Access: Private Markets Pause & Rewind

“Some of the best returns in PE are delivered in volatile & uncertain times.” - Haresh Vazirani

Hello reader,

Welcome to the 28th edition of Access - the most clicked link from last week’s newsletter was this link to PE Stack’s market maps.

Not to make the global economic meltdown all about us, but we’ve found it tricky writing about the financial markets when everything is doom and gloom. You naturally want to remain optimistic about the market sector you rely on for your salary, but wow, that’s hard to do when PE just posted a negative performance for the first time since 2008.

There’s no sugar coating it - private markets are having a wobble (even Hunter Lewis, former Chief Exec of Cambridge Associates has had enough of buyouts).

We thought we’d take a breather this week, and look back over PE’s story so far - hope you enjoy the read.

Until next time -

Liz & Melissa

In case you missed it…

Last week’s edition looked at news, resources and profiles of tech leaders in Private Capital, including:

FEATURING:

In Brief: The very best global private markets resources, including:

How Big Is Private Equity?

Looking Beyond North America & Western Europe

The Venture Capital and Private Equity Attractiveness Index

In Depth: Private Markets Pause & Rewind

IN BRIEF

Below, you’ll find a selection of global private equity resources from people and companies in our private markets network.

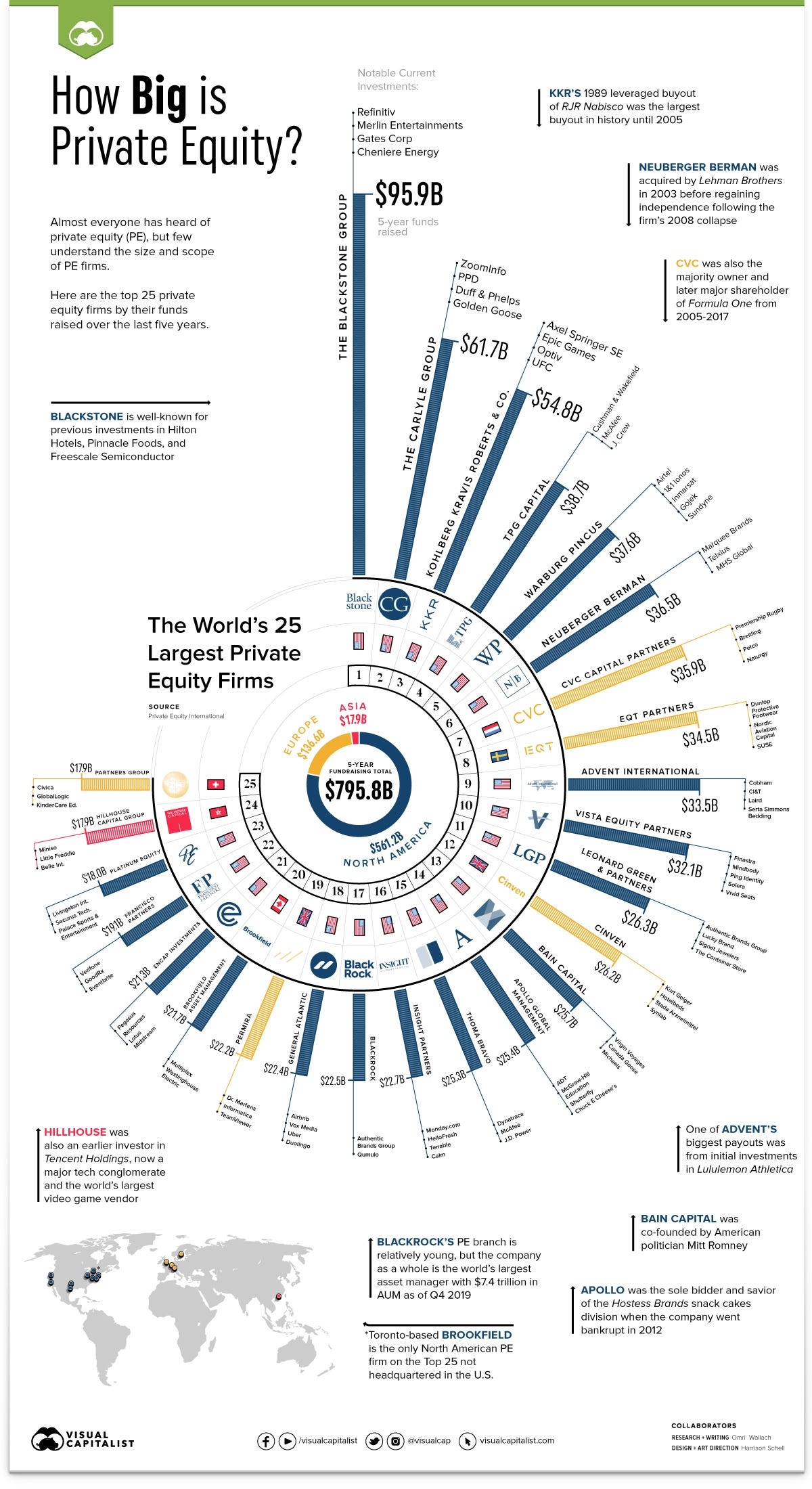

How Big Is Private Equity?

This infographic is a couple of years old now, which is why Blackstone is shown in the top spot (it was knocked off pole position last year, after KKR raised a staggering $126.5bn, to Blackstone’s $82.46bn).

But there’s a reason it still surfaces on social media every so often - it’s a fantastic visual to show the sheer size of the PE market, as well as the scale of some of the companies within each firm’s portfolio.

Notably, eight of the top ten funds are US-based. While the firms in the top 10 have shifted a little since this was published, North American funds still dominate, taking eight of the top ten spots, and a total of 202 out of the top 300 fundraisers.

[Data Meets Design at Visual Capitalist]

***

Looking Beyond North America & Western Europe

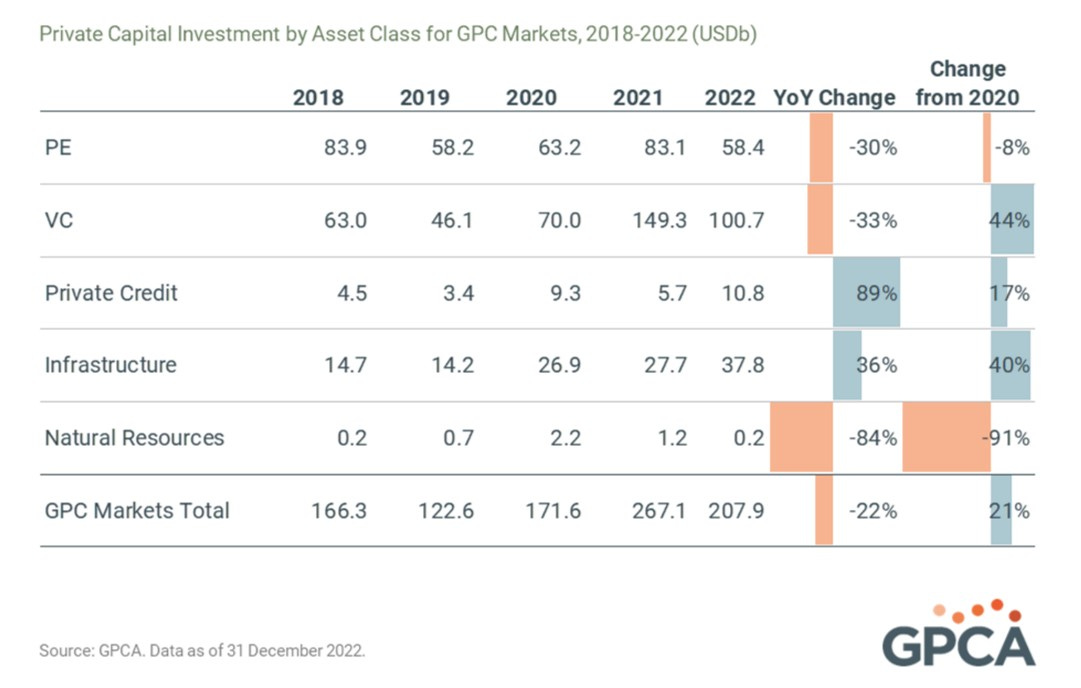

Founded in 2004, the Global Private Capital Association (GPCA) represents private capital investors across the world, with a focus on investment into Asia, Latin America, Central & Eastern Europe, and the Middle East.

"Our markets constitute 88% of the world's population and 44% of GDP; 45% of global household wealth is located outside of North America and Europe."

