Access: The Big Squeeze

“Only when the tide goes out do you discover who's been swimming naked.” - Warren Buffett

Hello reader,

Welcome to the 29th edition of Access - the most clicked link from last week’s newsletter was to the Venture Capital and Private Equity Country Attractiveness Index, which ranks 125 countries across the world for the quality of their investment environment.

It’s no secret that private markets are currently navigating choppy waters. Yet, as this edition was being finalised, the CEO of Calpers, the largest US public pension plan, confirmed that they were considering increasing their allocation to private capital investments, including “more deal flow opportunities” in private debt.

This week, we’ve been researching some of the ways that private equity firms are leveraging their people & expertise, new sources of funding, and even new fund structures, to weather the storm.

(Also, we love a good metaphor - forgive us).

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition took a closer look at private equity’s story so far, including:

FEATURING:

In Brief: The very best global private markets resources, including:

Are You Banking On The Job Market Changing?💸

IIGCC Net Zero Guidance for PE

Alt Goes Mainstream

In Depth: The Big Squeeze

IN BRIEF

Below, you’ll find a selection of global private equity resources from people and companies in our private markets network.

Are You Banking On The Job Market Changing? 💸

Puns aside, a recent report from eFinancialCareers indicates that while job vacancies are falling globally, the number of candidate applications are increasing. That's potentially good news for employers on the hunt for talent, although it's also likely to result in a lot more competition for fewer jobs (and more applicants per role, which often erodes the candidate experience as hiring managers become overwhelmed).

Headlines:

📈 The average number of applications on eFinancialCareers was up by a whopping 67% (no surprise due to recent layoffs) but on the whole, financial institutions are slowing down hiring decisions and taking longer to appoint candidates.

📊 eFinancial reports a 291% average increase in job applications for consultancy roles, despite a swathe of job cuts due to a 'slump in client demand'. Examples of this include: EY announcing 3000 layoffs in the US, McKinsey & Co. planning to cut 2000 jobs, and KPMG laying off nearly 2% of US staff in February. Accenture also revealed it was axing 19000 roles worldwide (which is only 2.5% of its workforce, by the way).

💻 Average job applications for tech roles have doubled, and although there are fewer jobs than a year ago, eFinancialCareers reports there are still more jobs in tech than any other function. Citi alone took on 8,000 tech staff last year.

[Download the full report from eFinancial’s website]

With thanks to Jess Main, who posted this on LinkedIn & kindly allowed us to republish here.

