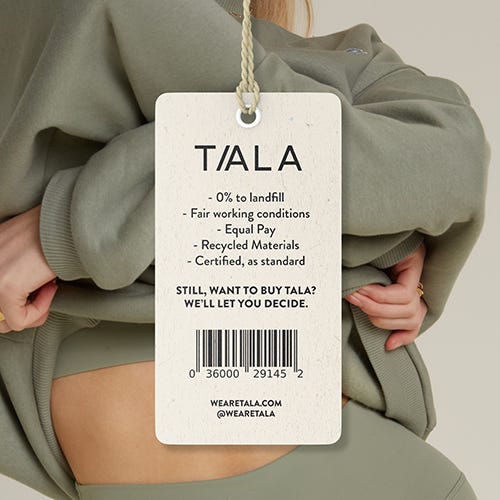

One brand that’s attempting to tackle the subject is Tala.

“In fashion, there is never ever going to be a full perfect answer about sustainability because it’s always going to be at odds”

- Grace Beverley, CEO at Tala

Activewear brand Tala raised £4.2m in a funding round last year, co-led by Venrex & Active Partners, who successfully backed consumer brands like Rapha (premium cycle wear) and Soho House (famed members club). Tala was founded in 2019 by Grace Beverley who spotted a gap for sustainably-produced athletics gear that wouldn’t break the bank.

Tala has built its reputation on responsibility, in fact there’s an entire page on their website dedicated to it. There, the brand addresses some of the tough questions (“Why do you work with [fast fashion brand] ASOS?”) as well as detail on their factories, choice of materials, inclusive sizing, even down to their use of a local, eco-friendly laundry service for photoshoots.

In an interview earlier this year, Beverley discussed the role that social media plays in consumer buying decisions, commenting that shoppers will use TikTok to search for products even when they’re stood in a physical store.

Social media has become an integral part of the consumer experience. The hashtag #TikTokMadeMeBuyIt accounts for 57.7bn views on TikTok, with content creators attempting to entice viewers with videos that appear unfiltered and accessible. In the example below, user xixiplease asks for opinions on a viral Skims dress.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

TikTok Shop allows users to make purchases from within the app, a sort of QVC for Gen-Z, which some are concerned is fuelling ‘fast fashion’ behaviours and undermining the industry’s efforts to improve working conditions and reduce overconsumption.

“The success and virality of many of these videos may mean creators disconnect from the uncomfortable truth that they are benefitting from the exploitation of the human beings producing these garments.”

In a great piece for Varsity, the independent student newspaper for the University of Cambridge, Oketa Zogi-Shala documents her efforts to enquire about the sustainability of the items for sale on TikTok. It’s clear that many brands and influencers are prioritising sales over sustainability, with digital tools like TikTok encouraging a ‘click first, think later’ approach.

Increasingly, private equity investors face the same challenge of balancing profits and planet, although with businesses like Tala and Vinted leading the way perhaps it’s possible to imagine a more responsible future for fashion.

And finally… Fashion Beasts! 👹

If you fancy reading what The Fence describes as ‘a deep dive into the gilded coffin of the fashion world’, look no further than Clive Martin’s piece, Fashion Beasts!

It’s available for a very limited time (and if you like it, please consider subscribing).

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)