- Cate Ambrose, CEO at GPCA

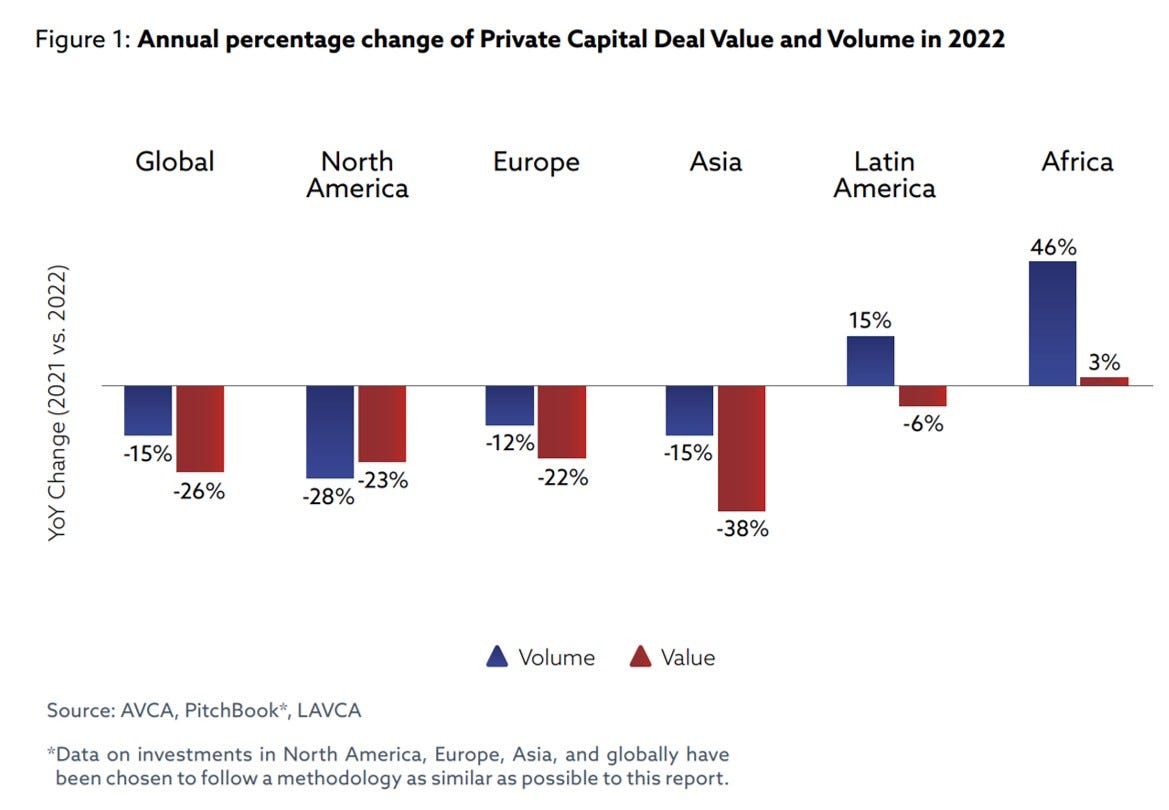

Earlier this year, the GPCA reported that overall deal value had dropped over the past 12-months but noted that 2022 was still the second-highest year on record. Thematically, private credit and infrastructure deal activity reached record levels in 2022, and investment in energy transition assets doubled, even amidst broader market uncertainty.