***

IIGCC Publishes New Net Zero Guidance for PE

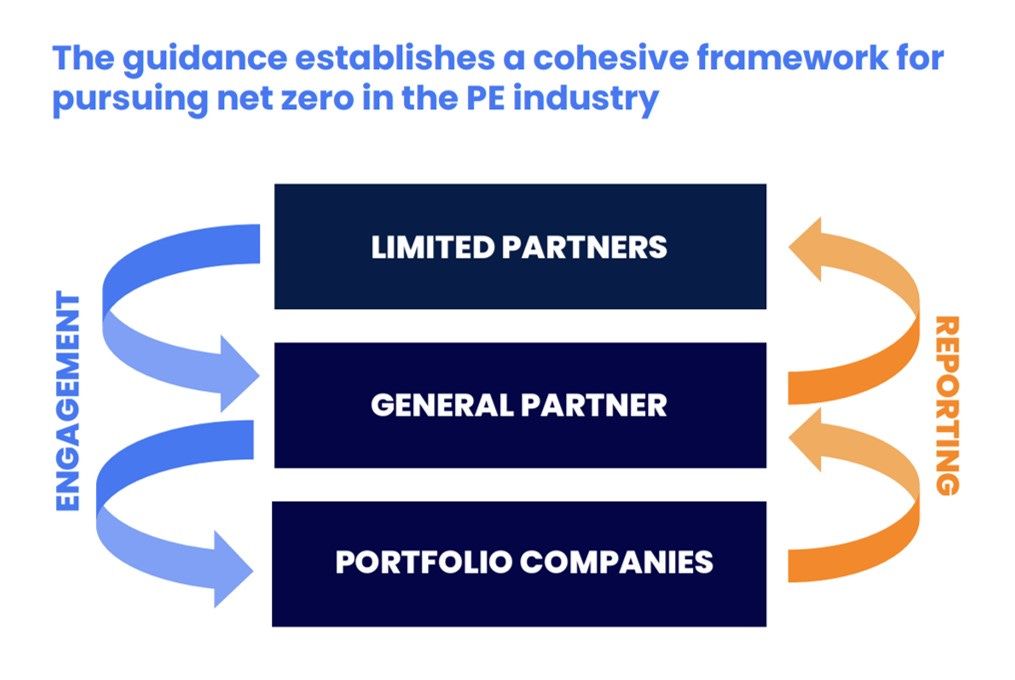

The Institutional Investors Group on Climate Change has just issued updated guidance for the private equity industry, providing a framework for pursuing net zero.

The guide aims to standardise target setting, engagement, & reporting between LPs, GPs, and portfolio companies, and forms part of the Net Zero Investment Framework.

“The updated Net Zero Investment Framework for private equity offers a helpful blueprint for marshalling the private equity industry’s net zero efforts.”

- Peter Dunbar, Head of Private Equity at PRI

[Access the guide on IIGCC’s website here]

***

Alt Goes Mainstream Launches Weekly Newsletter

We stumbled across Alt Goes Mainstream (AGM) this week, a fellow Substack publication devoted to the world of alternatives.

AGM just launched a fantastic weekly newsletter that’s packed with news & resources. Written by Michael Sidgmore, cofounder & partner at Broadhaven Ventures, it’s currently free to subscribe and you’ll get access to a host of blog posts & podcasts, plus an index of publicly traded fund managers.

“No longer do people expect to have a traditional 60/40 portfolio. They want to invest in everything from startups to cars to crypto to trading cards as culture collides with finance. Alts have gone mainstream (become a larger part of investors’ portfolios) and downstream (available to more investors).”

Sidgmore previously worked at iCapital, one of the firms that’s working to make private markets more accessible to retail investors. Back in 2021, Sidgmore launched the AGM podcast with an interview with iCapital’s CEO, Lawrence Calcano; there are now 60+ episodes, including a recent one with Wrexham AFC board advisor Shaun Harvey. Have a listen over on Alt Goes Mainstream, or check out the weekly newsletter below!

Looking For Your Next Hire? 👀

We are building a community of the best finance and technology professionals in private markets, including:

ESG specialists

Private equity technology leaders

Fund finance experts

If your firm is looking for talent and you’d like to access our network, please reach out for a chat.

IN DEPTH

“The music didn’t stop, but someone turned it way down.” - McKinsey’s Global Private Markets Review

It’s a tricky time for private markets. 2022 started out with so much promise, but ended in a flurry of falling valuations and declining deal volumes.

This week, we take a look at who’s making like Beyonce, and turning lemons into lemonade.

🍋

Trading In Social Capital For Private Capital

Since announcing the launch of SKKY Partners last year, co-founders Kim Kardashian & Jay Sammons have been busy building up the team ahead of raising their first fund.

SKKY is reported to be aiming for a $1.34bn fundraise, and will be hoping to draw on Kardashian’s network of wealthy superstars and her global social media presence to boost success.

The current team of 12 is expected to grow to 15 by the end of this year. SKKY Partners added a new COO, Kaitlin May, in January, quickly followed by VP, Brittany Serafino, previously at L Catterton & Carlyle, and a finance director, Mark Urso last month.

Other recent hires include Blackstone alumni Riyanka Ganguly, and Ashley Baxter, previously at Stripes, a growth equity firm focused on software and consumer sectors with no less than nine dogs on their Meet the Team page. 🐶

Kardashian’s co-founder Sammons has talked recently about ‘harnessing the power of diverse teams & highly inclusive cultures’ to improve creativity and impact. He has a long track record of championing workplace diversity, having founded Carlyle’s LGBTQ+ employee resource group and helping lead the firm to achieve a perfect 100 score on the Human Rights Campaign’s Corporate Equality Index.

