Hello reader,

Welcome to the 46th edition of Access - our last edition was the Jobseeker Edition, featuring 99 opportunities across private capital finance, operations, and technology.

Sticking with the theme of private capital careers, this week we’ve compiled a bumper edition that’s packed with everything you need to navigate your career in private markets.

We’ve been digging through our archives to select the very best bits of Access from 2023, curated for your enjoyment into three special editions. We’ll be back next week with Part Two, featuring the most interesting interviews and profiles of Private Capital People, and our last Access of the year will look at Private Capital Insights, with some of our most popular deep dives and long reads.

Until next time -

Liz & Melissa

In case you missed it…

Last week, we posted our final Jobseeker Edition of 2023, with global opportunities at fund managers, technology vendors, advisors, consulting firms and fund services providers working in private markets.

FEATURING:

The Ultimate End of Year Guide To Private Markets - Part One, featuring…

89 Private Equity Essentials

Private Capital Employers - The Ones To Watch

Hot Tips for Jobseekers

Interview Horror Stories (How Not To Do It)

IN DEPTH

“He’s making a list, checking it twice / Gonna find out who’s naughty and nice.” - Job interviews, Santa-style

Welcome to The Ultimate End of Year Guide To Private Markets - Part One…

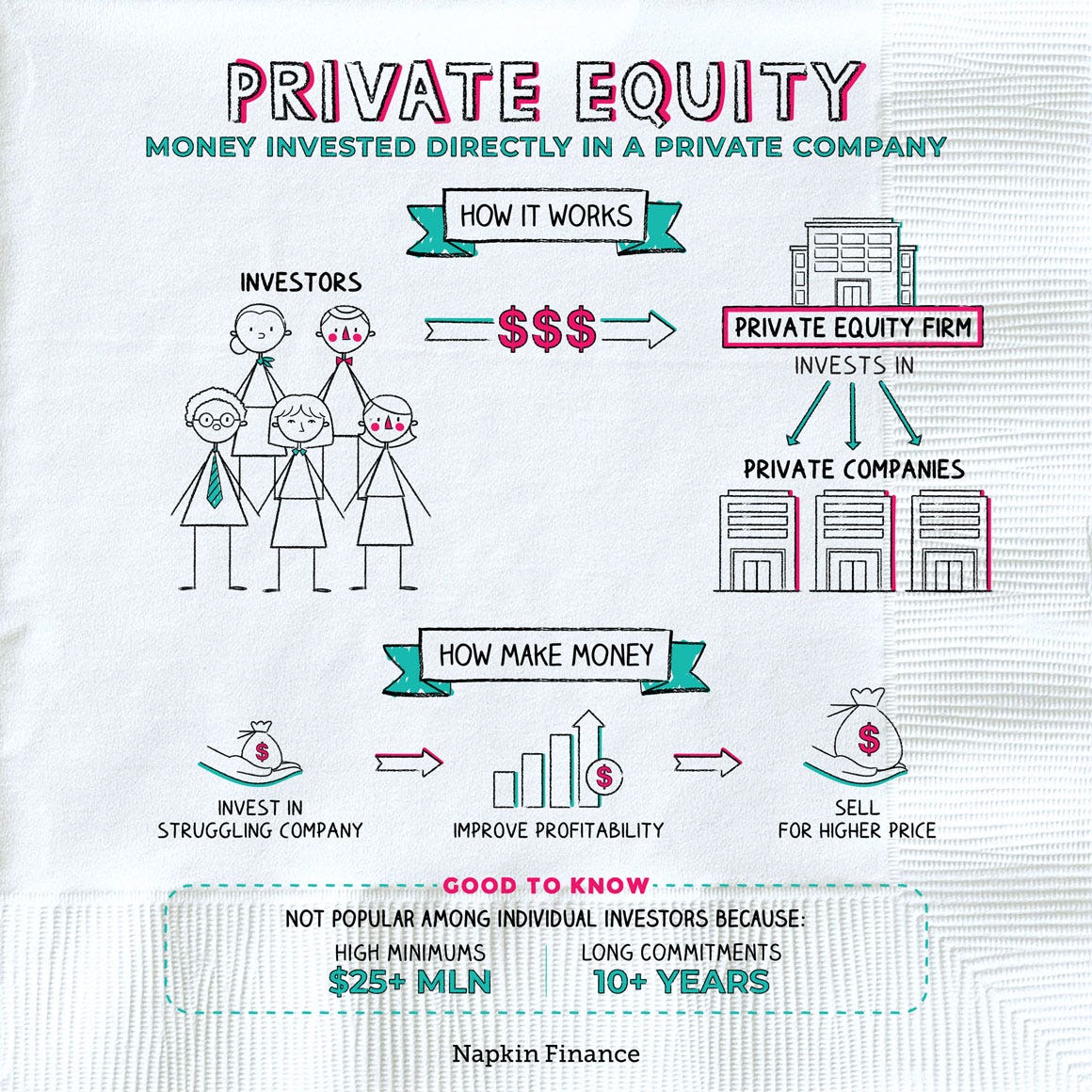

We’re kicking off our festive collection with a link to one of our best loved newsletters, the Private Equity Essentials edition. Inside, you’ll find podcasts, industry reports, explainers, long reads, infographics, interactive maps, courses, technical glossaries, and more.

“Whether you’re a PE veteran, a niche super-specialist, or you just need to know a little bit about everything, we’re confident that the resources we’ve assembled below will be helpful.”

We refresh this on a regular basis to keep it current, so if you have a favourite resource you’d like to recommend, get in touch!

💫Our top pick from Access: 89 Private Equity Essentials is…

PE ON A NAPKIN! Check out Napkin Finance’s PE Explainer below, with some commentary here.

🎄

We couldn’t run a feature on Private Capital Careers without mentioning our regular Jobseeker Editions, which drop monthly right into your inbox. We gather up all the global opportunities we can lay our hands on, across finance, operations, and technology roles, including jobs for recent graduates as well as experienced PE specialists.

If you’re curious to see who’s hiring, or you’re considering a move, check out the December edition below!

🎄

Every now & then, we do a deep dive into some of the most interesting employers in private capital. (Note - if you want to dish the dirt in confidence, or recommend your company as a top employer, drop us a line!).

Highlights from 2023 include our employer snapshots below… 👇

And our countdown of the top tech innovators in the industry today (hint: some of them are hiring! Check out the jobseekers edition for the best tech jobs in private capital).