***

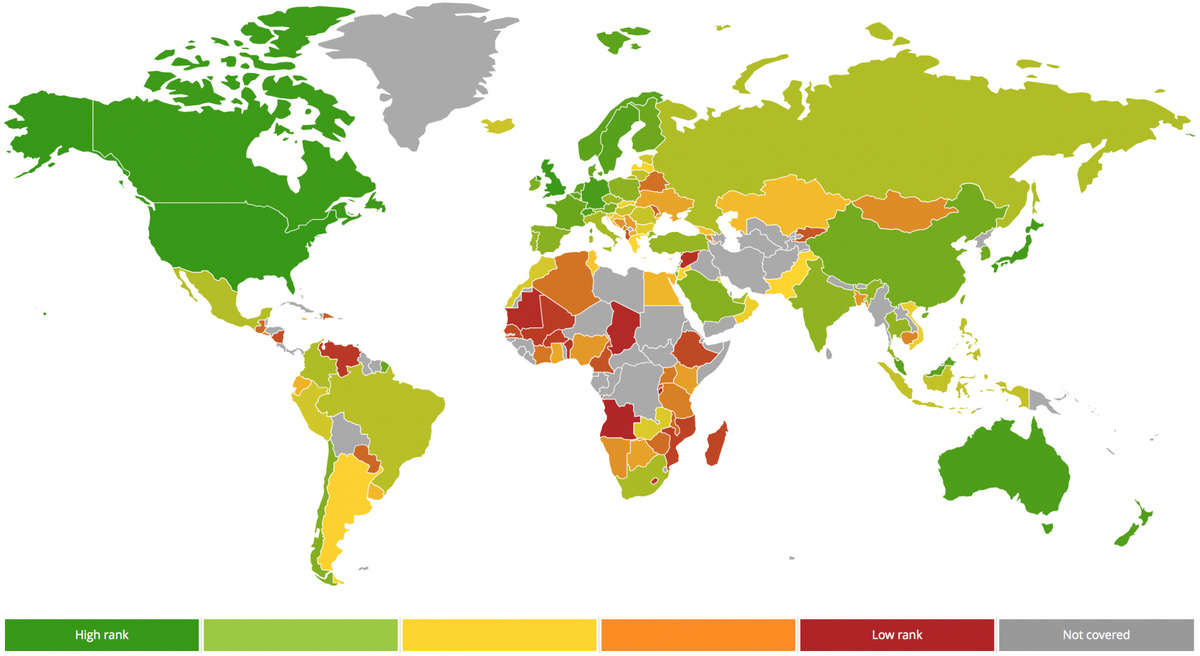

How Attractive is Your Country?

The delightfully titled Venture Capital and Private Equity Country Attractiveness Index ranks 125 countries across the world for the quality of their investment environment, and the ease of transaction-making.

Designed by IESE Business School’s Centre for International Finance, the tenth edition of the index was published in July 2021 and is packed with free resources, including an annual report, allocation matrix, heat map, and detailed profiles for each of the countries on the list.

The ranking is curated by analysing thousands of data points across six themes: economic activity, depth of capital markets, taxation, investor protections and corporate governance, human and social environment, and entrepreneurial culture and deal opportunities.

Looking For Your Next Hire? 👀

We are building a community of the best finance and technology professionals in private markets, including:

ESG specialists

Private equity technology leaders

Fund finance experts

If your firm is looking for talent and you’d like to access our network, please reach out for a chat.

IN DEPTH

“Even though there are still positive mood and outlook on what the future could be for alternative investing, my sense is that things are taking longer than expected.” - Alejandro Beltrán de Miguel, Senior Partner at Bain

Since its inception in the 1940’s, and beyond the LBO boom of the 1980’s, the global private equity industry has evolved significantly. Up until fairly recently, PE has enjoyed strong tailwinds since the Global Financial Crisis (GFC), in part driven by low interest rates and the availability of credit.

Even the Covid-19 pandemic didn’t seem to slow things down much, although McKinsey’s latest private markets review describes 2022 as a “year of two halves… with buoyancy in the first half and plummeting deal volumes, declining performance, and falling valuations in the second.” Recent reports of firms struggling to fundraise have contributed to a more sombre mood across the industry.

There’s a sense of anticipation and uncertainty, as everyone waits to see how the rest of 2023 unfolds.

This week, we thought we’d take a look back at how far the global private equity industry has come. Let’s start, as they say, at the very beginning.

