Hello reader,

Welcome to the 47th edition of Access - last week we published Part One of our Ultimate End of Year Guide to Private Markets focused on Private Capital Careers. The first of our festive special editions featured 89 private equity essentials, the industry employers to watch, top tips for jobseekers, & interview horror stories (how not to do it…).

This week, we’ve taken a look back through our archives to select the very best interviews and profiles of private capital people from Access editions across 2023 - we hope you find their stories inspiring.

We’ll be back next week with Part Three - and, the final Access newsletter of this year - taking a look at private capital insights, which will include some of our most popular deep dives and long reads.

Until next time -

Liz & Melissa

In case you missed it…

Last week, we posted our bumper edition packed with everything you need to navigate your career in private markets - check it out below! 👇

FEATURING:

The Ultimate End of Year Guide To Private Markets - Part Two, featuring…

The Grandfather of Private Equity

The Catalyst and Capitalist, Georges Doriot

Pivot! Four Professionals Who Made the Leap Into Private Equity

Private Markets Pioneers & Leaders

IN DEPTH

“The job of a leader is making sure that everyone has the best chance to do their job really well. It's not about ego or having all the answers.” - Wol Kolade

Welcome to The Ultimate End of Year Guide To Private Markets - Part Two…

We’re kicking off Part Two of our festive collection with our profile of The Grandfather of Private Equity, the late Jerome Kohlberg Jr., most famously known as the first ‘K’ in KKR. Read our profile on Jerome Kohlberg Jr. to find out more about his legacy.

“Jerry was a real visionary, having played an important role in developing the private equity model in the 1960's, and he was a true mentor to George Roberts and me"

- Henry Kravis, cofounder at KKR

🎄

The development of modern private equity investment, particularly the venture capital model, traces back to the post-World War II era with Georges Doriot, a French immigrant, often regarded as the 'Father of Venture Capitalism’.

Following the war, Doriot’s commitment to science and technology aligned with Eisenhower’s vision to ensure post-war American prosperity; a challenge which Doriot applied himself to after returning to civilian life. Along with Ralph Flanders (an engineer-turned-politician) and Karl Compton (MIT’s President), Doriot established the American Research and Development Corporation (ARDC) in 1946. The ARDC aimed to support the growth of new or existing businesses into significant entities.

“The armed forces could not have won the war alone. Scientists and businessmen contributed techniques and weapons which enables us to outwit and overwhelm the enemy... This pattern of integration must be translated into a peacetime counterpart.”

- Dwight D. Eisenhower, then U.S. Army General Chief of Staff

Our piece on ‘The Catalyst and The Capitalist’ also outlines how Doriot later helped to found INSEAD, including a link to a great piece here by the late Claude Janssen, recounting his own personal experiences of working with Doriot to set up the now legendary business school.

🎄

Navigating the complexities of the professional world can be challenging, especially when embarking on a new career path. Last month, we spotlighted four professionals who have successfully transitioned into the field of private equity - hopefully insightful whether you’re considering a switch for personal growth, navigating evolving industry dynamics, or to follow a newfound passion.

“Pivot!”

- Ross Geller, Friends - “The One with the Cop” (S5, E16)

Read on to discover short profiles on:

Dr Ashish Patel - Managing Director, Head of Growth Capital Solutions at Deutsche Numis

Marketeer, Fiona Moore - Head of ESG at ECI Partners

Tech specialist, Bob Balfe - CTO at 4Pines Fund Services

HR Pro, Suzie Ruffley - Global Head of People and Sustainable Culture, Managing Director at Foresight Group

“You often end up in a much better place when you can convince people you can move laterally. If you're hungry and you're capable, you'll be quite surprised where you end up.”

- Fiona Moore

Access: Pivoting to a Career in Private Capital

🎄

One of our best loved newsletters from this year was our conversation with Nima Fara, Head of Business Development at Kent Finance. During my interview with Nima, we discussed his career transition from Australia to UK, joining the scaling team at KF & what's next as he grows the sales and marketing function.

“I think that’s been the most interesting part for me. For PE when you peel back the curtain and you get to know these people underlying the industry, it’s a really great market to be in.“

Liz and I founded Access with the goal of being able to provide insight into the behind the scenes of private markets, spotlighting interesting people working in private capital. It was such a great opportunity to be able to sit down for a discussion with Nima and the resulting transcript was so rich that we decided to publish without edits - which makes for a more intimate and unvarnished glimpse behind the scenes.

If you’d be interested in making a guest feature as our next interviewee, drop us a line!