“It is a challenge that firms don’t have more diverse talent at the top level. It makes it harder for people to look at the leadership of companies and ask themselves ‘can I be one of them one day?’ whether they’re female, LGBTQ or another minority.”

Sammons is no stranger to the world of celebrity, having played a key role in the controversial deal that handed control of Taylor Swift’s back catalogue to Scooter Braun, as well as investments in a number of celebrity-backed businesses, including Beats by Dre.

Both Kardashian & Sammons will be speaking at SuperReturn International next month, in a keynote interview titled ‘The next generation of consumer brands’.

🍋

Private Wealth Push Continues: Part I

Earlier this week, EQT announced the launch of Nexus, a semi-liquid strategy that will open up private markets investing to individuals.

It’s the latest in a steady stream of funds looking to muscle in on the private wealth market, which represents an estimated $150 trillion USD globally, yet only a fraction is invested in alternatives. As global fundraising slows, it becomes increasingly important for GPs to attract individual investors with a viable (and compliant) private markets product.

With over 3,500 individual investors and more than $2.5bn invested, Moonfare is one of the best known retail platforms for private capital in Europe. They’ve just announced that their second proprietary portfolio, Moonfare Core Portfolio II, has closed at €100m+.

“It also reaffirms once again that our dream of broadening top-tier private market access is a shared one.”

- Steffan Pauls, CEO at Moonfare

You can read more about the democratisation of private assets in our recent edition below 👇

🍋

Private Wealth Push Continues: Part II (WTF Is An LTAF?)

Another angle on the retail market for alternatives is the unattractively titled LTAF, or long term asset fund.

It’s a new concept, although has been some time in the making. The UK government gave the new FCA-authorised fund structure its blessing back in 2020, hoping to stimulate the economy and encourage more investment in UK start-ups, as well as providing much-needed financing for sustainability initiatives to help meet net zero aims.

Initially intended only for defined contribution pension schemes, professional investors, and certified HNWIs, the FCA has proposed that rules are relaxed to allow access to retail investors, subject to conditions designed to avoid uninformed investors over-committing. That includes a minimum 90-day redemption period to avoid a run on the fund.

“An ability to invest in illiquid assets, through appropriately designed and managed investment vehicles, is also important to supporting economic growth and the transition to a low carbon economy.”

In March this year, the FCA approved Schroders to launch UK’s first LTAF; they now have two of the three UK LTAFs, with Aviva holding the third and largest, which is focused on real estate investments.

Both Schroders LTAFs will explicitly support the transition to a low carbon economy; the first will aim to invest across four themes - climate mitigation, climate adaption, biodiversity/natural capital, and social vulnerabilities, while the second is focused on renewable energy and energy transition-aligned infrastructure.

🍋

Taking Their Own Advice?