The Catalyst and The Capitalist

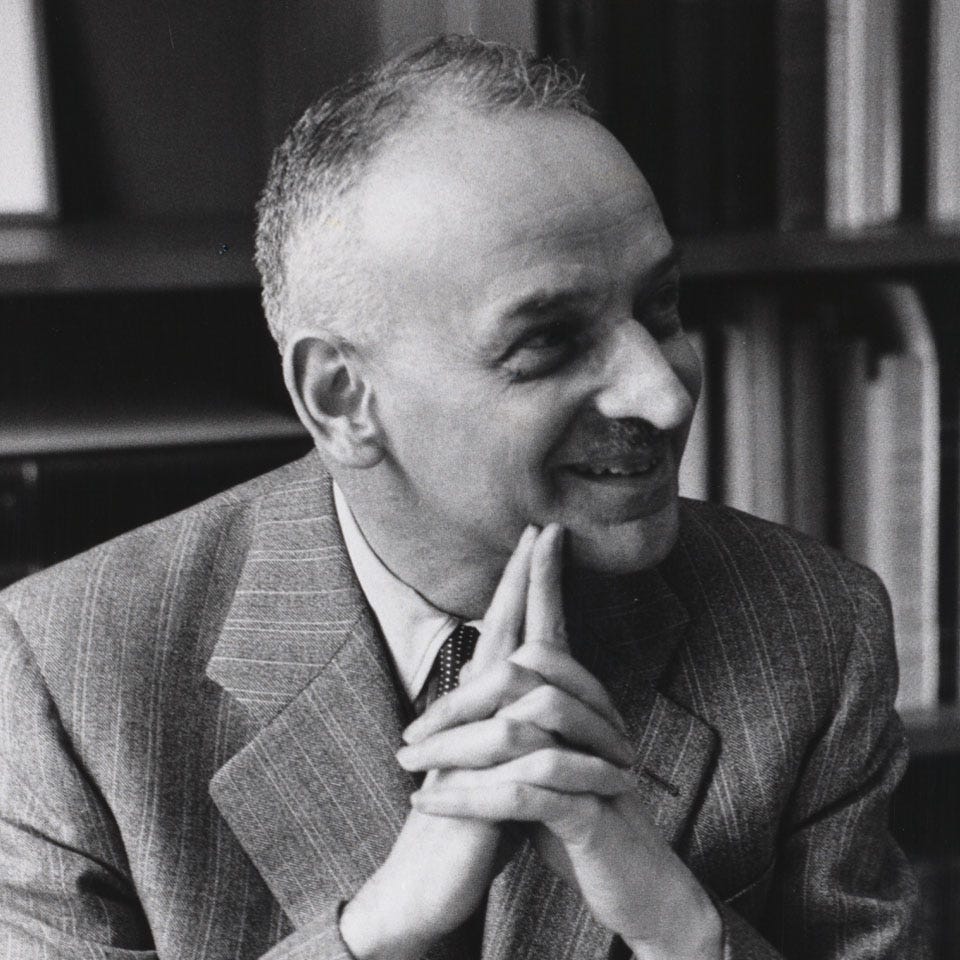

Although leveraged buyouts can be traced back to the early 1900’s, the modern private equity investment model as we know it emerged in the aftermath of World War II. Whilst PE was born in the USA, the person many refer to as the ‘Father of Venture Capitalism’ is a French immigrant called Georges Doriot.

Doriot was born in Paris in 1899 and later emigrated to the US to study an MBA, becoming a US citizen in 1940. He had initially enlisted in the French army, then played a key role in the US’s war effort during the Second World War, as Director of the Military Planning Division, which focused on bringing innovative ideas to reality quickly, and deploying them on the battlefield.

“The armed forces could not have won the war alone. Scientists and businessmen contributed techniques and weapons which enables us to outwit and overwhelm the enemy... This pattern of integration must be translated into a peacetime counterpart.”

- Dwight D. Eisenhower, then U.S. Army General Chief of Staff

Doriot shared Eisenhower’s views on the importance of science and technology, and after returning to civilian life, he applied himself to the challenge of ensuring post-war American prosperity. Along with engineer-turned-politician Ralph Flanders and MIT’s President Karl Compton, Doriot founded the American Research and Development Corporation (ARDC) in 1946 “to aid in the development of new or existing businesses into companies of stature and importance”. (He later helped to found INSEAD, and there’s a great piece here by the late Claude Janssen, recounting his own personal experiences of working with Doriot to set up the now legendary business school.)

Another firm, J.H. Whitney & Company, was founded around the same time with a similar goal; to encourage private investment into businesses that were not considered eligible for bank loans, some of which were run by soldiers returning from WWII. Whitney & Co. went on to execute the nation’s first post-WWI leveraged buyout, Spencer Chemicals, which converted a munitions plant into a fertiliser factory.