Access: Nima Fara, the man selling private capital's 'hidden secret'

🎄

A piece on Private Equity People wouldn’t be complete without a nod to PE’s pioneers and leaders. Highlights from 2023 include 👇

Our Impact and Influence edition, featuring:

Thomas H. Lee - pioneering leader in private equity who helped to shape the leveraged buyout industry

Renuka Ramnath - known as the ‘Mother of Private Equity’ in India

Weijian Shan - Co-founder, executive director and executive chairman of PAG, prominent in the Asia-Pacific markets

Wol Kolade - CEO of Livingbridge & a driving force behind diversity in private equity.

🎄

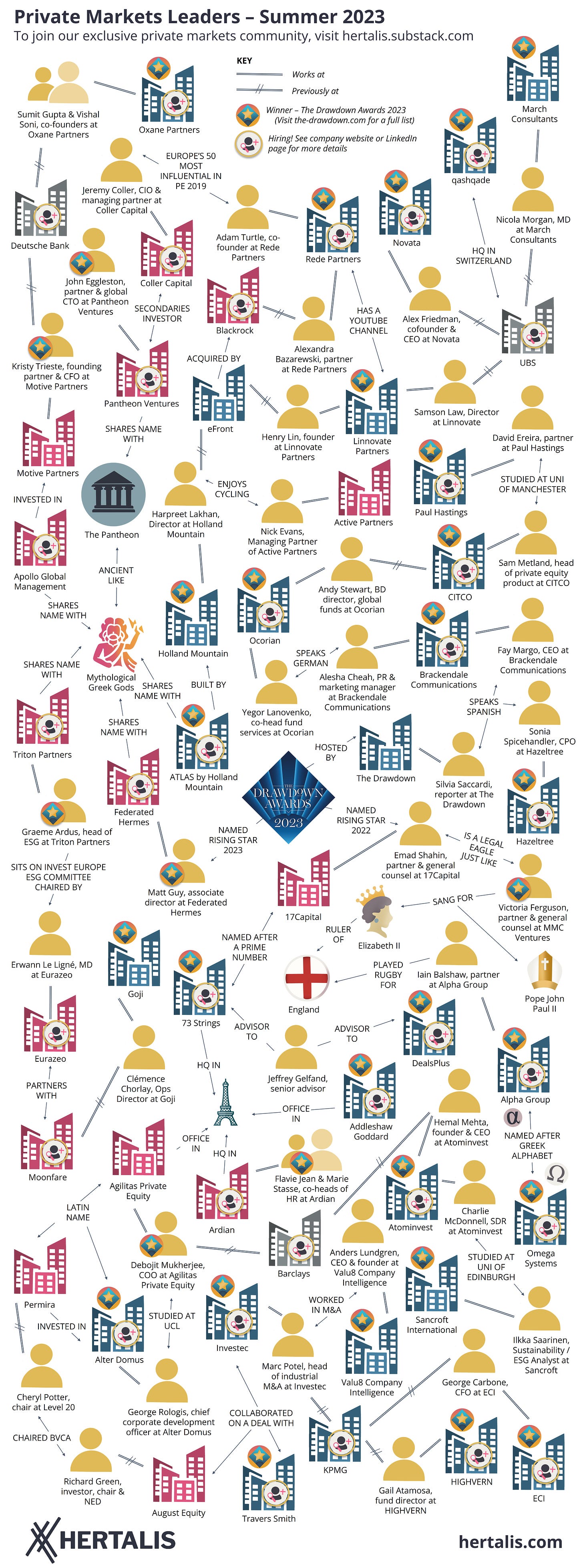

We’d also recommend taking a look at our first ever network map, inspired by the Drawdown Awards that took place in June 2023.

"Your network is your net worth"

- Porter Gale

In our bid to connect every single winner, we reviewed hundreds of LinkedIn profiles, countless ‘Meet the Team’ pages, and created a ‘who’s hiring’ tracker*… all on one page!

*Top tip: For updated career opportunities in private capital, check out our latest Jobseeker’s Edition.

🎄

And finally… Sherrese Clarke Soares acquires a valuable discography of music rights from iconic musicians 🎶

PE Hub interviewed Sherrese Clarke Soares recently and it sounds like it’s been a busy year... Since HarbourView was founded in 2021, the firm has been leading the way in the investment of music royalties and copyrights. Read more about their founder & CEO, in our profile from last year 👇

Access: The 'Content is Queen' founder & CEO investing in music and intellectual property

Thanks for reading. If you don't want to miss our next newsletter, please add Access to your contact list. (Or move this email from "promotions" to your primary inbox.)