And in June, we went Beyond the Capital to do a roundup of the top PE firms headquartered outside of London who are driving vital investment into the UK.

🎄

When you’re interviewing with a potential new employer, how do you decide whether or not the company is the right one for you? Liz & Sahm tackle that question, and more, in our first audio edition below 👇

Access: Due Diligence for Jobseekers

“One question that always seems to come up in job interviews is ‘Tell me why you want to work here’. It’s a difficult one to answer because often, you don’t know much about a company until you spend some time working within it.”

Due Diligence Advice for Jobseekers

Where to look: Start with the basics - most companies have an online profile, so get Googling… Read more

What To Search For: Probably more important than where to look, is what to look for. Critically assess the information you find - how reliable is this? How does it relate to the role or team I’m hoping to join? Read more

How To Stand Out From The Crowd: In a competitive selection process, it’s vital to showcase your best knowledge and skills. One way to do this is to prepare some insightful questions for the people you meet along the way, so use your due diligence findings to inform what to ask. Read more

“The simplest questions are the most difficult.”

- William S Burroughs

🎄

If you have a job interview coming up, the 32nd edition of Access ‘In The Hot Seat’ featured our top tips for handling difficult questions with confidence, including the dreaded “Tell me about yourself…”.

And on a spookier note, we’re wrapping up Part One with a link to our 2023 Halloween edition which featured a rundown of the most terrifying interview horror stories, including this classic:

Showed up looking good in my suit with a ton of knowledge on Capital Partners.

It turned out I had researched the wrong company named Capital Partners.

Anonymous

“In the shadowed corridors of employment, where the boundaries between hope and despair blur, a spectral collection awaits. Behold, Interview Nightmares!”

Enjoy 😁

🎄

And finally… Getting Punny with ChatGPT

Proof that even AI can’t make private equity sound amusing.

Me: Make some christmas themed puns out of 'private equity', 'private capital', and 'private markets'

ChatGPT: Certainly! Here are some Christmas-themed puns incorporating "private equity," "private capital," and "private markets":

"Private Equity-el: Spreading Yuletide Joy and Capital Gains!"

"Jingle All the Way to Private Capital Excellence!"

"Sleighing the Private Markets: 'Tis the Season for Strategic Investments!"

"Stocking up on Private Equity Cheer: 'Twas a Merry Year in the Markets!"

"Private Capital Claus: Bringing Prosperity Down the Chimney of Opportunities!"

"Holly Jolly Private Markets: Tidings of Returns and Reinvestments!"

"Snow Business Like Private Equity Business: Making Winter Investments Shine!"

"Yule-tide Investments: Where Private Equity Meets Festive Prosperity!"

Me: 🙈

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)