Private Capital Across the Globe

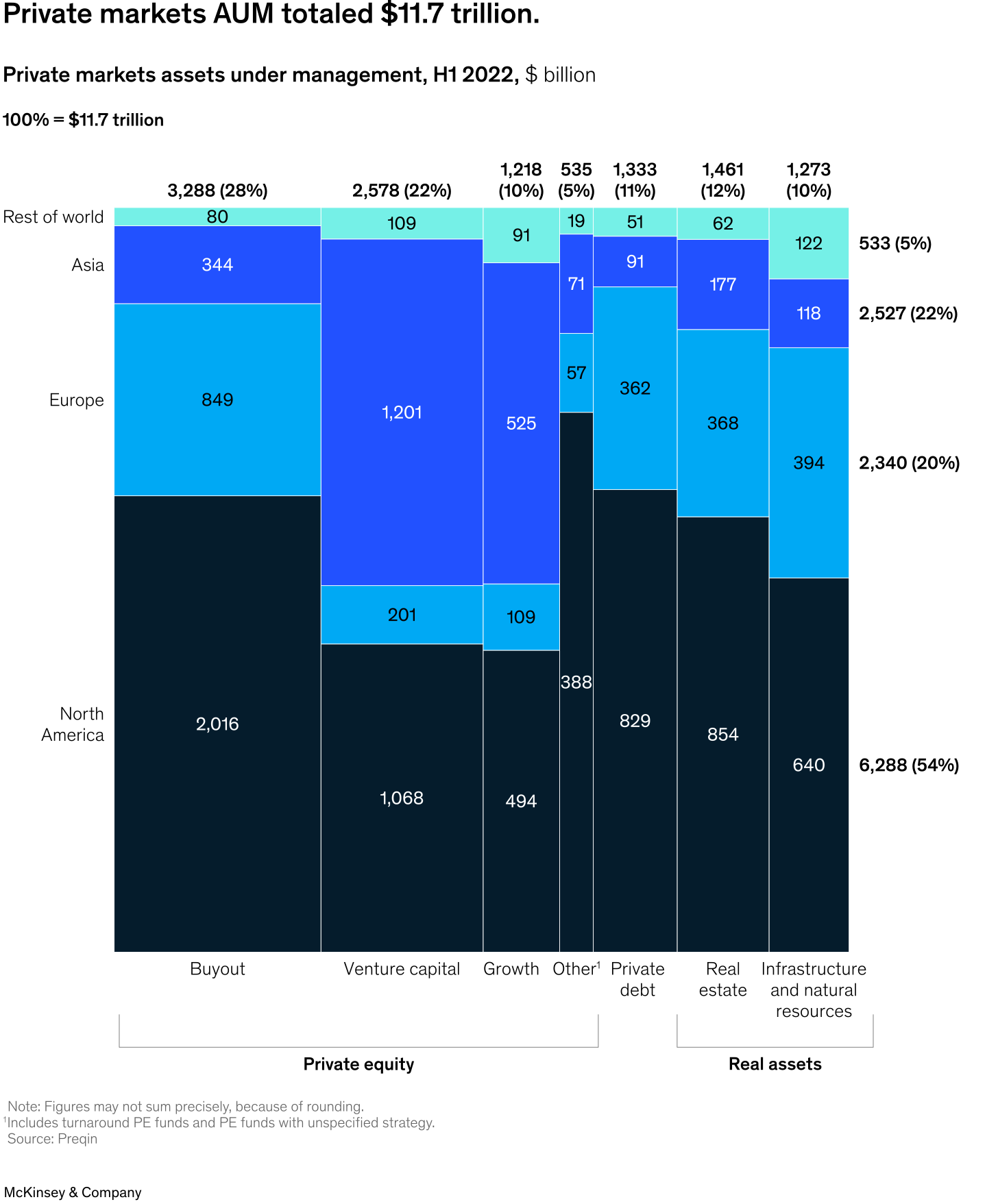

Fast forward to the present day, and private equity is a global phenomenon. While North America continues to lead the charge, investments in Europe and Asia have grown to account for a significant portion of the world’s private markets AUM.

The number of strategies used has also shifted, from a focus on private equity buyouts to the emergence of private credit and secondary deals.

The most recent Global Private Equity Barometer from Coller Capital showed that LPs still believe private markets are more attractive than public markets in volatile times, although interest in investments into CEE, UK, and Italy has waned over the past four years.

Earlier this year, Bain’s Asia-Pacific Private Markets Report acknowledged the ongoing turbulence and highlighted that investors were becoming more selective. They also predicted an increased focus on portfolio value creation, with fund managers becoming more hands-on with portfolio companies to help improve performance.