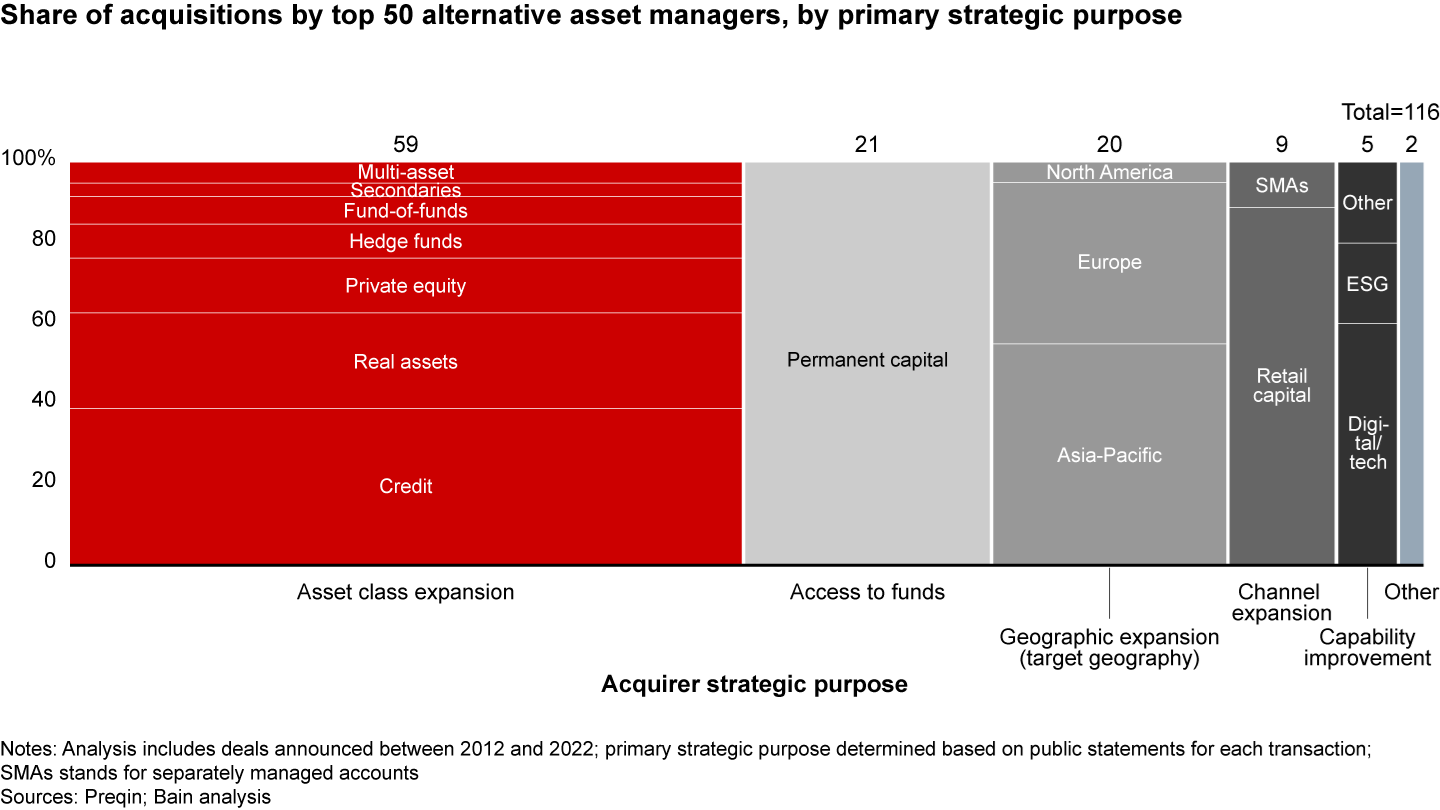

Among the top 50 alternative asset managers, there were as many acquisitions in 2021 & 2022, than in the preceding five years. In short, M&A in private capital is on the rise.

But will it continue? While M&A can open up new geographies & strategies, a recent report from Bain suggests that other than a couple of high profile successes, the complexity of attempting to merge two PE firms has been a deterrent.

“The difficulties are stubborn enough that most general partners (GPs) simply assume that consolidation makes perfect sense in every industry but their own.”

Publicly traded PE firms appear to be at an advantage when it comes to acquisitions, due to the availability of debt financing and liquid currency. They’re also usually under more pressure to accelerate growth, so the incentive is there too. Bain points out that EQT completed five strategic acquisitions since going public in 2019 (and none prior to this).

Here too, there’s a link with the private wealth angle, because building scale in this way results in a global brand that will attract retail investors.

Aside from channel expansion into retail, building private credit capability is another dominant reason for acquisition activity in the top 50 managers (see graphic below).

🍋

And finally… The Best Video You’ll Watch All Week

In case you need a break from the day job, please enjoy this exceptional video of baby goats leaping in slow motion to Tchaikovsky’s Waltz of the Flowers.

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)