“Many funds that traditionally did not have strong operating-partner groups are now setting them up. There is much more active management by GPs of their portfolio companies. And we also see them focus on a bunch of completely different things, like data and analytics, sustainability, costs, and resilience.”

- Alejandro Beltrán de Miguel, Senior Partner at Bain

Last month, the African Private Equity and Venture Capital Association (AVCA) reported ‘a more nuanced picture’ for emerging markets, against the downturn in North America & Europe. Latin-America & Africa are showing a 15% and 46% increase in deal volume respectively, although the financial numbers are still relatively small (which is why these sectors get grouped into ‘Rest of world’ on the chart above).

What Determines a Vibrant Investment Environment?

The short answer is - it’s hard to know for certain.

There are plenty of factors that are likely to contribute to a more attractive investment environment, but there’s a so-called ‘chicken & egg’ debate over whether economic growth attracts investors, or investment in growth results in a thriving economy.

“One line of argument is that modern, open and educated societies develop a legislation that protects investors’ claims, which favours the output of innovation and the development of a capital market. This leads to economic growth and to demand for VC and PE. However, the causality might be the reverse: economic growth spurs innovation and the development of modern educated societies.”

- The Venture Capital and Private Equity Country Attractiveness Index 2021

A recent report from Vistra outlines what they believe is a new era of globalisation, born out of the instability created by events like the Covid-19 pandemic and Russia’s invasion of Ukraine. There has been some debate about whether globalisation is over, with Goldman Sachs’ José Manuel Barroso, commenting that globalisation faces “friction from nationalism, protectionism, nativism, chauvinism if you wish, or even sometimes xenophobia, and for me, it is not clear who is going to win.”

“What is clear is that the 'old model' of globalisation, in which the trajectory was towards ever-greater integration of the global economy, has been replaced by something different.”

- From the Vistra 2030 report

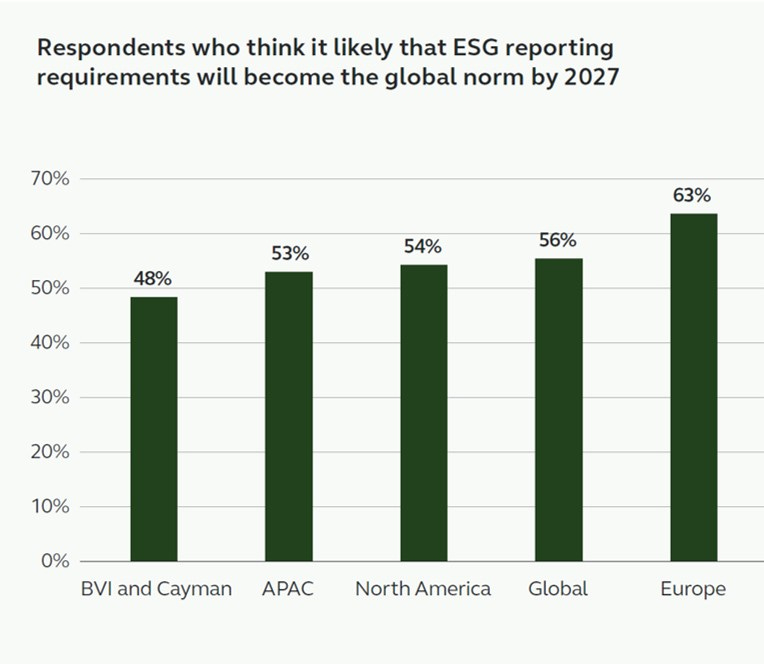

One area that business leaders, investors, and fund managers seem to increasingly agree on is the growing importance of ESG data. Many expect ESG reporting requirements to become the global norm, so whether you’re a climate warrior or a climate denier, being able to gather, organise, and report on ESG data is likely to be a key differentiator for successful investing.

***

If all that has whetted your appetite for looking back to move forwards, you might enjoy our first Access edition of 2023…

And finally… Ravishankar G V Outlines MENAP’s Potential

Hear from Ravishankar G V, managing director of Sequoia India, discussing the role of global investors in Middle East, North Africa, & Pakistan (MENAP), including what Sequoia looks for in founders, how the current funding environment is affecting the region, and the sectors Sequoia is most excited by.

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)